Real Estate Market in Turmoil Due to Government's Ultra-Strong Loan Regulations

Most Major Banks Suspend Non-Face-to-Face Mortgage Applications

Concerns Grow Over Impact on Actual Homebuyers

While It Has Become Harder for Koreans to Buy Homes,

Concerns Arise Over Reverse Discrimination Favoring Chinese Nationals Exempt from Loan Regulations

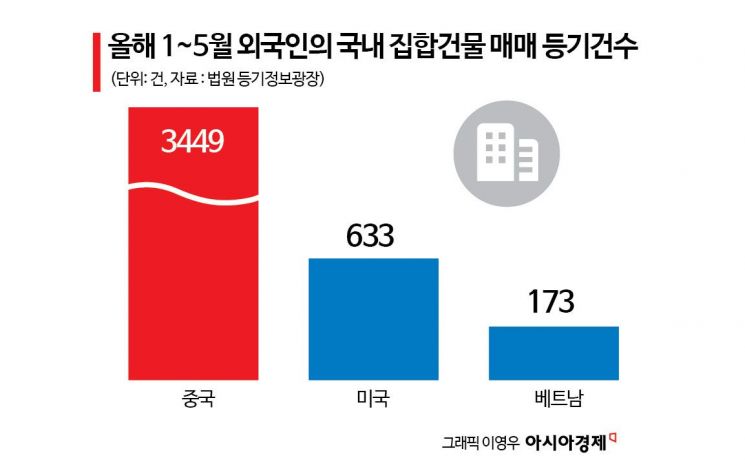

Chinese Nationals Account for 66.9% of Foreign Registrations for Collective Building Sales

A view of apartment complexes in downtown Seoul from Namsan, Seoul. 2025.06.27 Photo by Dongjoo Yoon

A view of apartment complexes in downtown Seoul from Namsan, Seoul. 2025.06.27 Photo by Dongjoo Yoon

As the government's extremely stringent real estate loan regulations come into full effect, the impact is growing, with banks suspending non-face-to-face mortgage loan applications all at once. Some critics argue that the regulations are unfair, as they only benefit wealthy individuals with large amounts of cash or foreigners such as Chinese nationals who are not subject to the loan restrictions.

Real Estate Market in Turmoil Due to Government's Ultra-Strong Loan Regulations

According to the financial sector on June 30, major domestic banks suspended non-face-to-face applications for key loan products such as mortgages and unsecured loans starting June 27. Although there are slight differences depending on the bank and the product, all banks in the Seoul metropolitan area have blocked internet and mobile applications for mortgages intended for home purchases.

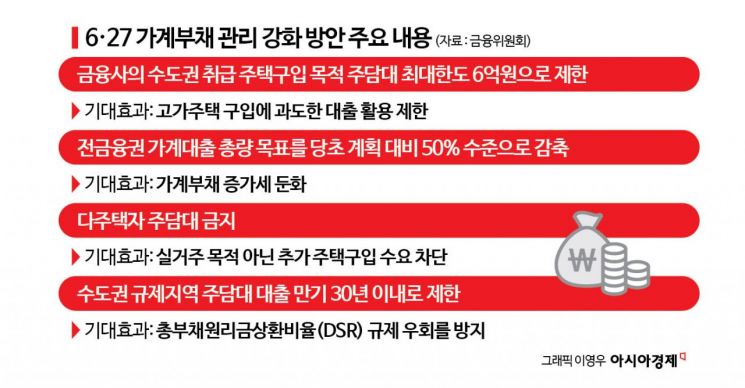

This unprecedented situation, in which most banks have halted non-face-to-face loans, occurred because the government’s "Strengthened Household Debt Management Measures Focused on the Seoul Metropolitan Area," announced on June 27, took effect immediately on June 28 without any grace period. After the government announced a strict regulation capping mortgage loans for home purchases in the metropolitan area at a maximum of 600 million won, banks had to urgently update their computer systems, which led to a temporary suspension of online mortgage applications. As the confusion intensified, financial authorities are now receiving updates from banks on their system maintenance status and urging a quick return to normal operations. A representative from a major commercial bank explained, "Because the government's measures were not announced in advance, it takes considerable time to newly apply them to the loan system."

The market turmoil continues as a result of the government's strong loan regulations. The burden has especially increased for actual homebuyers, such as young people and newlyweds, who were planning to purchase a home through loans immediately. This is because the new household debt management measures target actual homebuyers, not only by reducing loan limits but also by imposing a six-month mandatory occupancy requirement, limiting mortgage loans for living stabilization funds to 100 million won, and restricting access to policy fund loans.

While It Has Become Harder for Koreans to Buy Homes, There Are Concerns About Reverse Discrimination in Favor of Chinese Nationals and Others Exempt from Loan Regulations

There is also criticism that the government’s regulations are disadvantageous only to Korean nationals, and that foreigners who can bypass loan restrictions will find it easier to purchase homes in Korea. This is because the new measures are difficult to apply to foreigners who buy homes in Korea using funds borrowed overseas. Furthermore, foreigners who use overseas loans to purchase homes in the metropolitan area are not subject to the six-month move-in requirement. While individuals with multiple homes cannot obtain additional loans to purchase more properties in the metropolitan area, it is difficult even to verify this in the case of foreigners. In effect, they are in a regulatory blind spot.

There are ongoing concerns about the lack of reciprocity in real estate purchases between countries. In particular, while Koreans face significant restrictions when purchasing real estate in China, Chinese nationals can acquire land and apartments in Korea with few limitations, leading to debates about fairness. Since the majority of foreigners buying homes in Korea are Chinese nationals, calls for regulatory measures are growing.

According to the court’s real estate registration information system, from January to May this year, there were a total of 5,153 registrations for transfers of ownership (sales) of collective buildings such as apartments and officetels by foreigners. By nationality, Chinese nationals accounted for 3,449 cases (66.9%), the highest number, followed by Americans with 633 cases and Vietnamese nationals with 173 cases. Lawmakers including Ko Dongjin and Yoo Yongwon of the People Power Party have recently proposed bills containing regulatory measures on foreign real estate purchases, but the prospects for their actual passage remain uncertain.

Ju Jinwoo, a member of the People Power Party, criticized, "The government’s sudden and unexpected regulations are causing numerous unforeseen victims," and argued, "To prevent greater confusion, the implementation should be postponed over the weekend and the measures should be thoroughly reconsidered." He also pointed out via his social networking service (SNS) on June 29, "There is also a fairness issue regarding Chinese nationals who are not subject to loan regulations," and added, "Even if foreigners speculate, housing prices will rise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)