9.5 Trillion Won in Treasury Shares Purchased in the First Half of the Year, Companies Join the Trend

Sharp Increase in Treasury Share Purchases via Trust Contracts

Purchase Scale Can Be Reduced or Suspended at Any Time, Caution Advised

Recently, as discussions on making treasury share cancellation mandatory have gained momentum in political circles, buying has concentrated on stocks with a high proportion of treasury shares. When treasury shares are cancelled, the number of outstanding shares decreases, which not only increases earnings per share (EPS) but also fundamentally blocks the possibility of treasury shares being misused as a means to strengthen the ownership's control over the company.

According to the Korea Exchange on July 10, Shin Young Securities closed at 166,700 won the previous day, up 17.25%. Shin Young Securities has the highest proportion of treasury shares among all listed companies, at 53.1%. On the same day, Bookook Securities, which hit the upper price limit, also has a high treasury share ratio of 42.7%. Infovine, which has the highest treasury share ratio (51.5%) among KOSDAQ-listed companies, also closed at the upper price limit.

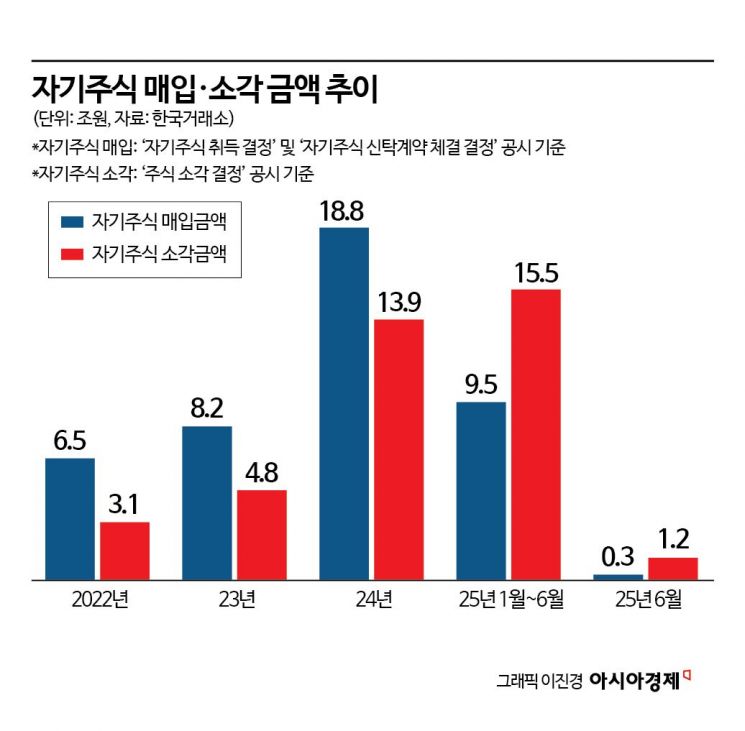

As value-up (corporate value enhancement) policies are being promoted, many listed companies are responding by increasing the scale of their treasury share purchases and cancellations. In the first half of this year, the total value of treasury shares cancelled reached 15.5 trillion won, already surpassing last year’s previous record high of 13.9 trillion won. During the same period, the amount spent on treasury share purchases also reached 9.5 trillion won, exceeding the records set in 2022 and 2023, and already surpassing half of last year’s total. Treasury share purchases reduce the number of shares in circulation, which boosts share prices and indirectly distributes cash to shareholders.

The issue is that an increasing number of listed companies are acquiring treasury shares indirectly through trust contracts with securities firms, rather than purchasing them directly. In the first half of this year, direct acquisitions of treasury shares totaled 6.3 trillion won, while acquisitions through trust contracts amounted to 3.2 trillion won. Excluding Samsung Electronics’ 3 trillion won direct treasury share purchase in February, the majority of companies opted for trust acquisitions.

The reason companies are willing to pay a premium to have securities firms acquire treasury shares through trust contracts, rather than purchasing them directly and incurring only the purchase commission, is the lack of mandatory requirements. When companies acquire treasury shares directly, they must purchase the entire target quantity within three months. There are also several restrictions, such as a ban on selling the shares for six months after acquisition.

In contrast, with trust contracts, companies only need to hold the shares for one month after acquisition, and are required to disclose their holdings just once, three months after signing the contract. After that, there are no additional disclosure obligations until the contract ends. Furthermore, companies are not required to purchase the full contract amount, and the purchase period can be flexibly managed over a long term, such as six months to one year. It is also possible to terminate the trust contract earlier than the agreed period. In fact, in the first half of this year, there were 132 disclosures of early termination of treasury share acquisition trust contracts, a 67% increase compared to the same period last year.

A securities firm official commented, “Compared to direct purchases, treasury share acquisitions through trust contracts have uncertain purchase amounts and timing, and disclosures are limited, so it is difficult to definitively assess their impact on share prices. When a company announces a treasury share purchase, investors should first check whether it is a direct acquisition or a trust contract, and closely monitor whether the company actually purchases the promised amount of shares and its future disposal plans.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.