Over 20% Surge in Leveraged Copper ETNs in Two Days

Copper ETNs Dominate Top Returns

Trump Announces 50% Tariff on Copper Starting August 1

Copper Prices Expected to Remain Strong for Now

Following President Donald Trump's announcement of a 50% tariff on copper, copper prices have surged, leading to a significant rise in copper exchange-traded notes (ETNs). As copper prices are expected to remain strong until the tariff is imposed on August 1, related ETNs are also projected to continue their upward trend.

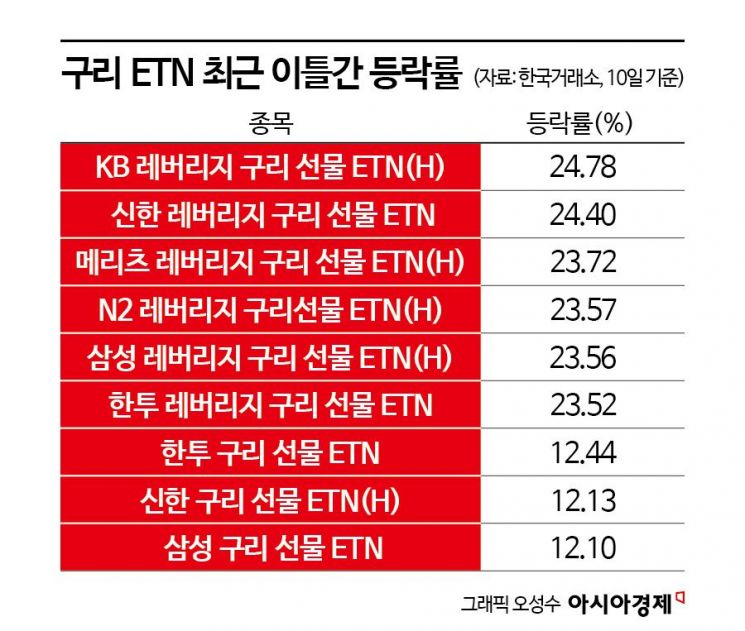

According to the Korea Exchange on July 11, after President Donald Trump announced his plan to impose a 50% tariff on copper, leveraged copper ETNs recorded gains of over 20% over two days, making them the top performers among all ETNs.

KB Leveraged Copper Futures ETN(H) rose by 24.78%, marking the largest increase among all ETNs. This was followed by Shinhan Leveraged Copper Futures ETN at 24.40%, Meritz Leveraged Copper Futures ETN(H) at 23.72%, N2 Leveraged Copper Futures ETN(H) at 23.57%, Samsung Leveraged Copper Futures ETN(H) at 23.56%, Korea Investment & Securities Leveraged Copper Futures ETN at 23.52%, Korea Investment & Securities Copper Futures ETN at 12.44%, Shinhan Copper Futures ETN(H) at 12.13%, and Samsung Copper Futures ETN(H) at 12.10%. Copper ETFs dominated the top eight spots in terms of returns.

On July 8 (local time), President Trump stated during a Cabinet meeting at the White House, "We will announce tariffs on copper imported into the United States," specifying that the tariff rate would be 50%. The following day, Trump wrote on his social media platform Truth Social that the decision was made after a "strong national security assessment" and that the 50% tariff on copper would take effect starting August 1.

Hong Sungki, a researcher at LS Securities, explained, "Copper, along with steel and aluminum, is a key raw material for which the United States has a high import dependency. As of 2024, the U.S. imported 53% (860,000 tons) of its total copper demand (1.6 million tons). The Trump administration appears to be aiming to increase domestic copper production by imposing tariffs on copper, just as it has done with steel and aluminum, which are also major raw materials for manufacturing."

The imposition of tariffs is expected to drive copper prices higher in the short term. Jang Jaehyuk, a researcher at Meritz Securities, noted, "The tariff expectations already priced into the spread between the New York Mercantile Exchange (COMEX) and the London Metal Exchange (LME) were only about 10-15%, but with a much higher rate now being discussed, the market is reacting strongly. Since the U.S. is a net importer of copper, in theory, the implementation of tariffs would lead to supply shortages and higher prices domestically, while creating the risk of oversupply and lower prices overseas. However, given that the announced tariff rate exceeded expectations and that there is a high likelihood of preemptive demand and inventory buildup before the tariffs take effect, copper prices are expected to remain strong and volatility is likely to increase in the short term."

However, there are projections that copper prices will begin to weaken after the tariffs take effect. Ok Jihoe, a researcher at Samsung Futures, said, "After the copper tariffs officially take effect in early August, prices are likely to start declining. Over the past six months, the U.S. has imported an entire year's worth of demand, so domestic inventories are sufficient, and import demand is expected to drop sharply. This will act as a factor easing tightness in non-U.S. markets, including the LME, and copper prices could fall below $9,000 per ton, giving back the gains accumulated over the past six months."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.