Board Resolution for Paid-in Capital Increase on March 18

8.4 Million New Shares to Be Listed on July 7... Issue Price Set at 4,260 Won

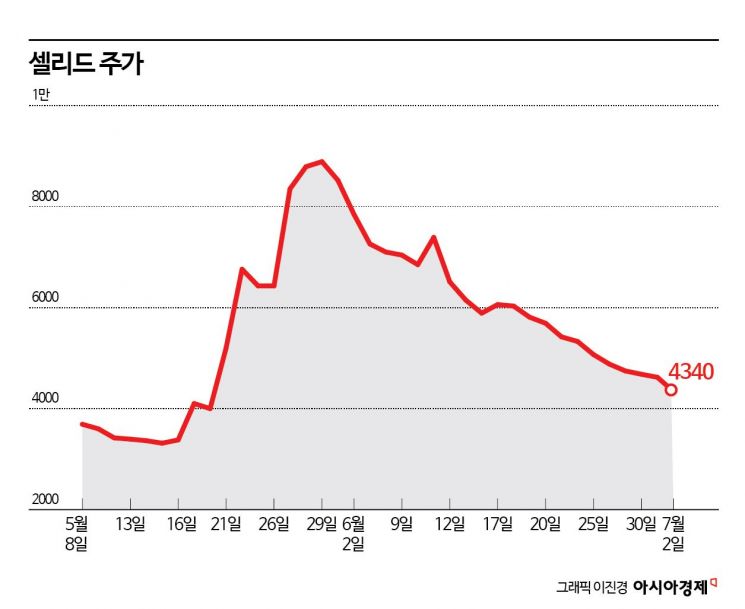

Shares of Cellid, which recently issued new shares to raise funds for COVID-19 vaccine development, have been falling for several consecutive days. Concerns over shareholder value dilution ahead of the listing of the newly issued shares through a paid-in capital increase are weighing on the stock price.

According to the Financial Supervisory Service's electronic disclosure system on July 3, 8.4 million new shares of Cellid will be listed on July 7. Cellid successfully raised funds through the paid-in capital increase. The funds raised will be used for clinical trials and production costs related to the COVID-19 vaccine.

Cellid's share price rose by about 170% during the month of May. The uptrend was influenced by signs of a resurgence of COVID-19, particularly in Greater China. As the confirmation of the new share issue price approached, the stock price rose, resulting in the capital increase amount growing from 24.2 billion won to 35.8 billion won. When the board of directors resolved the paid-in capital increase on March 18, the planned issue price was 2,875 won, but the final issue price jumped to 4,260 won.

On June 16 and 17, Cellid conducted a subscription for existing shareholders over two days. The subscription rate for existing shareholders reached 97.6%. Unsold shares after the existing shareholder subscription were offered to investors through a public offering. The competition ratio for the public offering of forfeited shares was 477.2 to 1. At that time, Cellid's share price was above 5,000 won. Because the market price was more than 30% higher than the issue price, many investors sought to purchase the new shares.

After the subscription ended, Cellid CEO Kang Changyul stated, "We will complete the global Phase 3 clinical trial for the COVID-19 vaccine and prove our platform technology capabilities," adding, "We will continue research on new variants of the COVID-19 virus to secure vaccine sovereignty and contribute to the Korean healthcare industry." He also said, "We will repay concerns about the three paid-in capital increases over the past three years, as well as Cellid's technology and growth potential, with tangible results."

While Cellid has gained financial flexibility by successfully securing operating funds, investors who participated in the capital increase are growing anxious as the listing date for the new shares approaches. Cellid's share price has fallen by 25.3% compared to the time of the public offering subscription. The gap with the issue price has narrowed to just 80 won. Based on the previous day's closing price, if the stock falls just 2% further, investors who participated in the capital increase will incur losses. If many investors rush to sell on the day the new shares are listed, the stock price could plummet.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.