Government Begins to Strengthen Disclosure System to Encourage Voluntary Fee Reductions

Credit Finance Industry: "Opaque System Suspected, Aims to Resolve Fairness Issues Between Sectors"

Fintech Industry: "Infringement on Autonomous Management... Big Tech Unregulated While Small and Medium Firms Suffer"

The government has begun the process of adjusting merchant commission fees for simple payment service providers such as Baedal Minjok, Coupang, Naver Financial, Kakao Pay, and Toss. While credit card companies have been lowering their preferential commission rates in accordance with the government's recalculation of eligible costs, the commission structure of simple payment service providers has been criticized by the financial sector as being opaque and unfair. The government has accepted this criticism. Adjusting commission rates for big tech (large information technology companies) was a presidential campaign pledge of President Lee Jaemyung, aimed at boosting domestic demand and alleviating the burden on small business owners.

According to the fintech (finance + technology) and payment gateway (PG) industries on July 1, the Financial Services Commission has requested 11 simple payment service providers subject to mandatory commission disclosure to submit their current commission structures and future adjustment plans. The 11 companies are Woowa Brothers (Baedal Minjok), Naver Financial, Kakao Pay, Viva Republica (operator of Toss), Toss Payments, Coupang Pay, 11st, Gmarket, KG Inicis, NHN Payco, and SSG.com.

Previously, some companies subject to mandatory disclosure indicated during the 21st presidential election campaign that, after reviewing President Lee Jaemyung's campaign pledges, they would voluntarily develop plans to adjust (lower) commission rates and inform the financial authorities. In response, the Financial Services Commission asked the Korea Fintech Industry Association to conduct a survey on the commission structures of simple payment service providers. The aim was to encourage voluntary adjustments rather than directly pressuring the companies.

Until now, the financial sector has pointed out that the commission structures for card payments and prepaid electronic payment methods (prepaid) at simple payment service providers are not transparent and are excessively higher than the preferential rates offered by credit card companies. The government has accepted these criticisms and has been encouraging companies to lower their commission rates.

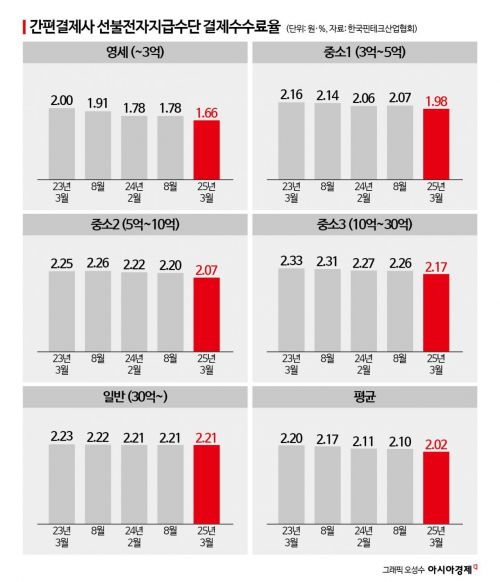

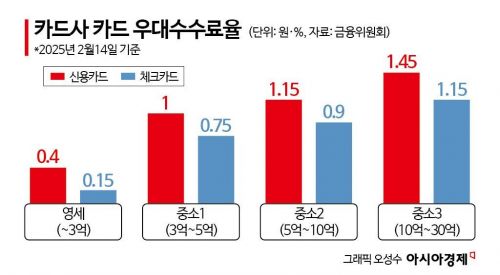

According to the Korea Fintech Industry Association, the average card payment commission rate and prepaid electronic payment method (prepaid) commission rate for nine simple payment service providers (excluding Toss Payments and KG Inicis, which were added to the disclosure list in March) serving small (annual sales under 3 billion KRW) and medium-sized (annual sales between 3 billion and 30 billion KRW) merchants are 1.60% and 2.02%, respectively. These rates are about twice as high as the average preferential credit card commission rate of 1.00% offered by credit card companies.

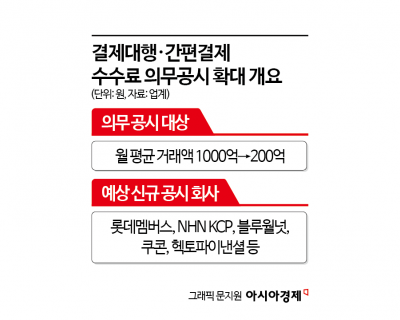

It has been reported that on June 19, the Financial Services Commission informed the National Policy Planning Committee of its plan to expand the mandatory commission disclosure requirement from companies with an average monthly transaction volume of at least 100 billion KRW to those with at least 20 billion KRW. It is also expected that the disclosure requirements will change from only disclosing total payment commissions to separately disclosing online and offline, external payment, and in-house revenue commissions.

If the plan proceeds as scheduled, the number of companies subject to mandatory commission disclosure in the second half of this year, which will take place around February to March next year, will increase from 11 to 19. Lotte Members and NHN KCP are expected to be included.

The credit finance industry has expressed cautious support, saying that expanding not only the number of companies subject to disclosure but also the detailed disclosure items could help make big tech commission rates more realistic. Since credit card companies have been lowering their preferential commission rates in accordance with the government's strict eligible cost recalculation policy, they argue that simple payment service providers should also transparently disclose their commission structures.

A credit card industry official stated, "When determining preferential commission rates for credit card companies, since 2012, eligible costs have been calculated based on cost analysis every three years, and preferential commission rates have been applied to small and medium-sized merchants. However, the commission rates of simple payment service providers lack a transparent calculation basis, leading to fairness issues between industries. Strengthening the disclosure system will not only reduce fairness disputes between industries but also have a positive impact on alleviating the commission burden for small business owners and self-employed individuals, as well as stimulating consumption."

The fintech industry has expressed dissatisfaction, arguing that the political sector and the government are excessively interfering in corporate management. They claim that, rather than large platform companies such as Baedal Minjok, which have a significant impact on consumer prices, only small and medium-sized PG companies may end up being adversely affected.

A fintech industry official said, "We will have to wait for the official announcement from the authorities, but it is inevitable that simple payment service providers will have to adjust their commission structures. However, it is uncertain whether strengthening the disclosure system will lead large platform companies such as Baedal Minjok to significantly lower their commission rates, or whether it will result in stronger consumer sentiment and increased sales for small business owners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)