In 2024, the investment execution volume of institutional private equity funds (PEFs) was limited to around 24 trillion won, marking a decrease of more than 25% compared to the previous year. This decline is attributed to the global economic slowdown and the stagnation of the mergers and acquisitions (M&A) market.

According to the "2024 Institutional Private Equity Fund Operation Status and Implications" report released by the Financial Supervisory Service on June 30, the total investment execution volume of institutional PEFs last year was tallied at 24.1 trillion won. This represents a decrease of 8.4 trillion won (25.8%) from the previous year's 32.5 trillion won. The global economic slowdown and stagnation in the M&A market were cited as contributing factors.

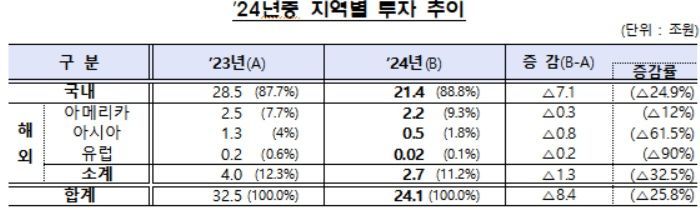

By target, investments were made in 431 domestic and overseas companies. The average investment per transaction was 55.9 billion won, down 17.5 billion won (23.8%) from 73.4 billion won in the previous year. By region, domestic investments amounted to 21.4 trillion won, a 24.9% decrease year-on-year. Overseas investments also fell by 32.5% to 2.7 trillion won.

By industry, 21.7 trillion won was invested in five sectors, including manufacturing, information and communications, and wholesale and retail, accounting for 90.2% of the total. Notably, investments in the sewage, waste treatment, and recycling sector surged by 450% to 3.3 trillion won, compared to 600 billion won in the previous year.

Undrawn commitments (dry powder), which indicate additional investment capacity, stood at 36.1 trillion won, down 3.7% from the previous year. Despite ongoing uncertainties in domestic and global economic conditions, the scale of undrawn commitments (where investment targets have not yet been selected) remained at a high level.

The domestic institutional PEF industry continues to grow. As of the end of last year, there were 1,137 institutional PEFs, an increase of 11 from 1,126 at the end of the previous year. Commitments reached 153.6 trillion won, and capital called amounted to 117.5 trillion won (76.5% of commitments), representing increases of 12.6% (17.2 trillion won) and 18.8% (18.6 trillion won), respectively, compared to the end of the previous year.

The number of general partners (GPs) managing institutional PEFs was 437, up 3.6% (15 firms) from 422 in the previous year. The number of dedicated GPs was 328, accounting for 75.1% of the total, maintaining a high proportion. By size, there were 40 large GPs, 155 medium-sized GPs, and 242 small GPs.

A total of 173 new institutional private equity funds were established last year, an increase of 17.7% (26 funds) from 147 in the previous year. New capital commitments to these funds amounted to 19.2 trillion won, up 2.7% year-on-year.

Based on capital commitments, there were only nine large funds (over 300 billion won). There were 44 medium-sized funds (between 100 billion and 300 billion won) and 120 small funds (less than 100 billion won). The Financial Supervisory Service explained, "As the economy slowed, the number and scale of large investment deals decreased, leading to a decline in both the number and size of large funds."

By fund type, project funds, which designate specific investment targets in advance, accounted for 113 funds (65.3%), while blind funds, which select investment targets later, totaled 60 (34.7%). This is a similar ratio to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.