Net Profit of Domestic Banks' Overseas Branches Reaches $1.61 Billion Last Year

Steady Growth from $990 Million in 2022 and $1.33 Billion in 2023

Impact of Reduced Credit Loss Expenses and Non-Performing Assets

Last year, domestic banks in Korea earned nearly 2.2 trillion won from their overseas branches. Overall profits improved as banks significantly reduced credit loss expenses, including those from non-performing loans.

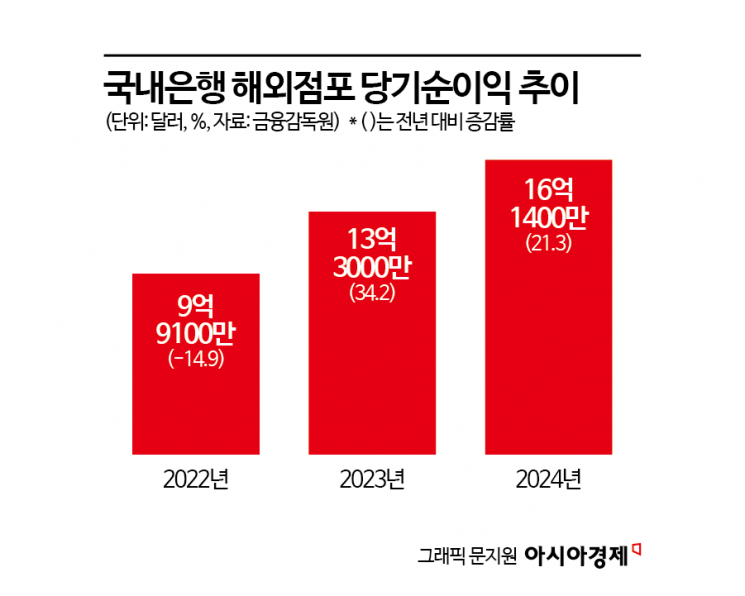

According to the "2024 Management Status and Localization Index Evaluation Results of Overseas Branches of Domestic Banks" released by the Financial Supervisory Service on July 4, the net profit of domestic banks' overseas branches last year reached $1.614 billion (2.19 trillion won), an increase of 21.3% compared to the previous year. The 2.19 trillion won in net profit from overseas branches accounted for 10% of the total net profit of 22.2 trillion won earned by domestic banks both at home and abroad last year. This marks an increase in the proportion of overseas branch profits compared to 8.1% in 2023.

The net profit of overseas branches of domestic banks rose significantly for two consecutive years, from $991 million in 2022 to $1.333 billion in 2023, and $1.614 billion last year.

Last year, domestic banks drove the increase in overall net profit by significantly reducing credit loss expenses at their overseas branches. Credit loss expenses refer to losses arising from uncollectible loans. Last year, credit loss expenses at overseas branches of domestic banks amounted to $594 million, a decrease of 45.6% compared to the previous year. This increase in profits is attributed to active efforts to reduce non-performing assets at overseas branches and to manage overall profitability.

By country, net profit increased by $229 million in the United States and $49 million in Singapore compared to the previous year. In contrast, net profit decreased by $56 million in Indonesia and by $27 million in China.

Asset quality also improved. At the end of last year, the ratio of substandard and below loans (non-performing loans) at overseas branches of domestic banks was 1.46%, down by 0.28 percentage points from 1.74% at the end of the previous year. The ratio of substandard and below loans fell in most countries, including the United States, China, and Southeast Asia.

As of the end of last year, domestic banks operated a total of 206 overseas branches in 41 countries, an increase of four compared to the end of the previous year. By type, there were 92 branches, the largest number, followed by 60 local subsidiaries and 54 representative offices.

By country, Vietnam and India each had the most branches with 20, followed by the United States with 17, China with 16, Myanmar with 14, and Hong Kong with 11. By region, Asian branches totaled 140, accounting for 68% of all overseas branches. The Americas had 29 branches (14.1%), Europe 28 branches (13.6%), and other regions 9 branches (4.4%).

At the end of last year, the total assets of overseas branches of domestic banks amounted to $217 billion, an increase of 3.3% compared to the previous year. By country, the United States had the largest total assets at $35.79 billion, followed by China with $31.8 billion and Hong Kong with $24.74 billion.

The overall localization index rating for all overseas branches remained at grade 2-plus, the same as the previous year. By country, the localization level of branches in Cambodia received the highest rating of grade 1-plus. Branches in Indonesia, Japan, and the Philippines also received high ratings at grade 1.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.