Financial Supervisory Service Announces First Quarter Status of Derivative-Linked Securities Issuance and Management by Securities Firms

"Demand Expands Due to Growing Interest in Overseas Investments and Falling Interest Rates"

The issuance of derivative-linked securities in the first quarter of this year reached 16 trillion won, an increase of nearly 3 trillion won compared to the same period last year. This is attributed to a recovery in demand for ELS investments, driven by increased interest in overseas investments and falling interest rates.

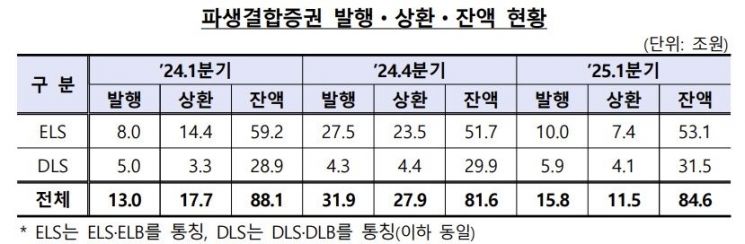

According to the Financial Supervisory Service on July 3, the issuance of derivative-linked securities in the first quarter amounted to 15.8 trillion won, up 2.8 trillion won from the same period last year. The amount redeemed was 11.5 trillion won, a decrease of 6.2 trillion won year-on-year. As of the end of March, the outstanding balance stood at 84.6 trillion won, an increase of 3.0 trillion won compared to the end of last year.

By product type, the issuance of equity-linked securities (ELS) was 10 trillion won, representing a 24.1% increase year-on-year. This was due to a partial recovery in investment demand, resulting from declining interest rates and growing interest in overseas investments. Public offerings accounted for 83.7%, and principal-protected products made up 51.7%.

By underlying asset, issuances were mainly focused on index-linked products (53.6%) and single-stock products (42.2%). The most commonly used underlying assets were KOSPI200 (4.1 trillion won), S&P500 (3.7 trillion won), and EuroStoxx50 (3.4 trillion won), in that order.

ELS redemptions totaled 7.4 trillion won, a decrease of 7 trillion won compared to the same period last year. This was because early redemptions declined as issuance was reduced following the H Index incident. The outstanding balance was 53.1 trillion won, up 1.4 trillion won from the end of last year.

The issuance of other linked securities (DLS) also expanded. In the first quarter, 5.9 trillion won was issued, an increase of 900 billion won year-on-year. Of this, principal-protected issuance amounted to 5 trillion won, up 900 billion won from the same period last year. The main underlying asset was interest rates, accounting for 4.5 trillion won. This was followed by credit (700 billion won) and exchange rates (500 billion won). The amount redeemed was 4.1 trillion won, an increase of 800 billion won year-on-year.

In addition, the outstanding issuance balance reached 31.5 trillion won, up 1.6 trillion won from the end of last year. Of this, the principal-protected outstanding balance was 25.2 trillion won, an increase of 1.5 trillion won compared to the end of last year.

The investment return rate for ELS in the first quarter was 5.7% per annum, an increase of 14.4 percentage points from the same period last year, shifting from a loss to a profit. DLS recorded an annual return of 4.6%. Securities firms' profits related to derivative-linked securities reached 226 billion won, an increase of 179.5 billion won year-on-year.

As of the end of March this year, products with knock-in (Knock-In) events accounted for only 0.4% of all derivative-linked securities. This is believed to be because most ELS based on the H Index were redeemed last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.