Household Loan Growth Target to Be Cut to 50% of Original Plan

Policy Loans to Be Reduced by 25% Compared to Annual Supply Plan

Mortgage Loan Limit Set at 600 Million Won in Seoul and Other Regulated Areas

As housing prices in Seoul have surged and household debt has increased significantly, the government has decided to drastically reduce the amount of household loans available across all financial sectors. To prevent excessive use of bank loans for purchasing high-priced homes in Seoul, the government will limit the maximum amount of mortgage loans for home purchases in regulated areas to 600 million won. The government will also strengthen loan regulations that had been somewhat loosened under the previous administration, such as the loan-to-value (LTV) ratio and the debt-to-income (DTI) ratio, in an effort to stabilize the real estate market.

Household Loan Growth Target to Be Cut to 50% of Original Plan

On the morning of June 27, at the Government Complex Seoul, the government held an 'Emergency Household Debt Review Meeting' with the Financial Services Commission, Ministry of Economy and Finance, Ministry of Land, Infrastructure and Transport, and the Bank of Korea. At the meeting, it was decided that, starting in the second half of this year, the total household loan growth target for all financial sectors will be reduced to 50% of the original plan. Policy loans such as Didimdol and Bogumjari loans will also be cut by 25% compared to the annual supply plan. If the government's plan is implemented as intended, the annual increase in household loans could be reduced by up to 20 trillion won.

The government had previously stated that it would manage the annual household loan growth rate for all financial sectors within the expected nominal GDP growth rate for Korea this year, which is 3.8%. However, as housing prices in Seoul have recently surged and the nominal GDP growth rate is now more likely to fall below expectations, the government has sharply lowered the household loan growth target. As a result, the volume of household loans handled by banks and other financial institutions is expected to decrease in the second half of the year, making it more difficult to obtain loans.

In particular, the government will limit the maximum amount of mortgage loans for home purchases in the Seoul metropolitan area and other regulated areas to 600 million won, in order to restrict excessive borrowing for high-priced home purchases. This regulation will take effect immediately on June 28. An official from the Financial Services Commission emphasized, "Financial authorities have focused on restricting loans that are not for genuine end-user demand in order to strengthen management of mortgage loans in the Seoul metropolitan area and regulated areas. If necessary, we will actively consider additional stabilization measures, such as designating more regulated areas."

The autonomous management system for household loan growth, which is currently being implemented in the banking sector, will be expanded to all financial sectors in the second half of the year. Currently, banks set monthly and quarterly loan growth targets and manage household loan growth through self-regulation. Starting in the second half of the year, this self-regulation will be extended to secondary financial sectors, such as mutual finance and savings banks, in an effort to curb the growth of household loans.

Until last week, when the government reported to the National Policy Planning Committee, the plan was to observe the effects of the third phase of the stress-based debt service ratio (DSR), which will be implemented next month, before preparing additional measures. However, as the rise in housing prices has accelerated, the government has brought forward its response. According to the Korea Real Estate Board, the weekly apartment sale price in Seoul rose by 0.43% compared to the previous week, marking the largest increase in six years and nine months.

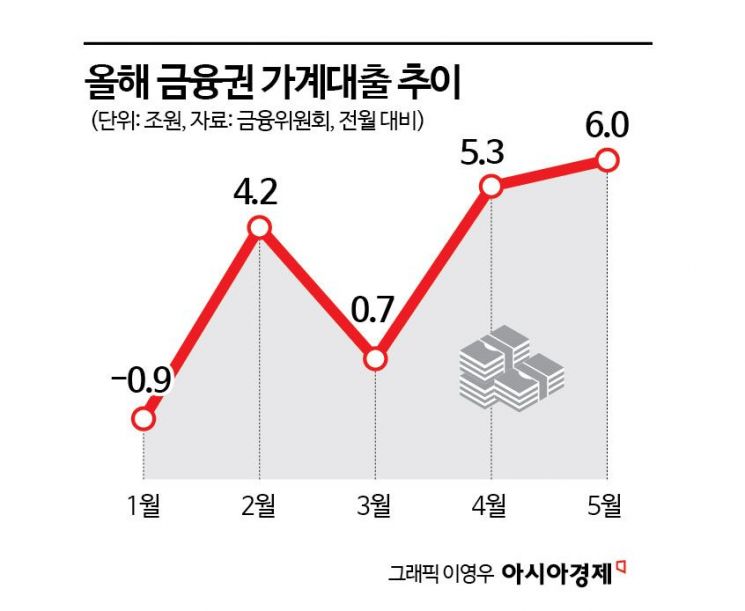

As housing prices have risen, household loans have also increased significantly. According to the Financial Services Commission, household loans across all financial sectors increased by about 6 trillion won last month compared to the previous month, the largest increase in seven months since October of last year. With the Seoul real estate market heating up, the market expects that the increase in household loans this month will exceed last month's figure.

Mortgage Loan Limit Set at 600 Million Won in Seoul and Other Regulated Areas

As warning signals have emerged from various sectors, the government is continuing to roll out new measures. Real estate regulations, which had been somewhat eased under the previous administration, will also be further strengthened. First, in the Seoul metropolitan area and regulated areas, if a person who already owns two or more homes purchases an additional home, or if a single-home owner purchases another home without selling the existing one, additional mortgage loans for home purchases will be prohibited (LTV=0%), thereby blocking demand for additional home purchases that are not for genuine end-user purposes. If a single-home owner sells the existing home within six months (conditional single-home owner), the same LTV rules as for first-time buyers will apply: 70% LTV in non-regulated areas and 50% LTV in regulated areas.

The LTV for first-time homebuyers in the Seoul metropolitan area and regulated areas will be tightened from 80% to 70%, and a mandatory move-in requirement (within six months) will be imposed. This measure will also apply to policy loans such as Didimdol and Bogumjari loans. The maximum amount for mortgage loans for living stabilization purposes, such as raising living expenses by using homes in the Seoul metropolitan area and regulated areas as collateral, will also be limited to 100 million won.

The Financial Services Commission will also proceed without delay with the implementation of the third phase of the stress-based DSR regulation, scheduled for next month. Once the third-phase DSR regulation is implemented, the amount available for borrowing will decrease. In addition, the maturity of mortgage loans in the Seoul metropolitan area and regulated areas will be limited to within 30 years to prevent circumvention of the DSR regulation.

Kwon Daeyoung, Secretary-General of the Financial Services Commission, emphasized, "Now is the time for financial authorities, relevant agencies, and the financial sector to proactively manage household debt with a heightened sense of urgency. All financial sectors must swiftly and thoroughly implement household debt management measures, including reducing total loan growth targets, expanding self-regulation, and limiting mortgage loan ceilings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)