Hot-Rolled Steel Sheet at 820,000 Won per Ton

Rebar Maintains 700,000 Won Level

Despite Hopes for a 'Supercycle,' Supply Chain Instability Persists

Despite the possibility of crude steel production cuts in China in the second half of the year, domestic steel distribution prices in Korea have remained stagnant. While there are expectations for a repeat of the past 'supercycle,' concerns are also rising that production cuts could introduce new instability into global supply chains. As a result, the industry is leaning toward caution rather than optimism.

As of July, according to industry sources, the price of domestically produced hot-rolled steel sheets is around 820,000 won per ton, showing a trend similar to the beginning of the year. The price of rebar also stands at about 700,000 won per ton; it rose from 700,000 won in January to 750,000 won in May, then fell back again. Imported steel prices, including those from China, have shown a similar pattern. Imported hot-rolled steel sheets dropped from 760,000 won per ton in January to 710,000 won this month, while imported rebar has remained at around 690,000 won. The global distribution price of Chinese steel also continues to fluctuate within a 12% range.

Earlier this year, China's crude steel output recorded negative growth for the first time, raising the possibility that the Chinese government may intervene to control supply. In May, China's crude steel production was about 86.55 million tons, a decrease of about 7% compared to the same month last year (92.98 million tons). For the January-May period, cumulative production was 431.63 million tons, down 2.1% from the same period last year. This decline is attributed to weakening domestic demand in China, the government's steel industry restructuring policies, and local governments' environmental regulations. In addition, major countries such as the United States and those in Europe are stepping up protectionist measures, including anti-dumping tariffs and import restrictions on Chinese steel, which is expected to accelerate this trend.

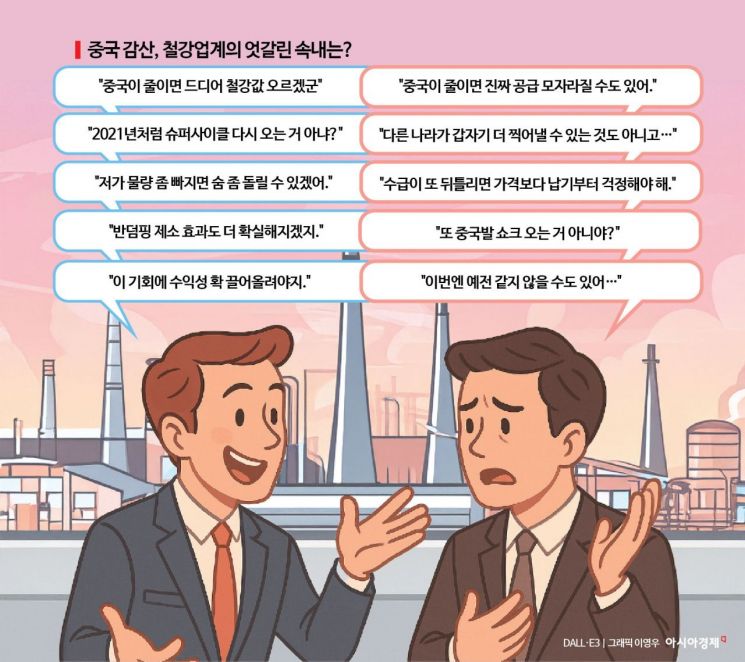

Korean steelmakers are maintaining a cautious stance rather than optimism about possible production cuts in China. In 2021, production cuts in China driven by the environmental, social, and governance (ESG) agenda led to a 'supercycle' with a sharp rise in steel prices. However, there are also concerns that production cuts could further exacerbate supply imbalances. China continues to supply excess steel to the global market at low prices due to structural issues such as sluggish domestic demand and an oversupply of blast furnace facilities. If production cuts become a reality under these circumstances, it could lead not only to simple supply-demand adjustments but also to global supply disruptions. Former Hyundai Steel Vice Chairman Woo Yucheol also expressed concerns in a recent interview with this newspaper, stating, "If production cuts become a reality in China, which has overinvested in blast furnaces, there are no suitable countries to replace that production. Korea, Japan, the United States, and Europe already have limited production capacity, so if China reduces output, it could lead to a global supply shortage." An industry official added, "China is a country that keeps producing even when told not to, but if actual production cuts do occur, there is some hope that the market could improve. We need to watch whether this will trigger a market rebound or mark the beginning of another period of instability."

The industry is also paying close attention to whether anti-dumping (AD) petitions will be expanded. Currently, imports of thick steel plates have been virtually blocked through high preliminary tariffs, and preliminary rulings on hot-rolled steel sheets are reportedly imminent. Anti-dumping petitions for galvanized steel sheets are also under discussion. The industry explains that if anti-dumping measures are added to China's production cuts, the inflow of Chinese steel could decrease and pressure on domestic prices could ease.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.