Manufacturing Sector Falls by 0.9 Points,

Non-Manufacturing Sector Rises by 2.7 Points

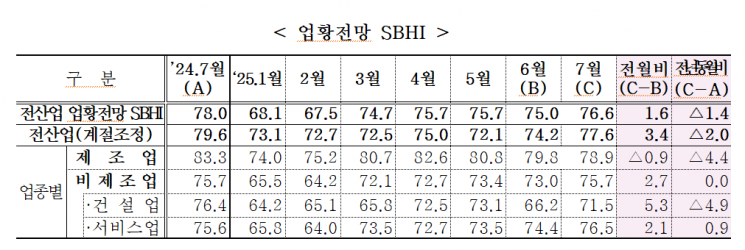

The Small Business Health Index (SBHI) for July 2025, which reflects the business outlook of small and medium-sized enterprises (SMEs), was recorded at 76.6, up 1.6 points from the previous month. However, compared to the same month last year (78.0), it decreased by 1.4 points.

On June 29, the Korea Federation of SMEs announced the results of the "July 2025 SME Business Outlook Survey." This survey was conducted by the Federation from June 11 to June 17, targeting 3,086 SMEs.

The July business outlook for the manufacturing sector was 78.9, down 0.9 points from the previous month, while the non-manufacturing sector recorded 75.7, up 2.7 points from the previous month. The construction sector (71.5) rose by 5.3 points from the previous month, and the service sector (76.5) increased by 2.1 points from the previous month.

Within manufacturing, seven industries saw an increase from the previous month, led by ▲medical substances and pharmaceuticals (84.6→93.9, up 9.3 points) and ▲rubber and plastic products (77.7→83.7, up 6.0 points). However, 16 industries, including ▲medical, precision, optical instruments and watches (84.4→74.7, down 9.7 points) and ▲beverages (98.7→91.5, down 7.2 points), experienced a decline compared to the previous month.

In the non-manufacturing sector, the construction sector (66.2→71.5) rose by 5.3 points from the previous month, and the service sector (74.4→76.5) increased by 2.1 points from the previous month. Within the service sector, six industries, including ▲real estate (75.7→80.6, up 4.9 points) and ▲wholesale and retail (70.8→74.2, up 3.4 points), saw an increase from the previous month. However, four industries, including ▲arts, sports, and leisure-related services (86.3→74.0, down 12.3 points) and ▲transportation (79.6→71.7, down 7.9 points), declined compared to the previous month.

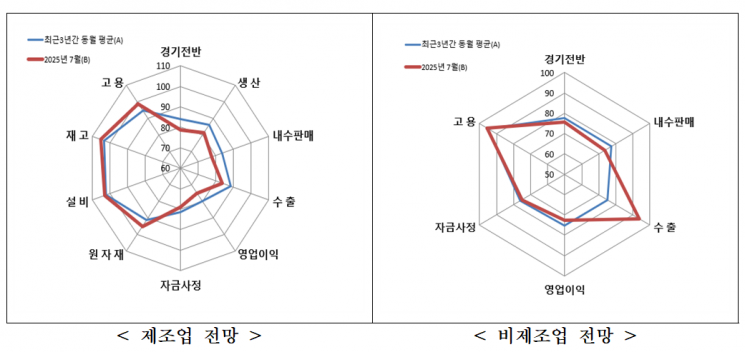

Domestic sales (74.9→74.7) declined from the previous month, but ▲financial conditions (74.9→76.3), ▲exports (86.1→87.1), and ▲operating profit (72.6→73.4) all improved compared to the previous month. Employment, which is a counter-cyclical trend (96.3→96.5), is expected to worsen from the previous month.

When compared to the average SBHI values for each category in the same month over the past three years, the manufacturing sector is expected to see improvements only in raw materials, while other categories are projected to worsen compared to the three-year average. In the non-manufacturing sector, only exports are expected to improve, with other categories likely to deteriorate compared to the average of the past three years.

In June, the most significant management difficulty faced by SMEs was "sluggish sales (product sales)" (61.4%), followed by ▲rising labor costs (33.3%), ▲increases in raw material (input material) prices (27.5%), and ▲intensifying competition among companies (26.7%).

The average operating rate of small manufacturers in May was 71.0%, up 0.3 percentage points from the previous month but down 2.1 percentage points from the same month last year. By company size, small enterprises (67.0%→67.1%) increased by 0.1 percentage points from the previous month, while medium-sized enterprises (74.8%→75.4%) rose by 0.6 percentage points. By company type, general manufacturing (69.7%→70.0%) climbed by 0.3 percentage points from the previous month, and innovative manufacturing (73.2%→73.6%) increased by 0.4 percentage points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.