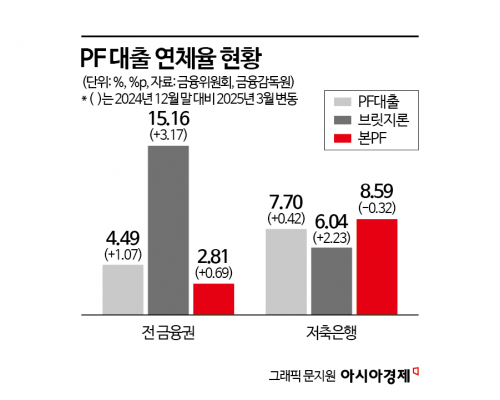

When Overall Financial Sector PF Delinquency Rose by 1.07%p,

Savings Banks Held the Line at 0.42%p... "Strict Management"

Federation's NPL Subsidiaries Begin Operations...

Regulatory Relief Extension Creates 'Synergy'

Concerns Over Introduction of Prudential Regulations...

"Potential for Weaker Investment Sentiment"

While the savings bank industry has welcomed the extension of financial regulatory relief measures related to real estate project financing (PF) until the end of the year, it has also expressed concerns about the introduction of large exposure credit regulations currently being pursued by the government. Although the industry has managed PF delinquency rates relatively well, it is concerned that the new regulations could increase the burden on fundraising and project execution.

Construction has been halted at an apartment construction site in Daemyeong-dong, Nam-gu, Daegu. Photo by Kang Jinhyung

Construction has been halted at an apartment construction site in Daemyeong-dong, Nam-gu, Daegu. Photo by Kang Jinhyung

On July 2, the savings bank industry expressed support for the government's decision, announced after a real estate PF status review meeting held the previous day, to extend the application period for 10 out of 11 temporary financial regulatory relief measures from June 30 to December 31, a six-month extension. Regulatory relief policies for savings banks include easing the holding limit on PF-related securities and relaxing the credit extension limit within their business areas.

The industry was relieved that the extension of the holding limit on securities would reduce the burden on investors (financial institutions) to secure funds for purchasing non-performing loans (NPLs). With the Korea Federation of Savings Banks set to begin full-scale operation of NPL subsidiaries in the second half of the year, the industry welcomed the opportunity to benefit from these policies.

The extension of the credit extension limit relaxation within business areas until the end of the year was also viewed as a positive development. An industry official said, "There are often cases where savings banks located in their business areas fail to meet soundness ratios during the process of selling non-performing loans, and it appears that the authorities have preemptively applied exceptional measures to address this possibility," adding, "Small and medium-sized savings banks will be able to reduce their burden in complying with relevant regulations when selling non-performing loans."

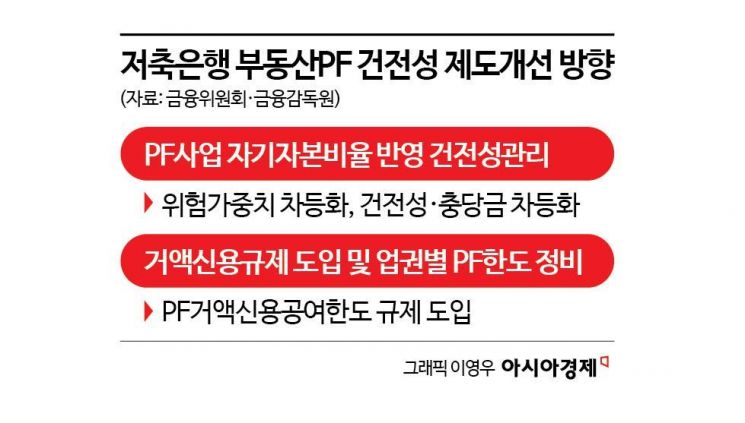

However, the industry is concerned that the government's plan to introduce new prudential regulation improvements by the end of the year could dampen the investment sentiment of investors (financial institutions) purchasing non-performing loans. Prudential regulations applicable to the savings bank sector include the reflection of the PF project capital adequacy ratio (for example, 20%) in soundness management, the introduction of large exposure credit regulations, and the adjustment of PF limits.

First, there are concerns that subdividing (and strengthening) the current risk-weighted asset ranges from '100%, 150%' to '100%, 130%, 150%' based on a 20% capital adequacy ratio could be unsustainable for project developers. An industry official said, "While we understand the intention to secure the capital strength of project developers and improve the soundness of financial institutions supplying funds and the stability of PF projects by applying different risk weights according to capital adequacy ratios, in the short term, this could lead to restructuring among project developers," adding, "It is important to minimize confusion during the initial implementation of the system."

Some have expressed concerns that introducing large exposure credit regulations to real estate PF handled by the savings bank sector could negatively impact the process of purchasing non-performing loans. To sell non-performing loans, it is necessary to smoothly raise the required funds during the PF structuring process, but this process could become more complicated amid discussions among stakeholders such as financial institutions and project developers.

An industry official said, "If the new regulation is applied at the end of the year, more participation from financial institutions will be required to raise the necessary funds during the PF structuring process, increasing the burden on project developers," adding, "It may become more difficult to coordinate opinions among consortium members, raising concerns that PF projects could contract."

Meanwhile, the savings bank sector succeeded in limiting the increase in real estate PF delinquency rates in the first quarter compared to other sectors.

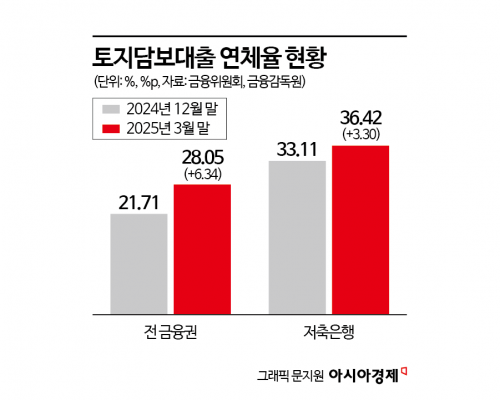

According to the Financial Services Commission and other related ministries, the PF loan delinquency rate in the savings bank sector as of March 31 (the end of the first quarter) was 7.70%, up 0.42 percentage points from December 31 of the previous year (the end of the fourth quarter). This is lower than the 1.07 percentage point increase seen across the entire financial sector. During the same period, the delinquency rate for savings bank land-backed loans rose by 3.30 percentage points, about half the 6.34 percentage point increase recorded across the entire financial sector.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.