IPO Price Set at 43,300 Won on July 2 Last Year

Current Price at 16,420 Won... Employee Stock Ownership Unable to Sell

Commercial Launch of Small Satellite Launch Vehicle "Hanbit-Nano" Anticipated

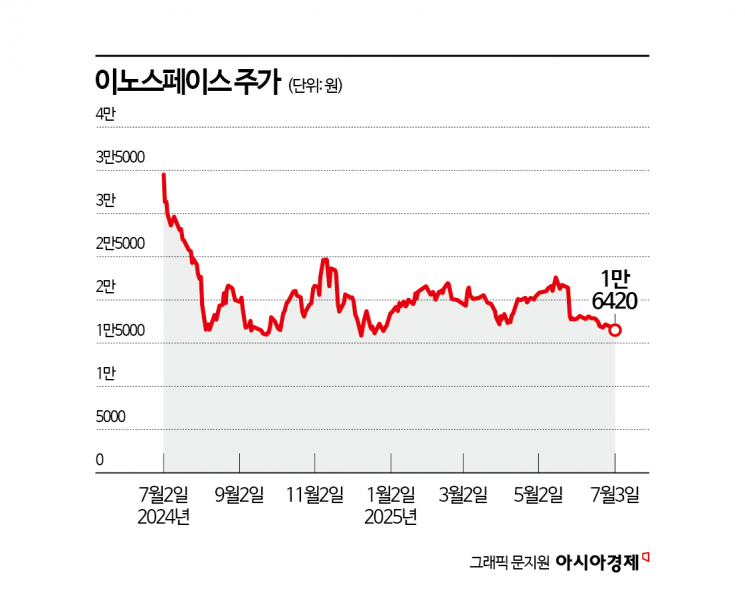

The stock price of Innospace, a space launch vehicle company that went public in July last year, is trading well below its initial public offering (IPO) price. The postponement of the commercial launch schedule for its small satellite launch vehicle, Hanbit-Nano, has negatively impacted the stock. However, the stock is expected to rebound if the company proceeds with commercial launches in the second half of this year.

According to the financial investment industry on July 4, Innospace's stock price has fallen by 62% compared to its IPO price after one year of listing. Its market capitalization has shrunk to approximately 155 billion won.

Previously, Innospace was listed on the KOSDAQ market on July 2 last year at an IPO price of 43,300 won. The company recorded a competition ratio of 599 to 1 during the demand forecast for the IPO. Based on this high competition ratio, the IPO price was set at the upper end of the desired range (36,400 to 43,300 won). Approximately 8.2836 trillion won in deposits were collected for the public subscription for general investors.

Despite strong interest before listing, the stock price declined steadily after the IPO. Institutions that participated in the demand forecast recorded a net sale of 1.3 million shares on the first day of trading. The cumulative net sale over the past year amounts to 1.92 million shares. Except for a brief moment during the first day of trading when the price exceeded the IPO price, the stock has remained below the IPO price since the second day of listing. Individual investors who participated in the public subscription and did not sell on the first day have had no opportunity to recover their principal. Employee stock ownership association members have been unable to sell their shares for a year and are currently facing significant valuation losses.

During the IPO preparation, Innospace presented its sales forecasts in its investor prospectus. The company set a sales target of 47.8 billion won for this year. It anticipated that the commercial launch of the Hanbit-Nano model, which has a rapid development schedule, would enable the full-scale commercialization of launch services. Mirae Asset Securities, the IPO underwriter, explained that its performance projections were based on a comprehensive review of contracts signed and under negotiation by Innospace, as well as the launch records of leading companies.

In the first quarter of this year, Innospace recorded sales of 240 million won and an operating loss of 12.16 billion won. Jung Jisoo, a researcher at Meritz Securities, explained, "Personnel expenses within selling and administrative costs increased by 64% compared to the same period last year," and "Research and development (R&D) expenses rose by 244.9%."

The stock price of Innospace is expected to rebound if there are concrete developments related to commercial launches. Innospace plans to enter the initial market with the Hanbit-Nano launch vehicle, which has a payload capacity of 90 kg, through its launch vehicle lineup. After the first commercial launch, the company aims to expand its launch capacity to accommodate payloads of up to 1,300 kg. The Hanbit launch vehicle is evaluated as overcoming the disadvantages of solid and liquid rockets by adopting a hybrid rocket. Researcher Jung analyzed, "The Hanbit-Nano launch is significant as it represents the first commercial launch by a private launch vehicle company in South Korea."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.