The Only Retail Sales Channel Eligible for the Livelihood Recovery Consumption Coupon

Sales Boosted During COVID-19 Relief Fund Distribution

Summer Product Demand and Third-Quarter Synergy Raise Hopes for a Performance Rebound

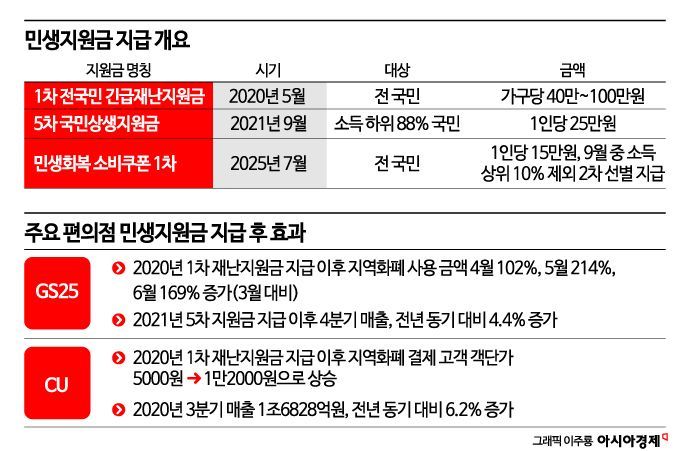

With the government finalizing the list of eligible businesses for the "Livelihood Recovery Consumption Coupon" to be distributed this month, the convenience store industry is expected to benefit. Most competing channels, both online and offline, have been excluded from the coupon’s usage scope. Combined with the seasonal increase in outdoor activities such as summer vacations and school breaks, the convenience store industry?which has experienced negative growth so far this year?is expected to secure a foothold for a performance rebound.

According to the Ministry of the Interior and Safety and related industries on July 7, the government will distribute the Livelihood Recovery Consumption Coupon to all citizens starting July 21, providing 150,000 won per person. The second phase, which selectively distributes support to 90% of the population, excluding the top 10% by income, will begin on September 22. The coupon can only be used at stores operated by small business owners with annual sales of 3 billion won or less. In the distribution industry, most convenience stores nationwide are expected to be included, as more than 90% of all stores are operated as franchises classified as small businesses.

Kim Minjae, Acting Minister of the Ministry of the Interior and Safety, is announcing the first phase of the livelihood recovery consumption coupon distribution plan at the government Seoul office briefing room. Photo by Yonhap News

Kim Minjae, Acting Minister of the Ministry of the Interior and Safety, is announcing the first phase of the livelihood recovery consumption coupon distribution plan at the government Seoul office briefing room. Photo by Yonhap News

The convenience store industry expects the Livelihood Recovery Consumption Coupon to act as a catalyst for improving sluggish business conditions. According to the Ministry of Trade, Industry and Energy, domestic convenience store sales in the first quarter of this year decreased by 0.4% compared to the same period last year. This is the first time since statistics began in 2013 that quarterly sales in the convenience store sector have shown negative growth. In fact, in February this year, domestic convenience store sales fell by 4.6% year-on-year, marking the first decline in about five years since February?March 2020. Sales continued to decrease in April (-0.6%) and May (-0.2%), recording a year-on-year decline for the third time this year. This was due to domestic consumption stagnation, a saturated number of convenience store locations, and unfavorable weather, such as repeated rain on weekends and holidays even during the spring outing season.

Previously, the convenience store industry saw an actual sales increase when the first nationwide emergency disaster relief funds were distributed from May 2020 for three months, with each household receiving between 400,000 and 1 million won. For example, GS25, operated by GS Retail, saw the amount spent using local currency (ZeroPay and Kona Card) increase by 102% in April, 214% in May, and 169% in June compared to the previous month, following the decision to provide emergency disaster relief funds. In addition, after the fifth round of national coexistence support funds?25 million won per person for 88% of the lower-income population?was distributed from September 2021, fourth-quarter sales that year increased by 4.4% compared to the same period the previous year.

CU, a convenience store operated by BGF Retail, also saw the average transaction amount of customers using local currency reach 12,000 won after the first emergency disaster relief fund was distributed in 2020, which was 2.4 times higher than the average for regular customers (about 5,000 won). Third-quarter sales that year, which included the support fund usage period, reached 1.6828 trillion won, a 6.2% increase compared to the same period the previous year.

An industry official stated, "Many consumers used the support funds at convenience stores near their homes or workplaces to purchase food items such as alcoholic beverages, side dishes, and ready-to-eat meals," adding, "We expect a similar pattern of use for the Livelihood Recovery Consumption Coupon this time as well."

Sales of convenience store products with high summer demand, such as ice cups, iced coffee, ice cream, and beverages, as well as alcoholic beverages like beer, are also expected to rise. When the COVID-19 emergency disaster relief funds were distributed, major convenience stores saw beer and wine sales increase by more than 500?700% compared to the previous period during the early phase of implementation.

With department stores, large supermarkets, online malls, and warehouse-style discount stores excluded from the list of eligible businesses for the Livelihood Recovery Consumption Coupon?as well as corporate supermarkets (SSMs), which were allowed to accept support funds only for franchises during the COVID-19 period?a clear performance rebound is expected for the convenience store industry. Joo Younghoon, an analyst at NH Investment & Securities, predicted, "About 5% of the consumption coupons could flow into convenience stores," adding, "This will help recover sales at existing stores and strengthen the third-quarter momentum, which is the period when convenience stores usually achieve their highest performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.