On the 20th, the KOSPI index, which had stopped its consecutive rise and started lower, was displayed along with the won/dollar exchange rate on the status board of Hana Bank dealing room in Jung-gu, Seoul. On that day, the KOSPI opened at 2661.72, down 0.37% from the previous session, and the won/dollar exchange rate in the Seoul foreign exchange market started strong, rising by more than 2 won. February 20, 2025 Photo by Cho Yongjun

On the 20th, the KOSPI index, which had stopped its consecutive rise and started lower, was displayed along with the won/dollar exchange rate on the status board of Hana Bank dealing room in Jung-gu, Seoul. On that day, the KOSPI opened at 2661.72, down 0.37% from the previous session, and the won/dollar exchange rate in the Seoul foreign exchange market started strong, rising by more than 2 won. February 20, 2025 Photo by Cho Yongjun

In order to maintain an adequate level of liquidity during the extended trading hours of the foreign exchange market, the foreign exchange authorities have set the transaction volume requirement for Registered Foreign Institution (RFI) status at an annual average of at least $100 million over the previous three years. The grace period for the obligation to report transactions via the foreign exchange electronic network has also been extended by an additional six months, until the end of this year.

On July 4, the Ministry of Economy and Finance and the Bank of Korea marked the first anniversary of the official implementation of the 'foreign exchange market structure improvement,' which allows licensed global financial institutions to directly participate in the domestic foreign exchange market. They reviewed the operational status over the past year and announced additional measures to further stabilize the system.

Since January of last year, the foreign exchange authorities have allowed foreign financial institutions to participate in the domestic foreign exchange market. From July 1 of the same year, the market's trading hours were extended from 9:00 a.m. - 3:30 p.m. to 2:00 a.m. the following day.

To date, a total of 52 foreign financial institutions have registered as RFIs and are participating in the domestic foreign exchange market. An RFI is a foreign financial institution based overseas that has been licensed by the foreign exchange authorities to trade in the domestic foreign exchange market.

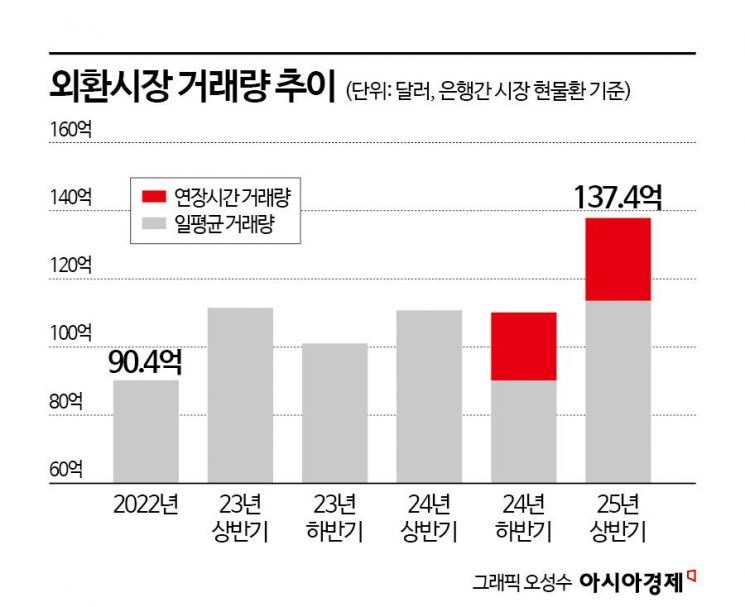

During the most recent one-year period (July 2024 - June 2025), the average daily trading volume in the foreign exchange market was $12.31 billion, an increase of 16.3% compared to the same period the previous year. This figure is 44.6% higher than the five-year average. An official from the Ministry of Economy and Finance stated, "As the effects of the system improvements are gradually appearing, the increase in trading volume in the first half of this year has been much more pronounced compared to the second half of last year."

To further boost trading during the extended hours, the government has established a specific transaction volume requirement of at least an annual average of $100 million over the previous three years. The evaluation will be conducted every three years, and to avoid discouraging initial market participation by RFIs, the new requirement will apply starting from next year's transaction volumes. In addition, when calculating transaction performance, not only interbank market transactions but also direct transactions will be counted, with direct transactions weighted at 50%.

An official from the Ministry of Economy and Finance explained, "Until now, we had not set specific criteria in order to help the RFI system take root, but now that the institutional foundation has been sufficiently strengthened, we have introduced clear standards to further promote actual RFI market participation."

The grace period for RFI reporting obligations via the foreign exchange electronic network will also be extended by six months, from the end of June to the end of December this year. The government also plans to steadily implement the introduction of customer-facing foreign exchange brokerage services to enhance the convenience of currency exchange for foreign investors, as well as domestic and overseas companies and institutions. The government stated that, with the goal of officially launching the service next year, it will sequentially revise subordinate regulations and carry out licensing procedures after gathering feedback from relevant institutions and industry stakeholders.

Additionally, the government has selected five institutions currently participating in the domestic foreign exchange market as leading RFIs for 2025: Deutsche Bank London Branch, Hana Bank London Branch, Standard Chartered Bank London Headquarters, State Street Bank Hong Kong Branch, and State Street Bank London Branch.

Originally, the government planned to designate three RFIs with outstanding transaction performance as leading RFIs every July starting this year. However, taking into account that these five institutions have actively participated in both spot and FX swap transactions and contributed to market activation, the number of leading RFIs was expanded to five.

The selected institutions will be granted the right to participate in the Seoul Foreign Exchange Market Council and its subcommittees. They will also receive benefits such as exemption from penalties for reporting violations once per year (excluding cases of intentional or gross negligence).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.