Record-Breaking First-Half Results Expected

Anticipation for Separate Taxation of Dividend Income

Securities Industry: "Plenty of Room for Further Gains"

As financial holding companies prepare to announce their first-half results this year, their stock prices have been soaring, reaching record highs. Despite an unfavorable environment?including interest rate cuts and rising delinquency rates?it is expected that these companies will achieve record-breaking results in the first half of the year alone, with net profits approaching 10 trillion won. Additionally, shareholder return incentive policies, such as the proposed bill for separate taxation of dividend income, are fueling expectations for value-up (corporate value enhancement). As a result, there is growing interest in whether the total shareholder return ratio of major financial holding companies will exceed 50%.

According to the financial sector on July 10, the stock prices of the four major financial holding companies (KB, Shinhan, Hana, Woori) have all recently hit all-time highs. On July 8, KB Financial closed at a record high of 122,000 won, up 6.64%. On the same day, Hana Financial Group also closed at 94,300 won, up 9.78%. Shinhan Financial Group (up 7.58%) and Woori Financial Group (up 8.51%) also posted significant gains on the same day. While there was a slight correction on July 9, it did not lead to a sharp decline, with the market instead taking a breather.

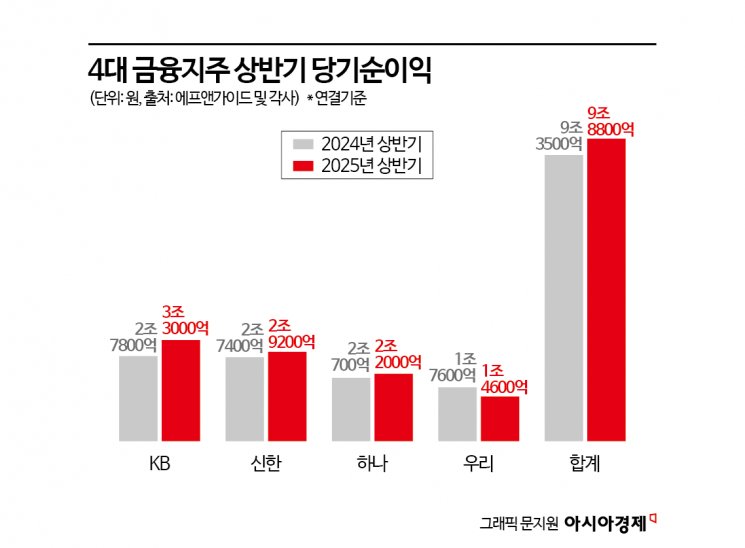

The main reason for the sharp rise in financial holding company stock prices is the anticipation of record-breaking results for the first half of the year. According to financial information provider FnGuide, the consensus for first-half consolidated net profit of the four major financial holding companies is 9.8821 trillion won. This represents an increase of about 6% compared to the first half of last year.

Despite unfavorable conditions such as interest rate cuts, rising delinquency rates, and participation in mutually beneficial finance, the companies were able to achieve record-high results in the first half of the year?nearly 10 trillion won?primarily due to the expansion of the 'loan-to-deposit interest rate spread.' While deposit interest rates were quickly lowered in line with the trend of base rate cuts, lending rates remained high to manage household debt.

Stricter government controls on household lending also contributed to the financial holding companies' results. Following the June 27 real estate measures, a surge in speculative demand led to significant growth in household loans in June. The outstanding household loans at the five major banks increased from 734 trillion won in January to 755 trillion won in June. In particular, there was a sharp increase of nearly 7 trillion won in June alone, and it is estimated that household loans for the second quarter grew by nearly 2%.

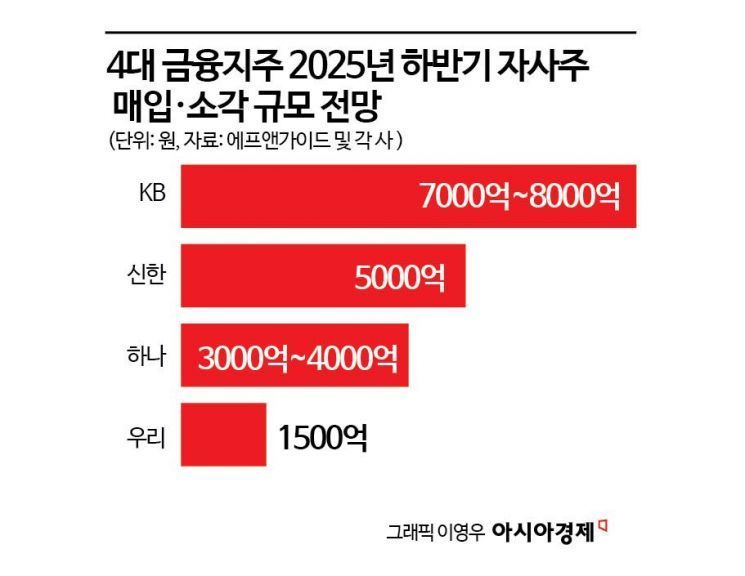

In addition to the prospect of record results, expectations for shareholder returns are being boosted by planned share buybacks and cancellations by the four major financial holding companies in the second half of the year, which is also supporting stock prices. According to FnGuide, the four major financial holding companies are expected to buy back and cancel at least 1.65 trillion won worth of their own shares in the second half of the year. By company, KB Financial bought back and canceled 820 billion won worth of its own shares in the first half of the year and is expected to buy back and cancel an additional 700 to 800 billion won in the second half. Shinhan Financial moved up its schedule for share cancellation, which was originally planned through August, and completed the cancellation of about 500 billion won worth of shares on June 26. Hana Financial also plans to buy back and cancel 300 to 400 billion won worth of shares in the second half, about two months earlier than its original September target, and the amount is nearly double the initial estimate. Woori Financial Group is expected to buy back and cancel 150 billion won worth of shares in the second half.

Kim Eungap, a researcher at Kiwoom Securities, said, "Given the stable results and share cancellations, there is still room for further increases in financial holding company stock prices," adding, "Considering that the price-to-book ratio (PBR) of the four major financial holding companies is about 0.4 to 0.6 times, they remain undervalued compared to their asset value, leaving room for further gains."

The fact that discussions on the separate taxation of dividend income are gaining momentum also appears to have contributed to the record rally in financial stocks. The main content of the proposed amendment to the Income Tax Act currently submitted to the National Assembly is that dividend income received from listed companies with a dividend payout ratio of 25% or more would be taxed separately from comprehensive income at a separate rate.

Park Hyejin, a researcher at Daishin Securities, commented, "Initially, it was expected that dividend tax reform would be difficult to implement due to concerns about tax revenue shortfalls. However, as expectations have grown that dividend tax reform will be included in the July tax reform plan, bank stocks have been showing growth rates exceeding those of the KOSPI."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.