Samsung Electronics Rises for Three Consecutive Days

Surpasses 63,000 Won for the First Time Since Late September Last Year

Institutional and Foreign Investors Lead the Uptrend

Second-Quarter Earnings Expected to Hit Bottom... Improvement Anticipated in the Second Half

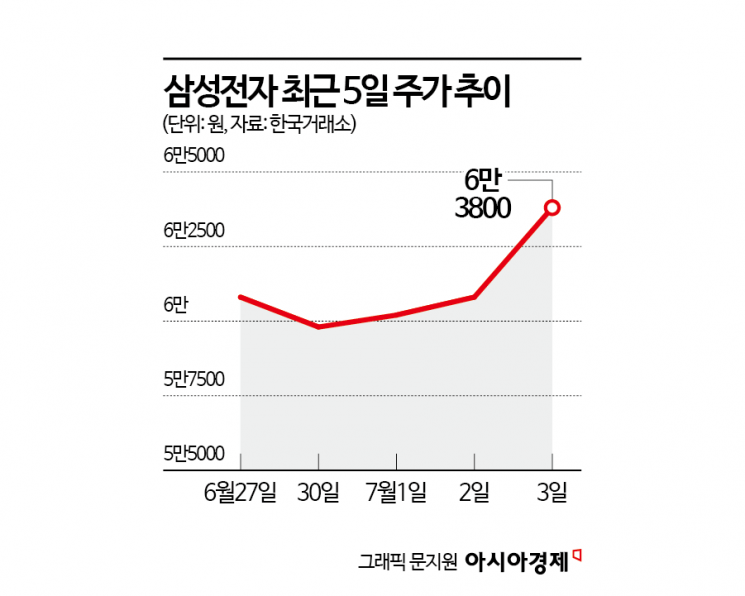

Samsung Electronics has continued its upward trend for three consecutive days, breaking its yearly high. This is the first time since late September last year that Samsung Electronics has reached the 63,000 won level. As there are forecasts that the company's second-quarter performance this year will mark the bottom, attention is focused on whether both earnings and stock price will continue to improve in the second half of the year.

According to the Korea Exchange on July 4, Samsung Electronics closed at 63,800 won on the previous day, up 4.93%. This is the highest level since September 27 last year, when it closed at 64,200 won.

While SK Hynix, having nearly reached the 300,000 won mark, has paused for a breather, Samsung Electronics is now riding an upward momentum. Lee Jaewon, a researcher at Shinhan Investment Corp., commented, "Samsung Electronics has broken through its previous high, forming a significant breakout candle," and added, "Notably, foreign investors have been net buyers in large volumes, with bargain hunting ahead of next week's earnings announcement driving the inflow."

The rise in Samsung Electronics' share price has been driven by institutional and foreign investors. Over the past week, institutions were the largest net buyers of Samsung Electronics, purchasing a net total of 457.7 billion won. They have continued net buying for five consecutive days as of the previous day. What stands out is the change in foreign investor behavior. While foreign investors had previously favored SK Hynix, they have recently shifted to buying Samsung Electronics. Over the past week, foreign investors were the largest net buyers of Samsung Electronics, with a net purchase of 134.1 billion won. In contrast, they were net sellers of SK Hynix, offloading 370.5 billion won, making it the second most sold stock after Naver.

Samsung Electronics is expected to report weak results for the second quarter of this year, which will be announced next week. According to financial information provider FnGuide, the consensus (average of securities firms' forecasts) for Samsung Electronics' second-quarter results is 76.5535 trillion won in revenue, up 3.36% year-on-year, and 6.4444 trillion won in operating profit, down 38.3%. Ryu Youngho, a researcher at NH Investment & Securities, said, "Second-quarter revenue is expected to be 75.2 trillion won and operating profit 6 trillion won, which falls short of market expectations." He explained, "Due to unfavorable exchange rates, limited improvement in foundry and system LSI losses, and a slower-than-expected recovery in high-bandwidth memory (HBM) sales, it will be difficult for the DS (Device Solutions) division, which handles the semiconductor business, to show significant improvement."

However, there are forecasts that performance will recover from the second quarter, which will mark the bottom. Noh Geunchang, a researcher at Hyundai Motor Securities, said, "Samsung Electronics' main businesses will gradually recover after bottoming out in the second quarter," and added, "DRAM will supply HBM3e 12-layer products to AMD, and as it begins full-scale supply of HBM3e products to Broadcom as well, the proportion of HBM in DRAM is expected to rise. In addition, with new customers joining the foundry business, the deficit is expected to decrease from the third quarter, so Samsung Electronics' operating profit will likely bottom out in the second quarter."

Recently, target prices have also been revised upward. Shinhan Investment Corp. raised its target price for Samsung Electronics from 77,000 won to 79,000 won, while LS Securities raised its target price by 19% to 83,000 won. Cha Yongho, a researcher at LS Securities, said, "Due to the rapid rise in semiconductor stock prices, competitors must use 2026 performance as a basis to consider upside potential, but Samsung Electronics is trading at a 12-month forward price-to-book ratio (PBR) of 1.0, which is the lowest level, making the risk-to-return ratio highly favorable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.