MLCCs Targeting AI Server and Automotive Markets

The "Rice of the Electronics Industry": A Core Component for All Electronic Devices

High Value-Added Lineup... Aiming for 2 Trillion Won in AI and Automotive Sales

Samsung Electro-Mechanics is shifting its business portfolio toward the AI server and automotive electronics markets in response to the rapidly changing electronics industry environment. The core of this strategy is the multilayer ceramic capacitor (MLCC) business, often referred to as the "rice of the electronics industry." As demand for high-performance computing increases, the use of MLCCs that are "thinner than a strand of hair" is rising significantly. Recently, demand has been shifting from the information technology (IT) market to the AI server and automotive electronics sectors.

Imingon Lee, Executive Director of the MLCC Development Team at Samsung Electro-Mechanics, is conducting a product training session on the 13th at the Taepyeongro Building in Jung-gu, Seoul. Samsung Electro-Mechanics

Imingon Lee, Executive Director of the MLCC Development Team at Samsung Electro-Mechanics, is conducting a product training session on the 13th at the Taepyeongro Building in Jung-gu, Seoul. Samsung Electro-Mechanics

Imingon Lee, Executive Director of the MLCC Development Team at Samsung Electro-Mechanics, announced this business strategy during the Samsung Electro-Mechanics product training session (SEMinar) held on the 13th at the Taepyeongro Building in Jung-gu, Seoul. Lee explained, "MLCCs are called the 'rice of the electronics industry' because they are used in almost every electronic device," and added, "It is easy to understand that as computing power increases and new features or specifications are added to products, the usage of MLCCs also increases."

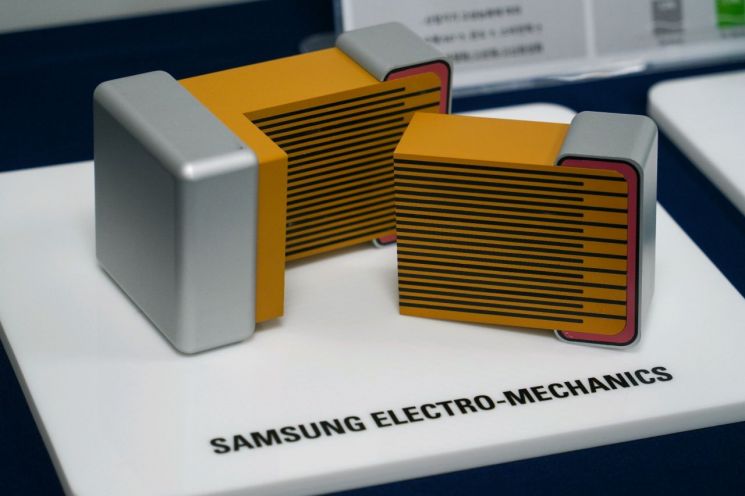

Capacitors play the role of supplying power stably and maintaining voltage when current fluctuates. Among them, MLCCs store electrical energy by alternately stacking dielectric and electrode layers, and through thinning and multilayering, they can achieve ultra-compact sizes and high capacity. "The main reason MLCCs are used so extensively is because they offer the highest (electrical) capacity relative to their volume," Lee explained.

Although their size is around 0.1mm, which is thinner than a strand of hair (0.3mm), they contain 500 to 1,000 layers of dielectric and electrode. If you fill a 300ml wine glass with MLCCs, it would be a high-value component worth several hundred million won.

The competitiveness of MLCCs lies in achieving the smallest size while securing the largest (electrical) capacity. The process involves printing thin layers of ceramic and metal (nickel), stacking them alternately, and then firing them like ceramics. The type and amount of additives mixed into the ceramic raw materials determine the product's performance. In particular, the ultra-fine powder materials (powders) used for the ceramic dielectric and electrode substances are key.

Samsung Electro-Mechanics highlighted its strength in fine powder manufacturing techniques. By developing and producing key raw materials in-house, the company is enhancing its technological competitiveness. Imingon Lee emphasized, "Using smaller powders is essential for making uniform products, and Samsung Electro-Mechanics has developed manufacturing processes and established a system for in-house production. We are also fully prepared to use even smaller powders in the future."

The global leader in the MLCC market is Japan’s Murata. Samsung Electro-Mechanics entered the market relatively later but has rapidly expanded its market share based on outstanding technology. The company began its MLCC business in 1998 and started producing industrial and automotive MLCCs in 2016. In the AI server MLCC market, Samsung Electro-Mechanics has achieved a high market share of about 40%, according to its own analysis.

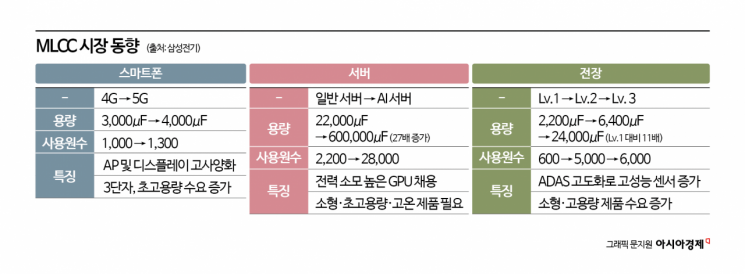

Until the 2010s, most MLCCs produced by Samsung Electro-Mechanics were supplied to smartphones and TVs. Recently, high-performance MLCCs used in AI servers, electric vehicles, advanced driver-assistance systems (ADAS), and autonomous driving systems are emerging as future growth engines.

With the advent of the AI era, both demand for and requirements of MLCCs are increasing significantly. For example, while a general server required an MLCC capacity of 22,000μF (microfarads, one-millionth of a farad), an AI server requires 600,000μF, which is 27 times higher. The number of MLCCs used also jumps from 2,200 to 28,000. The adoption of power-hungry graphics processing units (GPUs) is driving the need for compact, ultra-high-capacity products.

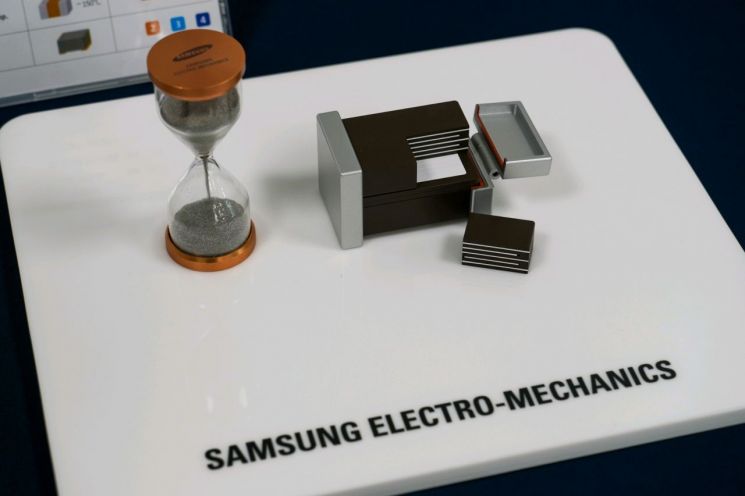

An hourglass containing 780,000 MLCCs thinner than a strand of hair and an MLCC mockup. Samsung Electro-Mechanics

An hourglass containing 780,000 MLCCs thinner than a strand of hair and an MLCC mockup. Samsung Electro-Mechanics

With the spread of AI technology, the proliferation of electric vehicles, and the evolution of autonomous driving systems, the MLCC product lineup is also expected to continue its steady growth. Samsung Electro-Mechanics analyzed that the MLCC market will grow at an average annual rate of about 6% from 2024 to 2030. During this period, the automotive sector is expected to grow by 11%, the industrial sector (including AI servers) by 6%, and the IT sector by 2%. The company plans to focus on high-value-added products targeting the automotive and AI server markets.

Previously, Deokhyun Jang, CEO of Samsung Electro-Mechanics, stated at the regular shareholders' meeting held in March that "to achieve 2 trillion won in sales from future growth businesses such as automotive and AI server products this year, we will strengthen our high-value product lineup." In addition, Samsung Electro-Mechanics plans to secure a leading position in the humanoid robot sector in the future, based on high-reliability technology for automotive electronics and ultra-high-capacity technology for IT applications.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)