Caution over rising housing prices expressed at July MPC press conference

"Household debt has reached a level that restricts consumption and growth"

Concerns about low growth persist, but August rate cut remains uncertain

Reaffirms stance: "Won-based stablecoins should be introduced gradually, starting with banks"

"Household debt has reached a critical level that restricts both consumption and growth."

Lee Changyong, Governor of the Bank of Korea, is answering questions from the press at a press conference regarding the Monetary Policy Committee's interest rate decision held at the Bank of Korea in Jung-gu, Seoul on July 10, 2025. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is answering questions from the press at a press conference regarding the Monetary Policy Committee's interest rate decision held at the Bank of Korea in Jung-gu, Seoul on July 10, 2025. Photo by Joint Press Corps

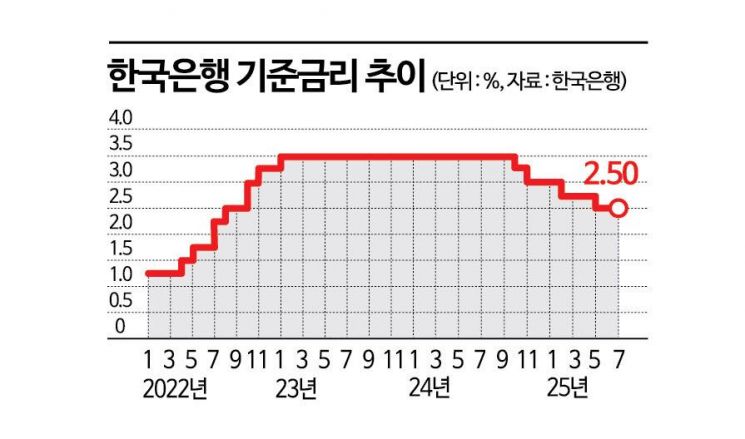

Lee Changyong, Governor of the Bank of Korea, explained the background of the decision to keep the base interest rate unchanged at 2.50% per annum during a press conference held after the monetary policy direction meeting on July 10. He stated, "It is the shared view of the Monetary Policy Committee members that the pace and scale of a rate cut by the Bank of Korea should not stimulate market sentiment in a way that drives up real estate prices."

Governor Lee pointed out, "The issue of rising real estate prices in the Seoul metropolitan area, especially in Gangnam, is one of the main causes of the low birth rate, and it is also closely linked to the concentration of population in the metropolitan area. It is also strongly related to social issues such as intense competition for college entrance. As a result, household debt has risen to nearly 90% of the country's GDP, and if it increases further, various side effects may occur." He emphasized, "I believe the policy priority should be to stabilize expectations so that housing prices in the metropolitan area do not surge and to manage household debt."

He expects that the government's June 27 measures to strengthen household loan management will be effective. He considers these measures to be stronger than expected, and if the current sluggish real estate transaction volume continues, household debt is also likely to stabilize over time. However, Governor Lee noted that it remains to be seen whether real estate prices will maintain their current stability, as a variety of factors, such as supply, can affect housing prices.

Governor Lee assessed that the current situation is "more concerning" than in August of last year, when a real estate frenzy led to a surge in household debt. He said, "The speed at which real estate prices are rising is faster than in August last year," and added, "In terms of severity, the current situation warrants even greater caution." He also suggested that it may take longer for the market to calm down compared to last year. While the issue was quickly resolved after a single rate freeze last year, despite criticism of policy missteps, it is now difficult to judge whether a 'happy ending' will come as quickly.

August rate cut 'uncertain'... The worst-case scenario: tariffs rise and housing prices remain unchecked

Concerns about economic growth persist. Although sluggish growth in the domestic economy has eased, the decline in construction investment has continued. However, consumption has improved due to the resolution of domestic political uncertainties, and exports?especially semiconductors?have continued to rise. Employment in major sectors such as manufacturing has declined, but the total number of employed people has increased. The execution of the supplementary budget is also expected to slightly alleviate concerns about low growth this year.

Nevertheless, there remains significant caution regarding growth uncertainty. Governor Lee stated, "The first and second supplementary budgets are expected to raise GDP by about 0.1 percentage point each. Mechanically speaking, the impact of the first supplementary budget is already reflected in the May economic outlook (which projected 0.8% growth for this year), so adding the 0.1 percentage point from the second supplementary budget would bring it to 0.9%." However, he noted that the situation could change depending on tariff uncertainties and whether the real estate market remains stable.

He explained, "In May, we assumed tariffs would be around 10%. Although the increase has been postponed until August 1, there are variables depending on what happens if tariffs go up to 25%. Many products are manufactured in countries such as Vietnam, Mexico, and Canada, or exported via China, so the overall outcome of tariff negotiations could affect not only Korea but the global market as well."

Governor Lee expressed concern, saying, "The worst-case scenario is that tariffs rise significantly (both directly and indirectly), household debt is brought under control, but real estate prices remain unchecked. If this happens, the trade-off between financial stability and growth could become very problematic. In such a case, there could be significant disagreement among Monetary Policy Committee members about which priority should guide the interest rate decision."

Stablecoins: Three main concerns highlighted... Project Hangang is only 'temporarily suspended'

Lee Changyong, Governor of the Bank of Korea, is speaking at a press conference on monetary policy direction held at the Bank of Korea in Jung-gu, Seoul on the morning of the 10th. The Monetary Policy Committee of the Bank of Korea decided to keep the base interest rate unchanged at 2.50% during the first meeting of the second half of the year. July 10, 2025 Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is speaking at a press conference on monetary policy direction held at the Bank of Korea in Jung-gu, Seoul on the morning of the 10th. The Monetary Policy Committee of the Bank of Korea decided to keep the base interest rate unchanged at 2.50% during the first meeting of the second half of the year. July 10, 2025 Photo by Joint Press Corps

The governor also reiterated his stance on won-denominated stablecoins at the meeting. While he reaffirmed that he does not oppose the issuance of won-based stablecoins, he pointed out three concerns regarding the method of introduction and regulatory framework.

First, he warned that if the issuance of won-based stablecoins is immediately allowed for non-bank financial institutions, the value of the currency could differ by issuer, causing confusion in monetary policy operations. Governor Lee said, "The value of a won-based stablecoin issued by a company with 1 billion won in capital will inevitably differ from one issued by a bank, due to differences in credit, among other factors. In the 19th century, the proliferation of private currencies caused confusion, which eventually led to the adoption of the current central banking system. To avoid such side effects, issuance should start with trustworthy institutions."

He also raised the possibility of conflict with foreign exchange liberalization policies. Foreign exchange liberalization is a policy that eases regulations on cross-border transactions, allowing for free remittance, currency exchange, and capital movement. Korea has been pursuing this gradually since the 1997 financial crisis. Governor Lee said, "The reason we have not fully liberalized foreign exchange is not just for financial market development, but also because we are concerned about the various side effects. The proliferation of dollar-denominated stablecoins is already making these issues a reality, and the introduction of won-based stablecoins could exacerbate them."

Regulatory consistency among issuers of won-based stablecoins is also a key issue. Governor Lee explained, "Granting non-bank financial institutions the right to issue stablecoins means allowing them to engage in payment and settlement operations. Non-bank financial institutions would then be able to issue stablecoins, which function as currency, and also take deposits, similar to banks." He added, "The same regulations should apply to the same business activities, but bank regulations are very strict. If non-bank institutions are allowed to issue stablecoins without being subject to such regulations, that would be problematic. This is the complex issue we need to discuss."

Governor Lee also clarified that the recent suspension of 'Project Hangang' is only temporary, and that the project will resume once discussions on won-based stablecoins and related matters are concluded. Project Hangang is a pilot project to test the possibility of issuing deposit tokens based on the Korean won. In this project, commercial banks issue 'deposit tokens' based on wholesale central bank digital currency (CBDC) issued by the Bank of Korea, allowing consumers to use them in everyday life. The first phase of the experiment concluded at the end of last month.

Governor Lee explained that the project was paused because, ahead of the second phase, banks requested legal clarity as discussions on won-based stablecoins by non-bank financial institutions intensified, but the Bank of Korea currently lacks the relevant authority to provide an answer. He added, "Once a direction is determined through discussions with the Ministry of Economy and Finance and the political community, the project can be resumed. I also expect that banks will actively participate once the direction becomes clear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)