Early Termination of EV Tax Credits: Direct Blow to Hyundai Motor

AMPC Maintained: Solar Cell and Battery Industries Relieved

Decreased Demand from Power Producers and Automakers a Negative Factor

A mega bill reflecting the campaign pledges of U.S. President Donald Trump has passed Congress, putting the domestic electric vehicle (EV) export strategy to the U.S. in a critical situation. This is because measures such as the early termination of tax credits and the reduction of subsidies are being implemented, even as Korean companies are making large-scale investments locally to target the U.S. market. Automakers, who benefited from clean energy subsidies under the previous administration of President Joe Biden, are expected to be hit hardest by the early termination of EV tax credits. However, there is an assessment that companies in the downstream sectors, such as battery manufacturers and solar producers, can breathe a relative sigh of relief as major tax credits for them are being maintained.

Domestic automakers such as Hyundai Motor and Kia are concerned about a contraction in sales in the second half of the year due to the early termination of U.S. EV tax credits, after the passage of the so-called 'One Big Beautiful Bill' in the U.S. House of Representatives on July 3 (local time). Together with the import tariffs that have been imposed since April, the burden on local operations has increased significantly.

This bill, which legislatively supports President Donald Trump's campaign pledges, includes the early termination of EV tax credits under the Inflation Reduction Act (IRA) as of September 30. Initially, the plan was to maintain tax credits of up to $7,500 (about 10.24 million KRW) for new EV purchases and leases, and up to $4,000 for used EV purchases until the end of 2032. However, the termination has been advanced by more than seven years.

An industry insider said, "EV sales could temporarily surge until September, when the tax credit system is still in place," but also predicted, "After that, sales volumes will drop sharply." This is expected to further accelerate the ongoing contraction in EV sales. Hyundai Motor and Kia sold a record-high 180,715 eco-friendly vehicles in the U.S. in the first half of this year, continuing their growth trend. However, as of June, Hyundai's sales (4,941 units) were down 12.6% year-on-year, and Kia's sales (2,074 units) dropped by as much as 63.9%.

Hyundai Motor Group has been focusing on producing the Ioniq 5 and Ioniq 9, which are eligible for IRA benefits, at its 'Metaplant America' facility completed in March. If EV incentives disappear, the company is expected to review plans to shift production more toward hybrids.

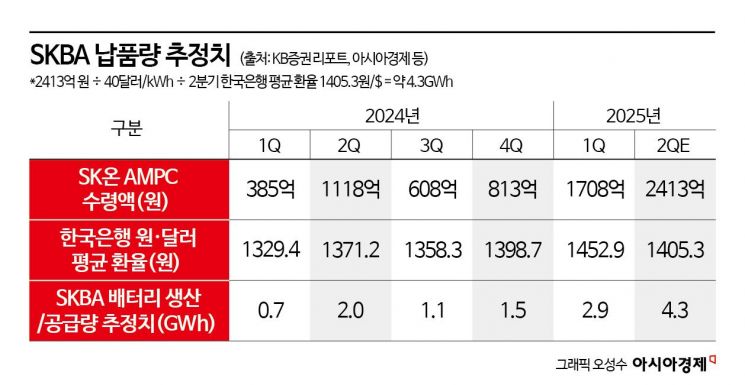

However, as the sunset period for the Advanced Manufacturing Production Credit (AMPC) is maintained, the three major battery companies and the solar industry are somewhat relieved. Although President Trump had suggested he might virtually wipe out the renewable energy industry, the passage of this bill has resolved much of the previous uncertainty. In fact, with some AMPC provisions revised and the addition of a 'Prevention of Foreign Influence (PFE)' clause to exclude Chinese influence, industry sources say Korean battery manufacturers could benefit.

Nevertheless, the decrease in demand from automaker customers due to shrinking EV sales remains a risk factor. An industry insider explained, "The battery market grows alongside the expansion of the EV market, so this is disappointing," but added, "The early termination of the tax credit has been anticipated since last year, so companies do not see it as a major crisis."

The solar industry is in a similar situation. While the AMPC remains in effect for the solar sector, the sunset date for the Clean Electricity Investment Tax Credit (ITC) has been moved up from 2032 to the end of 2027, which could reduce investment demand from power producers. An industry insider predicted, "Although the benefits for power suppliers may decrease, given the chronic power shortages in the U.S., the reduction in demand is unlikely to be significant."

Solar companies such as Hanwha Qcells and OCI Holdings, which are establishing or building production facilities in the U.S., stated, "With the AMPC maintained, solar-related stocks are being positively evaluated in the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.