Democratic Party Considers Fund-Type Legislation

"Bill Could Be Introduced as Early as This Month"

Government Focuses on Pureun Ssiat for Small Businesses

Experts Advocate Fund-Type System for Public Interest

Introduction Needed to Enhance Accountability

"Providers Should Move Beyond Seller Role in Contract-Type System"

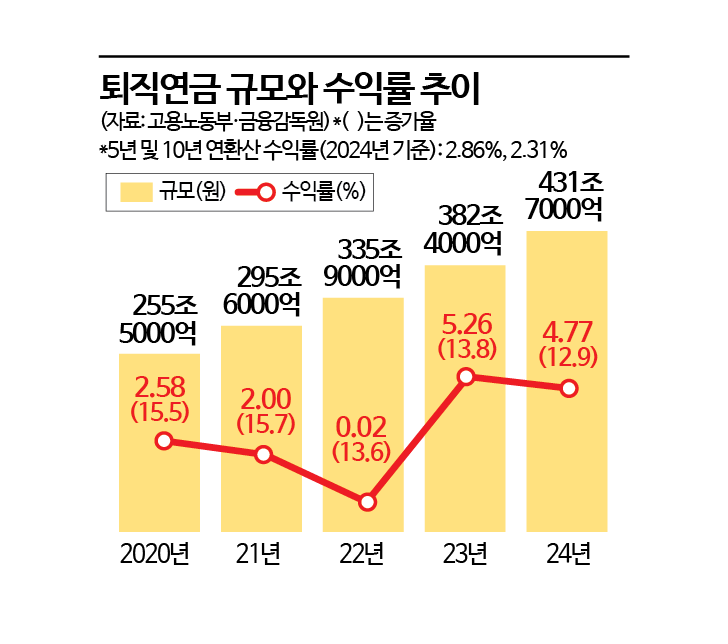

As interest in the introduction of a fund-type retirement pension system grows, it appears increasingly likely that related legislation will be refined in the National Assembly before any action is taken by the government. The government, for its part, seems to be focusing on the Small and Medium Enterprise Retirement Pension Fund (Pureun Ssiat), a fund-type system designed for small businesses. Experts believe that introducing a fund-type system is necessary to enhance the public nature of retirement pensions and to strengthen the accountability of those managing the funds.

According to the Ministry of Employment and Labor and the Democratic Party of Korea on July 1, while the new administration has shown little movement toward introducing a fund-type retirement pension, legislative discussions on the topic are actively underway in the National Assembly. Multiple related statements have been made, primarily by Democratic Party lawmakers such as Representative Ahn Dogeol and Representative Han Jeongae, who have shown interest in the adoption of a fund-type system. Last month, Representative Ahn drew attention by announcing plans to accelerate the proposal of a "unified fund-type" bill.

A Democratic Party official stated, "The bill has not yet been submitted as final details are still being coordinated," adding, "There is speculation that the bill could be introduced in early July, but we will have to wait and see." Regarding the bill, the official said, "There could be criteria for establishing a separate management body," and explained, "Asset management companies will likely have to participate in the form of a consortium." The official also commented that the National Pension Service is unlikely to be involved.

The new administration is focusing more on expanding Pureun Ssiat than on introducing a comprehensive fund-type system. Pureun Ssiat, introduced in 2022, is the only public fund-type retirement pension system in Korea and is designed to help employees of workplaces with 30 or fewer workers prepare for retirement. The government exempts subscribers from fees for three years, and for low-income workers, it provides support not only to the worker but also covers 10% of the employer's contribution. As of last year, the fund had accumulated 1.03 trillion won.

President Lee Jaemyung has pledged to expand Pureun Ssiat eligibility to businesses with up to 100 employees and to cover 100% of fees until 2030. He has made no specific mention of introducing a fund-type system. This approach differs from the previous administration, which began exploring the possibility of a fund-type system last year. It is also reported that discussions about Pureun Ssiat took place during the Ministry of Employment and Labor's policy briefing to the National Policy Planning Committee last month.

A government official commented, "When a new administration takes office, national policy tasks naturally become the top priority," and added, "Although the expansion of Pureun Ssiat was included in the campaign pledges, the intention appears to be to broaden the scope of the system to address concerns about wage arrears, rather than to introduce a fund-type system." The official explained that about 40% of wage arrears are due to unpaid retirement benefits, and the risk of arrears is higher in smaller workplaces, which is why the expansion of Pureun Ssiat is being considered.

However, since the new administration only took office last month, some believe it is necessary to wait and see how its policies develop. One reason the current administration is focusing on Pureun Ssiat is its emphasis on strengthening public services. For the public nature of retirement pensions to be enhanced, discussion of a fund-type system is considered essential. Since the previous administration had been preparing legislation to introduce a fund-type retirement pension system in the second half of last year, some believe that if the current administration shows the will, implementation would not be difficult.

Experts have advised that the government should discuss the introduction of a fund-type system to increase the accountability of retirement pension management organizations. They argue that, given the current focus on principal-guaranteed products, low returns are inevitable, and that the real issue behind the concerns raised by private retirement pension providers (financial companies) about the introduction of a fund-type system is the lack of management responsibility.

Nam Jaeu, a research fellow at the Korea Capital Market Institute, explained, "Under the current contract-type system, retirement pension providers simply list various products and act as sellers, passing on the products that subscribers want." He added, "This can result in either neglecting principal-guaranteed products or causing excessive concentration in them." He continued, "In the fund-type system, the trustee organization should act as an asset manager rather than a seller," and emphasized, "Instead of merely selling existing products, they should create and provide products themselves."

Kim Jaehyun, professor at the Department of Global Finance and Management at Sangmyung University and former president of the Korean Pension Association, stated, "If you look at various funds such as the National Pension, there is a concept of fiduciary responsibility, but this is absent in retirement pensions." He added, "Although retirement pension providers have expertise, they have shifted responsibility to the subscribers." He further explained, "The core of the fund-type system is to expand the scale of retirement pensions, have experts take on fiduciary responsibility, and manage the funds on behalf of subscribers, similar to the National Pension."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.