Record Highs for Holding Companies as Ruling and Opposition Parties Reach Agreement on Commercial Act Amendment

LS and Others Benefit from Subsidiaries' Strong Performance Under New Government

Need to Select Holding Companies with High Dividend Payout Ratios and Major Shareholder Stakes

With the ruling and opposition parties reaching a swift agreement on the amendment to the Commercial Act, holding companies have reignited their rally to record highs. As discussions on the separate taxation of dividend income are also forthcoming, analysts say it is now time to carefully select holding companies that have both sufficient dividend capacity and a clear intention to increase dividends.

According to the Korea Exchange on July 2, among the 124 stocks that hit a 52-week high the previous day, about 30% were holding companies. Crown Haitai Holdings surged by 21.19%, posting the most notable increase, while Seoyeon, Hanwha, and Wonik also jumped by more than 15%. HS Hyosung, which marked its first anniversary since establishment on this day, hit the upper price limit.

The imminent passage of the Commercial Act amendment in the National Assembly, which has fueled the honeymoon rally since the presidential election, once again boosted investor sentiment. The People Power Party, which had previously opposed the amendment, reversed its stance and announced a willingness to review it, serving as a decisive catalyst. With the breakthrough in bipartisan negotiations, the likelihood of the Commercial Act amendment being passed during the June extraordinary session of the National Assembly, which ends on July 4, has significantly increased.

Kang Jin-hyuk, Senior Researcher at Shinhan Investment Corp., said, "It seems possible that the amendment to the Commercial Act will be passed in the plenary session within this week," adding, "Although a short-term 'sell-on-news' phenomenon may occur even if the bill passes, it is a positive factor in that it could attract foreign funds that had been skeptical about the bill's passage."

Expectations for the amendment to the Commercial Act are not the only driving force behind the rise in holding company stocks. For example, in the case of LS, major subsidiaries such as LS ELECTRIC and LS Cable & System have been identified as beneficiaries of the new government's energy policy, adding to expectations for improved performance. Jang Jae-hyuk, a researcher at Meritz Securities, said, "There are a number of large-scale projects planned to support growth prospects, such as the wind power business and the West Coast power expressway being promoted by the current government," and added, "From this year, all subsidiaries except LS MnM have entered a full-fledged phase of earnings growth." In particular, LS Cable & System's consolidated operating profit is expected to rise sharply from KRW 314 billion in 2025 to KRW 384 billion in 2026, and KRW 564 billion in 2030, making it a core subsidiary within the group.

However, some point out that since the amendment to the Commercial Act has already been partially reflected in stock prices, the market focus may shift to issues such as the separate taxation of dividend income. Currently, an amendment to the Income Tax Act has been proposed in the National Assembly to separately tax dividend income at a maximum rate of 25% for listed companies with a dividend payout ratio of 35% or higher, instead of including it in comprehensive income.

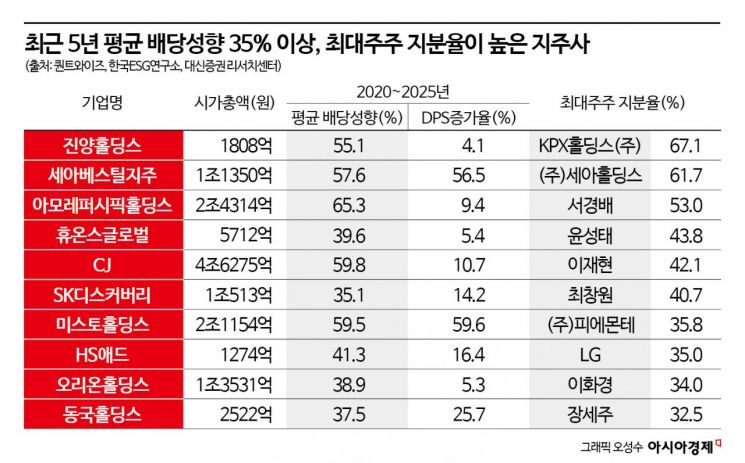

Lee Kyung-yeon, Chief Research Fellow at Daishin Securities, emphasized, "It is necessary to screen for 'true value stocks' that have dividend capacity, the intention to increase dividends, and the potential to benefit from tax policy," and added, "Attention should be paid to stocks where the largest shareholder has a high stake, providing a strong incentive to increase dividends, and where the average dividend payout ratio over the past five years exceeds 35%, making them likely to expand dividends when the policy is implemented." Stocks that meet these conditions and have shown a noticeable increase in dividends per share (DPS) over the past five years include Misto Holdings, Seah Besteel Holdings, Dongkuk Holdings, HS Ad, SK Discovery, and CJ.

It is also important to check whether the holding company you plan to invest in has any possibility of dual-listing or selling its core subsidiaries. Eom Su-jin, a researcher at Hanwha Investment & Securities, said, "If an unlisted subsidiary is listed or sold, it can affect the market value of the holding company, so before investing in a listed holding company, it is advisable to review the future plans for unlisted subsidiaries." She cited LS Cable & System and LS MnM (LS), HD Hyundai Robotics (HD Hyundai), and SK Ecoplant (SK) as major subsidiaries with the potential to be listed within the next one to two years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.