Export Value Reaches $400 Million in First Half of the Year

K-Beverages Gain Popularity in China and the U.S.

Unique Flavors Like Milkis and Sikhye Drive Overseas Demand

In the first half of this year, South Korea's beverage exports reached an all-time high. As demand for 'K-beverages' grows in overseas markets, drinks that highlight unique Korean flavors, such as Milkis and Sikhye, have established themselves as major export drivers.

According to export and import statistics from the Korea Customs Service released on the 17th, beverage exports from January to June this year totaled $409.81 million (approximately 566.8 billion won), a 3.9% increase compared to the same period last year ($394.18 million). Compared to 2021 ($321.42 million), this represents a nearly 27% increase. Of this total, general beverages excluding fruit and vegetable drinks accounted for 94% ($385.14 million).

Visitors are participating in an event at the Milkis booth set up in New York Times Square.

Visitors are participating in an event at the Milkis booth set up in New York Times Square. [Photo by Lotte Chilsung Beverage]

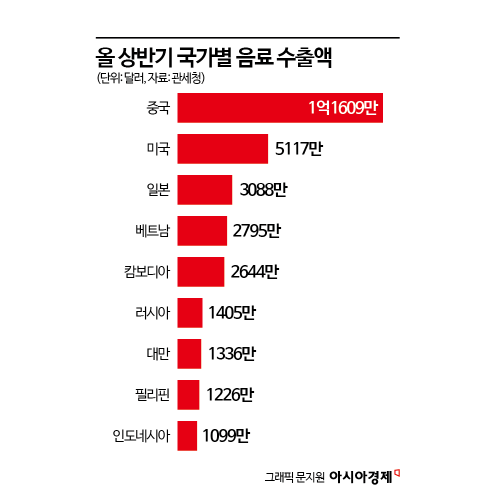

By export destination, China accounted for the largest share at 28.3% ($116.09 million). This was followed by the United States ($51.17 million), Japan ($30.88 million), Vietnam ($27.95 million), Cambodia ($26.44 million), and Russia ($14.05 million).

The leading driver of export growth is Lotte Chilsung Beverage's 'Milkis'. Milkis, Lotte Chilsung Beverage's flagship carbonated dairy drink, surpassed 100 billion won in annual sales last year by expanding its export markets alongside the launch of a zero-calorie version. Its export value last year increased by more than 11% compared to the previous year, and export sales in the first half of this year also grew by 10%. Currently, eight varieties of Milkis, including Original and Zero, are being sold and exported to more than 50 countries. In the United States, Russia, China, and Taiwan, annual sales exceed 10 million cans per market.

Growth in the U.S. market is particularly notable. From 2021 through last year, Milkis recorded an average annual sales growth rate of 30%. Initially, sales were centered on Asian supermarkets catering to Korean communities, but recently, Milkis has also entered major local distribution channels such as Costco. A Lotte Chilsung representative stated, "U.S. consumers perceive Milkis as a 'sweet and unique carbonated drink.'"

Russia is also a key market. From 2021 through last year, Milkis saw an average annual growth rate of 19%, with its distribution network expanding from the Far East to major cities such as Moscow. According to Lotte Chilsung, "Consumers in colder regions consider carbonated drinks containing milk to be healthy."

Marketing efforts are also active. On July 14 (local time), Lotte Chilsung conducted an outdoor advertisement for 'Milkis', Korea's representative carbonated dairy beverage, in New York Times Square and launched the 'Spicy Meets Smooth' campaign to promote Milkis. The campaign featured retro pixel art depicting scenes of Milkis being enjoyed with spicy foods such as chicken, tteokbokki, and ramen, drawing attention from passersby.

Lotte Chilsung is also considering establishing local production systems as part of its mid- to long-term strategy. The company is reviewing the possibility of producing Milkis and Chilsung Cider locally, using Pepsi Philippines as a base.

Traditional beverages are also performing well overseas. Paldo's 'Birak Sikhye' has gained popularity in Southeast Asian markets, with exports increasing by more than 30% compared to 2022. Woongjin Foods' 'Morning Rice' also saw sales in the same region rise by more than 10% year-on-year.

An industry official commented, "Korean beverages are attracting attention for their healthy ingredients, unique flavors, and distinctive packaging," adding, "Along with the K-food boom, beverage exports are highly likely to continue steady long-term growth."

Lotte Chilsung Beverage conducted an outdoor advertisement with the message "Milkis for eating spicy food" at New York Times Square on July 14.

Lotte Chilsung Beverage conducted an outdoor advertisement with the message "Milkis for eating spicy food" at New York Times Square on July 14. [Photo by Lotte Chilsung]

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.