GS25 triples overseas store count in just four years

CU increases international locations by 1.5 times in three years

7-Eleven, Emart24, and others

Export growth led by private brand products

A sharp contrast to the domestic focus on operational efficiency

Amid sluggish domestic demand, the convenience store industry is expanding its presence overseas. While companies are reducing the number of stores in Korea and focusing on operational efficiency, they are increasing store counts abroad and boosting exports, particularly of private brand (PB) products.

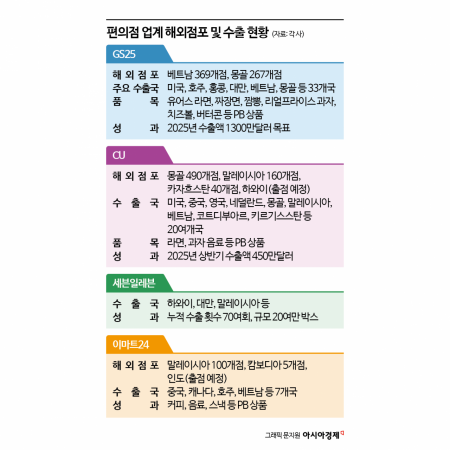

According to industry sources on July 16, GS25, operated by GS Retail, had secured 636 overseas stores as of the end of last month. This includes 369 stores in Vietnam and 267 in Mongolia. In Vietnam, where GS25 first entered the market in 2018, the number of stores surpassed 100 in 2021 and has since more than tripled in just over four years. In Mongolia, where GS25 launched in 2021, the company reached its 100th store in just over a year, with the store count continuing to grow rapidly.

GS25 is also exporting to 33 countries, including the United States, Australia, Hong Kong, Taiwan, Vietnam, and Mongolia. Key export items include ramen, snacks, and cheese balls from its PB brands Yours and Real Price. In May, GS25 installed exclusive display stands at 400 Don Quijote stores in Japan and exported 13 types of collaboration products with Netflix. Through these products, GS25 aims to achieve $13 million in exports this year, up from approximately $1.4 million in annual exports in 2018. A GS Retail representative said, "We plan to pioneer new markets and expand our distribution network to local supermarkets and other channels."

CU, operated by BGF Retail, had a total of 690 overseas stores as of the end of last month. This includes 490 stores in Mongolia, 160 in Malaysia, and 40 in Kazakhstan. This figure is more than 1.5 times higher than the 413 stores recorded in 2022. CU is also exporting a variety of PB products, such as ramen, snacks, and beverages, to around 20 countries, including the United States, China, the United Kingdom, the Netherlands, Mongolia, Vietnam, Malaysia, C?te d'Ivoire, and Kyrgyzstan.

In the first half of this year, CU's export value reached $4.5 million, and at this pace, the company is expected to surpass the annual export figure of $8 million recorded in both 2023 and 2024. Last November, CU became the first in the domestic convenience store industry to set up a PB-exclusive display stand at Don Quijote and exported 15 product types. The cumulative export volume has already exceeded 200,000 units. In October, CU plans to open its first store in Hawaii, marking the first entry by a Korean convenience store into the U.S. market, the birthplace of the convenience store industry.

7-Eleven, operated by Korea Seven, is also focusing on exports of PB products. Starting with the export of around 1,300 boxes of PB snacks and seaweed to 7-Eleven Malaysia in 2015, the company has expanded its reach to Hawaii and Taiwan. The cumulative number of export shipments stands at 66, with a total export volume of over 200,000 boxes.

Additionally, Emart24, a convenience store under Shinsegae Group, operates 105 overseas stores, including 100 in Malaysia and 5 in Cambodia. The company also exports PB products such as coffee, beverages, and snacks, as well as manufacturer brand products, to seven countries, including China, Canada, Australia, and Vietnam. Next month, Emart24 plans to open a new store in India, a country with a population of 1.4 billion, marking an industry first.

The main reason the convenience store industry is focusing on overseas markets is the challenging domestic environment. According to the Ministry of Trade, Industry and Energy, the combined number of domestic stores operated by GS25, CU, and 7-Eleven in April was 48,480, a 0.2% decrease compared to the same period last year. This was the first time the number of stores for these brands declined year-on-year. In May, the number further declined by 0.6% year-on-year to 48,315, marking two consecutive months of decrease. This trend is the result of intensified competition with other sales channels, such as online platforms, leading companies to close underperforming stores and focus on strengthening their core, high-performing locations.

In contrast, Korean convenience stores are enjoying a boom overseas, driven by the popularity of K-food, beauty products, and other domestic goods and content. An industry representative explained, "Interest in Korean products is rising overseas, especially among younger consumers, allowing us to secure a solid customer base. Korean products, including PB items, now account for 50% of total sales at overseas stores, reflecting their high level of popularity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.