"Even Finance and IT Lag Behind"

Service Sector Productivity Only 40% of Manufacturing

"Exporting Manufacturing-Service Integration"... Strategic Industrialization Needed

Legal and Institutional Reforms First... Framework Act on Service Industry Development Must Be Comprehensive

The per capita labor productivity of the domestic service industry has remained at just 40% of the manufacturing sector over the past 20 years, indicating a significantly low level. This is the result of the service industry being perceived as playing a supporting role to manufacturing, and relying solely on domestic demand and the public sector. In particular, since the COVID-19 pandemic, productivity has fallen far below previous trends. Experts argue that legal and institutional reforms are necessary to strategically industrialize the service sector, such as by integrating it with manufacturing and promoting exports.

On July 3, the Bank of Korea emphasized these points in its report, "BOK Issue Note: Evaluation of Productivity in Korea's Service Industry and Policy Directions" (authors: Jung Sunyoung, Choi Joon, and Ahn Byungtak). Jung Sunyoung, Deputy Director of the Macroeconomic Analysis Team at the Bank of Korea, stated, "Companies like Apple and Tesla consistently create substantial added value by combining services with manufactured products," adding, "Given Korea's strong manufacturing capabilities, it is necessary to strategically industrialize the service sector by integrating it with manufacturing."

High Value-Added Service Productivity Recently 10% Below Pre-Pandemic Long-Term Trend

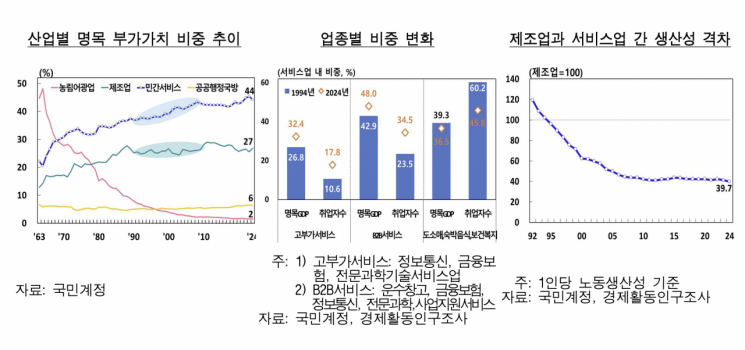

While Korea's service industry has experienced significant quantitative growth, improvements in productivity and efficiency have lagged behind. Since 1970, private services (excluding public administration, defense, and real estate) have grown at an average annual rate of 7% in terms of economic scale and 3% in employment, accounting for 44% of nominal GDP and 65% of total employment in 2023. However, per capita labor productivity in private services has remained at just 40% of the manufacturing sector for the past 20 years. Jung noted, "The level is low not only compared to major countries like Germany and Japan, but also compared to the OECD average."

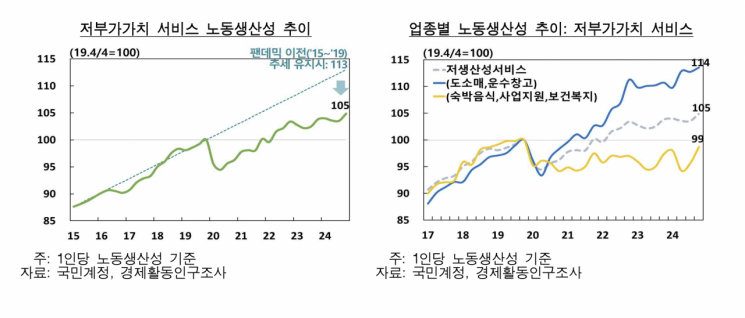

In particular, productivity since the pandemic has fallen well below previous trends. High value-added services such as finance and insurance, information and communications, and professional scientific and technical services experienced a temporary surge in productivity due to increased demand for non-face-to-face services and digital transformation, but have declined since 2022. Recently, productivity is about 10% below the pre-pandemic long-term trend. Jung commented, "Even in high value-added services, where Korea was expected to excel, it has been difficult to identify new growth drivers," emphasizing, "This stands in stark contrast to the United States, where high-tech service industries have driven post-pandemic economic recovery in terms of both employment and productivity."

Low value-added service sectors such as wholesale and retail, accommodation and food, and transport and storage also saw an overall drop in productivity immediately after the pandemic shock. Although there has been gradual recovery, productivity still lags about 7% behind previous trends. In particular, productivity in labor-intensive industries such as accommodation and food, business support, and health and welfare services plummeted in 2020 and has remained stagnant at levels lower than before the pandemic.

Perception as Manufacturing Support and Domestic-Only Sector: Structural Constraints on the Service Industry

Structural factors constraining service industry productivity include: the perception of services as supporting manufacturing, as a regulated industry, or as a public good; excessive reliance of high value-added sectors on domestic and public demand and insufficient innovation; and revolving-door competition among self-employed businesses in low value-added sectors.

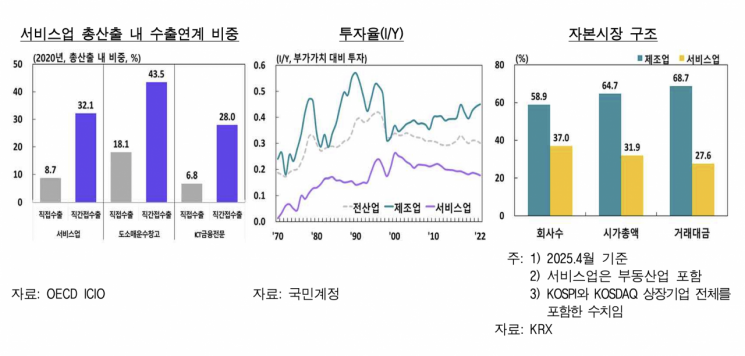

As of 2020, about 32% of total service industry output in Korea was directly or indirectly linked to goods exports, reflecting the sector's long-standing focus on supporting manufacturing production and exports (e.g., logistics, transport, finance). As a result, the independent demand base for services remains weak. Jung explained, "In general, services have tended to be regarded more as public goods or free activities than as industries that create added value," adding, "This perception has influenced industrial policy to approach services mainly from the perspective of regulation and public interest." This has acted as a constraint on private capital investment, leaving the service sector largely labor-intensive. "The investment rate in private services fell from 26% in 2000 to 18% in 2022, and the market capitalization of service firms in the stock market remains at about half that of manufacturing, indicating a structurally weak foundation for independent growth," she said.

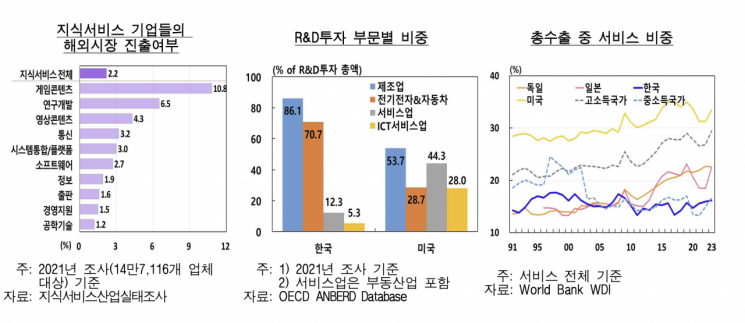

High dependence on domestic and public sectors is a structural factor that weakens incentives for companies to expand profits through overseas expansion or innovation. As of 2021, about 98% of total sales in knowledge services were concentrated in domestic transactions with government, public sector, domestic companies, and consumers. While high value-added service companies in major countries are rapidly expanding into global markets, only 2.2% of Korean knowledge service companies have experience entering overseas markets. Jung noted, "Recently, as domestic demand momentum has weakened due to factors such as population decline, and as global big tech companies accelerate their entry into the Korean market, domestic companies are facing dual pressures of shrinking domestic demand and intensified competition."

In low value-added services, the expansion of self-employment for livelihood purposes has entrenched the prevalence of small-scale businesses. In 2024, 60% of the self-employed worked in low value-added services, and among these, 73% were one-person businesses. As one-person or family-run businesses concentrate in sectors with low entry barriers and low initial capital requirements, economies of scale become difficult to achieve, and repeated entry and exit among small self-employed businesses creates "revolving-door competition," constraining business growth, resource reallocation, and job creation.

"Exporting Manufacturing-Service Integration" Should Be Included in the Framework Act on Service Industry Development

Jung stressed that legal and institutional reforms must come first to strategically industrialize the service sector. She argued that an overarching legal foundation for industrial policy is needed to encompass all sectors, reflecting the trend of manufacturing-service integration. "Bold deregulation is needed to flexibly accommodate new industries and converged services that are difficult to include under existing systems," she said. "To achieve this, a cross-ministerial control tower system should be established, common foundations such as digital infrastructure, standardization, and data linkage should be prepared, and systematic reform of regulations that hinder integration must be substantively reflected in legislation to design an inclusive policy platform." She particularly noted that the "Framework Act on Service Industry Development," currently under legislative review, should be designed to comprehensively address convergence-based industrial structures rather than focusing solely on nurturing specific industries.

For high value-added sectors, she suggested that export strategies should leverage Korea's manufacturing strengths. Since manufacturing and services each face limits in expanding export competitiveness independently, maximizing synergy through cross-industry integration is necessary to strategically expand the scope of exports. Jung said, "Korea possesses intellectual assets and outstanding operational capabilities accumulated in manufacturing, giving it high potential to convert manufacturing knowledge into AI- and data-driven industrial services. In fields with high global demand, such as content and digital healthcare, combining manufacturing technology can overcome the limitations of digital-based services and increase added value, thereby expanding opportunities to create new markets." She emphasized the importance of "star player" success stories, highlighting the potential of content such as games and bioindustries. "Industries with potential but limited export opportunities due to regulatory barriers could be targeted sequentially," Jung added.

For low value-added sectors, she argued that it is necessary to transition self-employed livelihood businesses to wage jobs and realize economies of scale. Rather than directly reducing small-scale self-employment to address structural constraints, it is important to create a business environment that expands quality jobs, encouraging self-employed and involuntarily self-employed individuals to move into jobs at mid-sized or larger companies. Jung stated, "To achieve this, companies' access to capital should be improved to facilitate capital accumulation and business scaling, and measures to promote corporatization, such as increasing the proportion of directly managed stores within franchises, should be pursued in parallel. Institutional support and tailored financing should be strengthened to support industry dynamism, including business start-ups and closures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.