Despite Decline in Household Loan Rates Including Mortgage Loans,

Loan-Deposit Interest Rate Spread Widens in One Month

as Large Corporate Loan Rates Surge

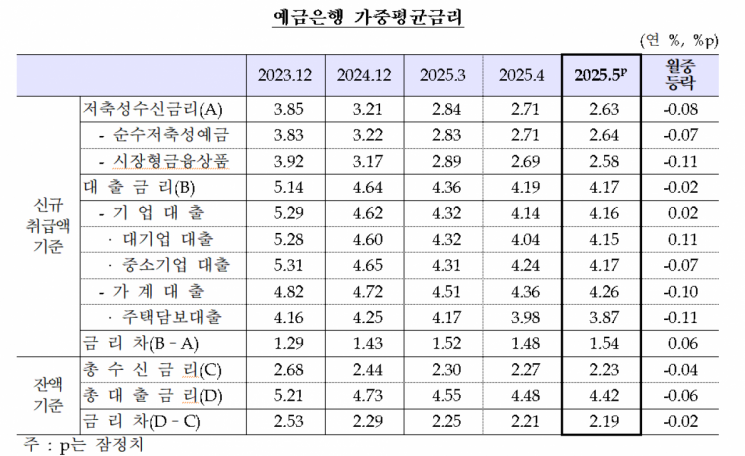

The interest rates on mortgage loans (jumdandae) offered by banks have declined for four consecutive months, entering the 3.8% range. The loan-deposit interest rate spread (loan rate minus deposit rate) widened again after just one month, as interest rates on loans to large corporations turned upward.

According to the weighted average interest rates of financial institutions for May, announced by the Bank of Korea on June 30, the mortgage loan rate (based on new loans) at deposit banks last month was 3.87% per annum, down 0.11 percentage points from the previous month.

The mortgage loan rate had risen to 4.27% in January this year, but has been on a downward trend for four consecutive months since February. Specifically, the fixed-rate mortgage loan rate (3.86%) fell by 0.10 percentage points, while the variable-rate mortgage loan rate (3.97%) decreased by 0.15 percentage points.

Due to factors such as a decline in benchmark interest rates, household loans including mortgage loans dropped to 4.26%, down 0.10 percentage points from the previous month. Jeonse deposit loans fell by 0.11 percentage points to 3.70%, and general unsecured loans dropped by 0.07 percentage points to 5.21%. All of these have been declining for six consecutive months since December last year.

Corporate loan interest rates rose by 0.02 percentage points to 4.16%. As short-term market rates, such as 91-day certificates of deposit (CDs) and short-term bank bonds, declined, loans to small and medium-sized enterprises (SMEs) dropped by 0.07 percentage points to 4.17%. However, due to a base effect from the provision of low-interest policy loans in April to support semiconductor facility investment, loans to large corporations rose by 0.11 percentage points to 4.15%. In May, relatively high-interest acquisition financing refinancing also contributed to the increase in corporate loan rates.

The interest rate on savings-type deposits (based on new deposits) was recorded at 2.63%, down 0.08 percentage points from the previous month, as rates on time deposits and similar products declined. This marks eight consecutive months of decline since October last year (3.37%). The pure savings deposit rate, mainly for time deposits, fell by 0.07 percentage points to 2.64% per annum. The interest rate on market-type financial products, mainly financial bonds, dropped by 0.11 percentage points to 2.58%.

The loan-deposit interest rate spread (based on new loans) increased by 0.06 percentage points from the previous month to 1.54 percentage points. This reversal after one month was due to the expansion of large corporate loan rates. Kim Minsoo, head of the Financial Statistics Team 1 at the Bank of Korea's Economic Statistics Department, said, "As the impact of low-interest policy loans for large corporations in April dissipated, upward pressure emerged," adding, "Excluding this special factor, the interest rate on loans to large corporations would have declined slightly, and the loan-deposit spread would have increased only marginally."

The loan-deposit spread for May is slightly below the long-term 10-year average of 1.69 percentage points. Kim explained that to view the overall loan situation, it is necessary to look at the loan-deposit spread based on outstanding balances. He said, "In May, the loan-deposit spread based on outstanding balances was 2.19 percentage points, the lowest since November 2011 (2.19 percentage points). It is highly likely that the spread will decrease further in June based on outstanding balances."

However, the future movement of the loan-deposit interest rate spread is expected to depend on the effects of the government's 'Strengthened Household Debt Management Plan' announced on June 27. Kim said, "As the pace of household loan growth accelerated, the lending margin was raised after April. Depending on the impact of this new policy, the direction of the lending margin could also change, so it is something to watch closely."

Meanwhile, the proportion of fixed-rate household loans rose by 3.1 percentage points from the previous month to 59.8%. This marks a turnaround after three months, driven by an increase in fixed-rate mortgage loans. The proportion of fixed-rate loans among mortgage loans increased by 2.1 percentage points to 91.6%.

For non-bank financial institutions, deposit interest rates for one-year time deposits fell across all sectors except mutual savings banks. Lending rates (based on general loans) rose across all sectors except credit unions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)