Securities Stocks Hit New Highs for Consecutive Days

On the 11th, Korea Financial Holdings, NH Investment & Securities, Kiwoom Securities, and Others Set 52-Week Highs

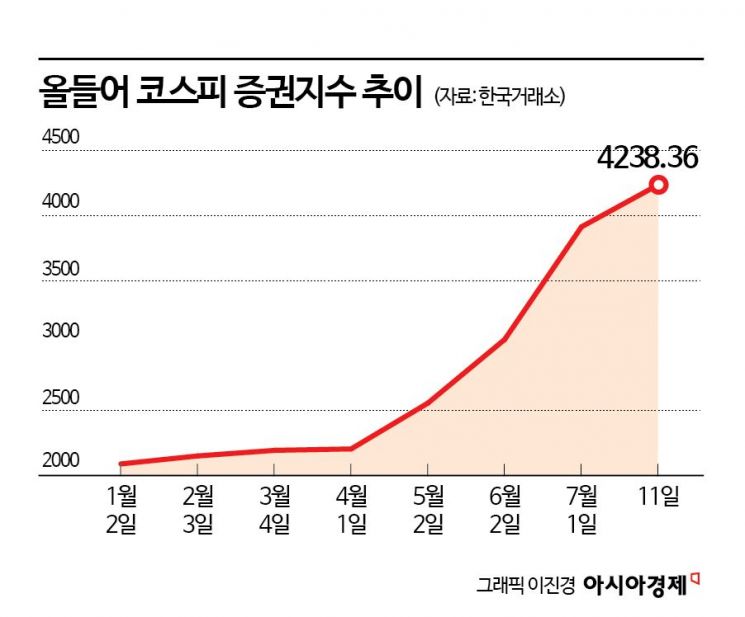

Securities Index Surges Over 100% Year-to-Date

Bullish Market Fuels Expectations for Strong Second-Quarter Earnings

As the KOSPI surpassed the 3,200 mark during trading hours for the first time in 3 years and 10 months, securities stocks consecutively set new 52-week highs. This surge is attributed to expectations of better-than-expected second-quarter earnings amid a bullish stock market, as well as heightened policy optimism. However, given the significant rise since the beginning of the year, a more cautious approach now seems warranted.

According to the Korea Exchange on July 14, on July 11, Korea Financial Holdings, NH Investment & Securities, Kiwoom Securities, Kyobo Securities, Hanwha Investment & Securities, Hyundai Motor Securities, Yuanta Securities, Daol Investment & Securities, LS Securities, and Bookook Securities all set new intraday 52-week highs.

With this rally in securities stocks, the KOSPI Securities Index has risen by 9.74% this month. This is a much greater increase compared to the 3.39% gain in the KOSPI over the same period. Year-to-date, the index has surged by 102.89%, while the KOSPI has climbed by 32.38% during the same timeframe.

There are projections that the rally in securities stocks could be prolonged, driven by policy expectations and liquidity. Yoon Yudong, an analyst at NH Investment & Securities, stated, "In a liquidity-driven market, securities firms are expected to see increased profits as trading volumes exceed previous forecasts. In addition, if shareholder return enhancement bills such as amendments to the Commercial Act are implemented, large firms with ample capacity are likely to further boost shareholder value. As both growth and shareholder returns progress simultaneously, the rally in securities stocks is expected to be prolonged."

Strong second-quarter results are also anticipated amid the bullish stock market. Jung Minki, an analyst at Samsung Securities, said, "The four securities firms under analysis (Mirae Asset Securities, Korea Financial Holdings, NH Investment & Securities, and Kiwoom Securities) are expected to report a second-quarter net profit that exceeds the consensus (average analyst forecast) by 19%." He added, "Brokerage profit is expected to increase by 10.9% due to higher domestic stock market trading volumes, and net interest income is also projected to grow by about 10% thanks to increases in deposits and margin loan balances, which lead to higher assets under management." He continued, "With the stock market rally, asset valuation and disposal gains from various investment asset groups held for different purposes by each company are expected to drive a 48.7% increase in trading profit." Samsung Securities raised its earnings forecasts for these securities firms by 13.4% for this year and 10% for next year.

However, as securities stocks have risen sharply on expectations, some now argue that it is necessary to consider the substance of these expectations and the fundamentals. Park Hyejin, an analyst at Daishin Securities, said, "The sector index for securities stocks has risen by 22% in just one month, and individual stocks have achieved returns close to 30%. The average price-to-book ratio (PBR) of the five analyzed securities firms (Kiwoom Securities, Korea Financial Holdings, NH Investment & Securities, Mirae Asset Securities, and Samsung Securities) has climbed to 0.9 times." She added, "While there may still be room for further gains in securities stocks, if valuations have entered a controversial range, it is inevitable that the substance of expectations and the fundamentals must be taken into account."

Daishin Securities believes that among the five analyzed firms, Korea Financial Holdings, Samsung Securities, and Kiwoom Securities have sufficient upside potential and raised their target prices by an average of 20.5%. However, for Mirae Asset Securities and NH Investment & Securities, the firm judged that the stocks have reached appropriate price levels and downgraded its investment rating from 'Buy' to 'Market Perform' without adjusting the target price.

Samsung Securities raised the target prices of the analyzed securities firms to 50-70% above previous levels. In the case of Mirae Asset Securities, the target price was raised by 57.1% from the previous level, but considering the limited upside potential, the investment rating was downgraded from 'Buy' to 'Hold.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.