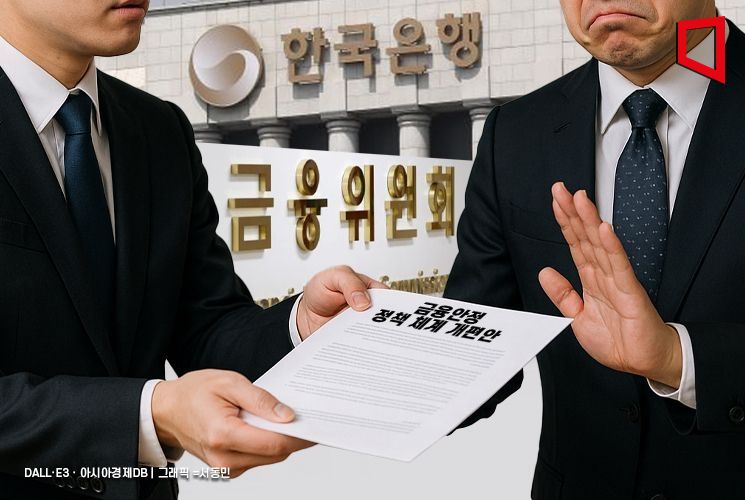

Bank of Korea Submits "Financial Stability Policy System Reform Proposal"

Requests Macroprudential Policy Tools and Exclusive Inspection Authority over Financial Firms

Financial Supervisory Service: "Unified Supervisory Body Should Exercise Inspection Authority Alone"

Financial Services Commission: "Sanctions Are an Administrative Power... Government Authority"

The Bank of Korea has expressed the view that it needs macroprudential policy tools and exclusive inspection authority over non-bank and other financial sectors, prompting financial authorities to conceal their discomfort. While they are refraining from making statements, concerned that the organizational restructuring debate could be seen as a turf war, their position is that prudential supervisory and sanctioning authority, as administrative powers, should be addressed separately from organizational restructuring. The financial industry also worries that if the Bank of Korea is granted supervisory authority, it would add another "mother-in-law" to the system, resulting in a dual regulatory structure.

According to the National Policy Planning Committee and financial authorities on July 15, the Bank of Korea submitted a "Financial Stability Policy System Reform Proposal" last week in response to the committee's request for opinions on supervisory authority over financial companies in relation to organizational restructuring. The proposal included the view that the Bank of Korea also needs macroprudential policy tools and exclusive inspection authority over non-bank and other financial sectors.

The Financial Services Commission and the Financial Supervisory Service are united in their opposition to the Bank of Korea's request for supervisory authority. However, their reasons for opposition differ, drawing attention. The Financial Supervisory Service maintains that a "unified supervisory body" should exercise supervisory authority.

Originally, financial supervisory functions were divided among the Bank Supervisory Board, Securities Supervisory Board, and Insurance Supervisory Board. Among these, bank supervision was under the authority of the Bank of Korea. After its establishment, the Bank of Korea started with a Banking Supervision Department, which was elevated to the Bank Supervisory Board in 1961. Even today, officials in financial authorities refer to the past banking supervision system as "Eungamwon."

The financial supervisory system was completely overhauled following the 1997 foreign exchange crisis. At that time, the International Monetary Fund (IMF) recommended the establishment of a strong and independent unified supervisory body, which led to the creation of the Financial Supervisory Commission and the Financial Supervisory Service. In this process, supervisory authority over financial companies, which had been dispersed, was concentrated in the Financial Supervisory Service.

An official from the Financial Supervisory Service stated, "It does not matter whether the central bank or a supervisory body holds supervisory authority over financial companies, as this varies by country. However, it is problematic for multiple organizations to exercise overlapping supervisory authority," adding, "If prudential supervision or financial stability issues had arisen during the 2008 global financial crisis or the 2020 COVID-19 crisis, supervisory authority could have been adjusted, but there has not been a single prudential issue in the past 25 years."

A former Financial Supervisory Service official explained, "In the United States, there are many financial companies in each state, so multiple agencies such as the Federal Reserve Board (FRB) and the Office of the Comptroller of the Currency (OCC) hold supervisory authority. Even so, supervisory authority is divided between national banks, commercial banks, and so on," adding, "In Korea, even if all bank CEOs are gathered, there are only about 20, so it is appropriate for a single agency to exercise supervisory authority." In other words, the view is that supervisory authority over financial companies should be exercised solely by the Financial Supervisory Service.

The Financial Services Commission, while also opposing the Bank of Korea's request along with the Financial Supervisory Service, has a different rationale. Its position is that the authority to inspect and sanction financial companies is an administrative power and therefore should be held by a government agency, not a private organization. This is interpreted as emphasizing that policy and supervisory functions cannot be separated in the context of the financial authorities' organizational restructuring debate.

A former official from the Financial Services Commission pointed out, "Supervision and sanctioning of financial companies should be carried out by administrative agencies delegated with presidential authority. The Financial Supervisory Service, as a private organization, exercises supervisory authority only as delegated by the executive branch (the Financial Services Commission). If the Bank of Korea or the Financial Supervisory Service wishes to exercise inspection authority, the discussion should first begin with converting them into government organizations."

Another former official from the Financial Services Commission stated, "In Korea, the Financial Services Commission is a small government organization with fewer than 400 people, responsible for policy, while supervisory functions are delegated to the Financial Supervisory Service, resulting in an abnormal structure that keeps prompting discussions about organizational restructuring. It would be more appropriate to establish an independent government agency under the government, like Japan's Financial Services Agency, that oversees both financial policy and supervision."

Financial companies are also refraining from making statements, but there is a prevailing atmosphere of opposition to increasing the number of agencies with exclusive supervisory authority. The logic is that double or triple regulation could hinder the expansion of non-interest income.

A senior official at a commercial bank said, "I do not think it is desirable for the Bank of Korea to be granted 'prudential supervisory authority.' In terms of monetary and credit policy, there is already joint inspection authority, and from the perspective of financial companies, it could mean having to answer to yet another supervisory agency." The official added, "It is regrettable that the organizational restructuring debate seems to be turning into a turf war."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)