Entertainment Stocks Continue to Decline This Month... "Profit-Taking"

Second Half Expected to Bring Stronger Earnings Momentum with Global Concerts

Entertainment stocks, which had been recording significant gains this year, have entered a downward trend in July. This is interpreted as a result of both uncertainty regarding second-quarter earnings and the emergence of personnel risks. However, securities analysts advise that as entertainment companies are expected to regain earnings momentum from the third quarter, investors should view the current price correction as an opportunity.

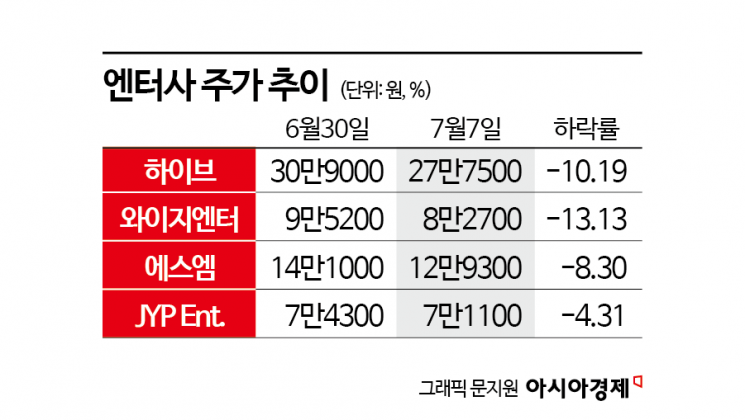

According to the Korea Exchange on July 8, HYBE closed at 277,500 won the previous day. This represents a 10.19% decline compared to 309,000 won at the end of last month. During the same period, YG Entertainment, SM, and JYP Ent. also fell by 13.13%, 8.30%, and 4.31%, respectively.

This year, entertainment stocks have recorded high rates of increase. Notably, from the end of last year to June of this year, HYBE and YG Entertainment saw their share prices rise by 59.77% and 107.86%, respectively. Given the significant gains, some investors have taken profits. In addition, personnel risks have emerged, such as HYBE Chairman Bang Si-hyuk being summoned by the Financial Supervisory Service on allegations of listing irregularities.

Lim Sujin, a researcher at Daishin Securities, explained, "Overall weakness has continued due to profit-taking following the sharp rise in share prices since the beginning of the year, as well as rotation into other sectors such as semiconductors," adding, "There is a possibility that this short-term price correction will persist for some time."

However, from the second half of the year, earnings momentum is expected to emerge due to global concerts and merchandise (MD) sales. In the case of HYBE, the announcement of BTS's large-scale world tour schedule is expected as early as the fourth quarter. In addition, YG Entertainment is likely to concentrate the announcement of BLACKPINK's earnings and additional encore concert schedules in the fourth quarter.

Researcher Lim emphasized, "The structural growth story centered on concerts and MD remains valid," and added, "In the short term, earnings announcements and the release of fourth-quarter event schedules could serve as inflection points for a rebound in share prices, and differentiated trends by stock are expected around those times."

In addition, the success of the animation 'K-Pop Demon Hunters' is also expected to have a positive impact. 'K-Pop Demon Hunters' ranked first in 41 countries worldwide after its release. The original soundtrack (OST) also ranked third on the Billboard 200. Kim Yooyeok, a researcher at IBK Investment & Securities, said, "The success of K-Pop Demon Hunters is expected to drive stronger growth in concert and MD sales for entertainment companies," adding, "It is positive in terms of expanding the global fandom."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.