Q1 Household Net Fund Operation at 92.9 Trillion Won... Up by 30.3 Trillion Won

Income Growth and Sluggish Consumption, Fewer New Apartment Move-ins

Corporations: Investment Down but Costs Up... Net Fundraising at 18.7 Trillion Won

Household Debt-to-Nominal GDP Ratio at 89.4%... Declines for Six Consecutive Quarters

In the first quarter of this year, the surplus funds (excess funds) held by Korean households increased by 30 trillion won compared to the previous quarter. This was due to a seasonal effect, such as the payment of year-beginning bonuses, which boosted income, while spending contracted as a result of the aftermath of the emergency martial law situation. The decrease in new apartment move-ins also reduced the need for large expenditures, further contributing to the increase in household surplus funds. It is analyzed that, in the second quarter, the rise in real estate prices in Seoul and other metropolitan areas and the resulting increase in household debt also affected household surplus funds.

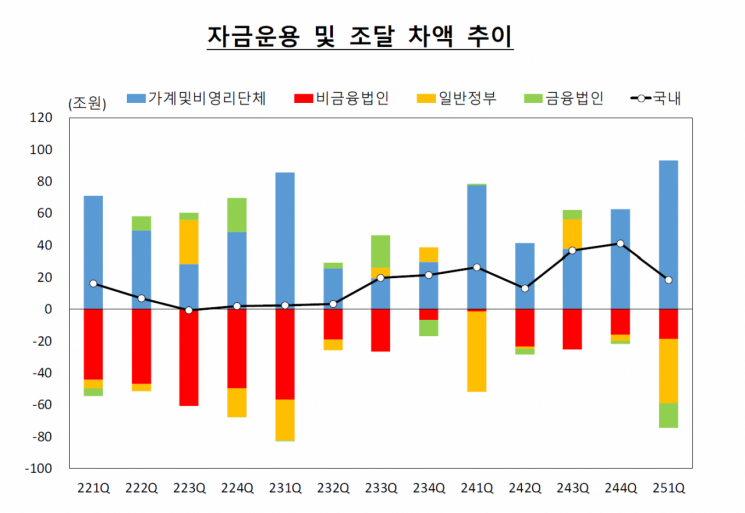

According to the "Preliminary Money Flow for Q1 2025" statistics released by the Bank of Korea on July 8, the net fund operation by households and nonprofit organizations in the first quarter was 92.9 trillion won, up 30.3 trillion won from the previous quarter (62.6 trillion won). This is the largest figure since the quarterly statistics began in 2009. The previous record was 92.8 trillion won in the first quarter of 2023. Net fund operation is calculated by subtracting the amount of financial liabilities (fundraising) from the amount of financial assets (fund operation) for a given economic agent, and can be interpreted as the agent's surplus funds.

Kim Yonghyun, head of the Money Flow Team at the Bank of Korea's Economic Statistics Department 1, explained, "Household income increased due to the inflow of year-beginning bonuses, and surplus funds grew as consumption slowed and new apartment move-ins decreased, resulting in a larger net fund operation compared to the previous quarter." According to Statistics Korea, household income in the first quarter of this year increased by 2.6% compared to the previous quarter. In contrast, private consumption in the first quarter decreased by 1.4% from the previous quarter. According to Real Estate 114, the number of new apartment move-ins nationwide was 92,000 units, down from the previous quarter (99,000 units) and the same period last year (108,000 units). When new apartment move-ins decrease, the transfer of transaction funds from households to construction companies also decreases, resulting in an increase in overall household surplus funds.

In the first quarter of this year, the fund operation amount for households and nonprofit organizations was 101.2 trillion won, up from 71.2 trillion won in the previous quarter. The increase was mainly driven by deposits at financial institutions, equity securities, and investment funds. During the same period, the amount of fundraising was 8.2 trillion won, a slight decrease from the previous quarter (8.6 trillion won), as the pace of borrowing from financial institutions slowed.

The net fundraising by non-financial corporations (general corporations) was 18.7 trillion won, an increase from the previous quarter (16.2 trillion won). Kim explained, "Although investment slowed due to worsening economic conditions such as increased internal and external uncertainty, demand for working capital, including bonus payments, increased, resulting in a slight expansion in net fundraising compared to the previous quarter." Fund operation amounted to 25.3 trillion won, a significant increase from 4.4 trillion won in the previous quarter. Although deposits at financial institutions decreased, equity securities and investment funds increased, leading to the overall expansion. Fundraising amounted to 44.1 trillion won, up from 20.6 trillion won in the previous quarter. The increase is attributed to a rise in direct financing, such as a shift to net bond issuance.

The general government recorded a net fundraising of 40.2 trillion won, a sharp increase from the previous quarter (3.9 trillion won). This was due to seasonal factors such as raising funds through government bond issuance in the first quarter, resulting in government spending increasing more than revenue. Fund operation shifted from net disposal to net acquisition, mainly through deposits at financial institutions, equity securities, and investment funds, rising from -24.8 trillion won in the fourth quarter of last year to 44.6 trillion won in the first quarter of this year. Fundraising also shifted from net repayment to net borrowing, jumping from -20.9 trillion won in the fourth quarter of last year to 84.8 trillion won in the first quarter of this year, mainly due to a significant increase in government bond issuance and borrowing from financial institutions.

The net fundraising by the overseas sector was 18.5 trillion won, down from the previous quarter (41 trillion won), mainly due to a narrowing current account surplus. An increase in fund operation by the overseas sector indicates an increase in Korea's external debt, while an increase in fundraising indicates an increase in Korea's external assets.

As of the end of the first quarter this year, the financial assets of households and nonprofit organizations stood at 5,574.1 trillion won, up 101.4 trillion won from the end of the previous quarter. Financial liabilities increased by 10.4 trillion won to 2,377.9 trillion won. Net financial assets amounted to 3,196.2 trillion won, an increase of 91.1 trillion won from the end of the previous quarter, and the debt-to-asset ratio rose to 2.34 times, up from 2.31 times at the end of the previous quarter.

The household debt-to-nominal GDP ratio for the first quarter of this year was 89.4%, down 0.2 percentage points from the previous quarter (89.6%, revised by 0.5 percentage points due to changes in debt balance and national accounts). This marks a decline for six consecutive quarters. However, the ratio is expected to rise slightly in the second quarter. Kim said, "While household surplus funds expanded, the lifting of land transaction permit zones (Toheoguyeok) in Seoul and other factors led to an increase in housing transactions, particularly in the metropolitan area, which in turn accelerated the growth of household debt. Although it is unclear how much GDP will grow in the second quarter, the household debt-to-GDP ratio is expected to rise slightly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.