Wholesale Price Set 5% Lower Than Original

Celltrion Begins Full-Scale Entry into 9 Trillion KRW Denosumab Market

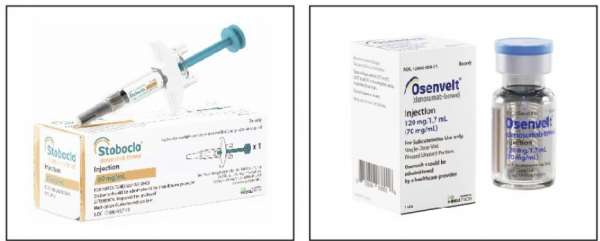

Celltrion has launched the bone disease treatment 'Stovoclo·Osenbelt (active ingredient: denosumab)' in the United States, targeting the global denosumab market, which is estimated to be worth approximately 9 trillion KRW.

According to Celltrion on July 8, the newly launched product is a biosimilar of Amgen's Prolia·Xgeva. In early March, Celltrion received approval from the U.S. Food and Drug Administration (FDA) for sales of the product for all indications, identical to the original. In addition, Celltrion has completed a patent settlement with the original developer, establishing a stable foundation for entry into the U.S. market.

Stovoclo·Osenbelt was launched in the U.S. at a high wholesale acquisition cost (High WAC), approximately 5% lower than the original product. As with previously launched products such as the autoimmune disease treatments Zympentra (active ingredient: infliximab, U.S. product name: RemsimaSC), Yuflyma (active ingredient: adalimumab), and Stekima (active ingredient: ustekinumab), Celltrion's U.S. subsidiary will handle direct sales.

With the launch of Stovoclo·Osenbelt, Celltrion has signed supply agreements with major hospital groups in the U.S., successfully securing an early foothold in the market. As product supply is already underway, actual prescriptions and resulting sales growth are expected to accelerate rapidly.

Celltrion plans to focus on targeting the 'open market,' which accounts for approximately 30% of the U.S. denosumab market. The open market refers to a segment where U.S. government support is provided directly to medical institutions, and typically, the influence of insurers or pharmacy benefit managers (PBMs) is minimal. Therefore, the pharmaceutical company's sales capabilities and product competitiveness play a key role in market penetration. Celltrion has already launched the oncology biosimilar Vegzelma (active ingredient: bevacizumab) through direct sales in the open market, raising its market share to 6% as of the end of last year.

In addition to the open market, Celltrion is also smoothly progressing negotiations with the three major PBMs to secure a presence in both public and private insurance markets. In particular, considering that most osteoporosis patients are postmenopausal, the company plans to quickly pursue inclusion in prescription formularies for the Medicare market, which has high demand for bone disease treatments among the elderly population.

Celltrion is also accelerating marketing activities targeting healthcare professionals. The company has previously built communication channels with key medical staff in fields such as rheumatology and oncology while selling autoimmune disease treatments. Celltrion plans to actively leverage these networks to accelerate prescription expansion in the bone disease treatment market.

The original products of Stovoclo·Osenbelt, Prolia·Xgeva, recorded combined global sales of $6,599 million (approximately 9.2 trillion KRW) in 2024. Of this, the U.S. accounted for $4,392 million (approximately 6.15 trillion KRW), representing 67% of total sales.

Thomas Nussbaumer, Chief Commercial Officer (CCO) of Celltrion USA, stated, "With the launch of Stovoclo·Osenbelt, we expect to provide U.S. healthcare professionals and patients with a broader range of bone disease treatment options, thereby improving access to care. Based on Celltrion's proven sales capabilities and distribution network, we will work to expand prescriptions in the open market and smoothly proceed with negotiations with PBMs to rapidly establish a strong presence in the bone disease treatment market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)