Life Insurers Rush to Launch Increasing Whole Life Insurance Products

Premiums Rise Along With Insurance Payouts

Future Burden of Payouts Shifts Significantly... Concerns Over Various Side Effects

Life insurance companies are competitively launching "increasing whole life insurance" products. The aim is to secure the Contractual Service Margin (CSM), a key profitability indicator under the International Financial Reporting Standards 17 (IFRS17) regime. However, as these products emphasize large insurance payouts rather than the high premiums, consumers are advised to exercise caution.

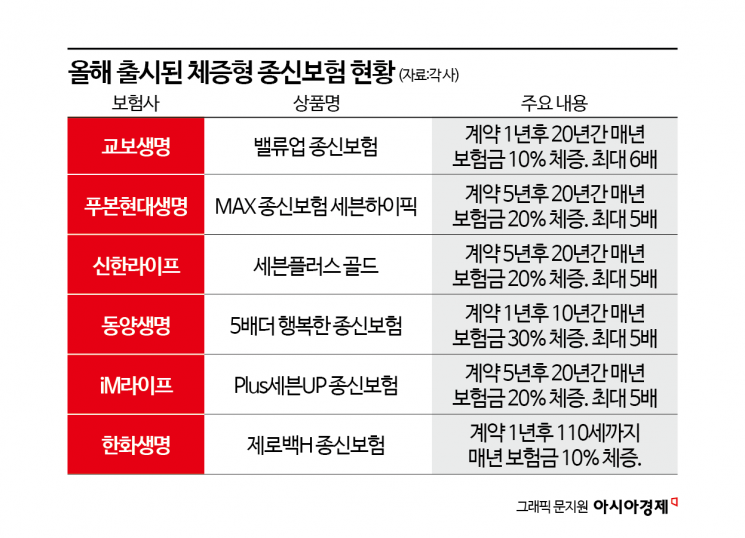

According to the insurance industry on July 8, Kyobo Life launched its increasing whole life insurance product, "Kyobo Value-Up Whole Life Insurance (non-participating)," the previous day. Kyobo Life designed the policy so that, starting one year after the contract begins and continuing until the end of the premium payment period (20 years), the death benefit increases by 10% each year. For example, if a policyholder subscribes to a main contract with a death benefit of 100 million won, the basic death benefit increases by 10% every year for 20 years, resulting in a death benefit of 640 million won (including maintenance bonus) after 20 years?about six times the original amount.

Unlike level whole life insurance, where the death benefit remains the same throughout the contract period, increasing whole life insurance products are designed so that the death benefit increases after a certain period following enrollment. These products were developed to address the issue that, as inflation rises, the real value of a fixed insurance payout decreases. Although they were popular during past periods of low interest rates and high inflation, they are now regaining attention.

The company that opened the competition for increasing whole life insurance products this year was Hanwha Life. Early in the year, Hanwha Life introduced the "Zero100H Whole Life Insurance," which increases the death benefit by 10% every year from one year after the contract begins until age 110. This is the longest coverage in the industry. For example, if a 40-year-old policyholder signs up for a main contract with a death benefit of 100 million won, the death benefit will increase by 10 million won each year, reaching 800 million won at age 110.

In May and June, Dongyang Life, iM Life, Shinhan Life, and Fubon Hyundai Life also launched increasing whole life insurance products in succession, intensifying the competition. These insurers designed their products so that, starting one to five years after the contract begins, the death benefit increases by 20?30% over a period of 10?20 years.

In the field, sales agents promoted these products by highlighting their ability to significantly reduce inheritance and gift tax burdens. The longer the policyholder survives, the greater the coverage compared to standard whole life insurance, allowing beneficiaries to use the payout as a source for tax payments upon the policyholder's death. In cases where the child pays the parent's insurance premium and receives the death benefit upon the parent's death, the payout is tax-exempt.

However, promotional materials such as press releases, blogs, and advertisements from life insurers mainly highlight the annual increase in death benefits, with little explanation regarding increases in premiums for policyholders. Since the increased death benefit is reflected in the premium, increasing whole life insurance products are more expensive than standard whole life insurance. Most of these products are either non-refund or low-refund types, so policyholders may incur significant losses if they surrender the policy early, as the surrender value is low or nonexistent. In August 2021, the Financial Supervisory Service issued a consumer alert when the sale of increasing whole life insurance products became overheated and the risk of mis-selling increased. However, as of now, four years later, the likelihood of similar issues arising is increasing.

Furthermore, increasing whole life insurance products shift even greater risks into the future compared to standard whole life insurance. The more these products are sold, the more current management can achieve short-term results by securing CSM, but future management will be burdened with paying out massive insurance benefits. An industry insider stated, "As people age and their survival period lengthens, the probability of death also increases, and if the insurance payout also rises, this becomes a significant burden for insurers. If competition overheats, financial regulators may intervene, as they did last year with short-term premium whole life insurance products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.