Second Quarter Shipments Estimated at 4.3GWh

Operating Loss Expected to Narrow Significantly

AMPC Receipts Projected to Reach Record High

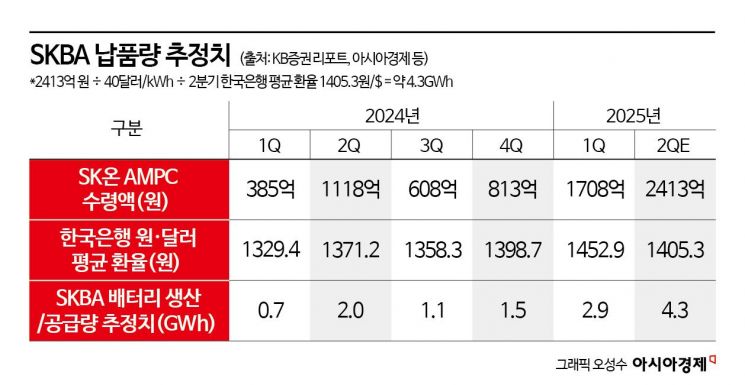

SK On's North American battery shipments in the second quarter are expected to more than double compared to the same period last year, significantly narrowing its operating loss. The amount of Advanced Manufacturing Production Credit (AMPC) received under the U.S. Inflation Reduction Act (IRA) is also projected to reach a quarterly record high.

According to an analysis by this publication on June 27, SK Battery America (SKBA) in Georgia, USA, shipped approximately 4.3 gigawatt-hours (GWh) in the second quarter of this year. This represents an increase of more than 115% compared to the estimated 2.0GWh in the same period last year.

The increase in delivery volume directly leads to a higher tax credit amount. Under the IRA, batteries produced and supplied within the United States are eligible for a tax credit of $35 (about 47,526 KRW) per kWh for cells and $45 per kWh for modules. Based on this, the AMPC received in the second quarter is estimated at approximately 241.3 billion KRW, the largest quarterly amount since the program was implemented.

Positive outlooks for SK On's performance are also continuing in the securities industry. KB Securities recently forecast in a report that SK On’s operating loss in the second quarter, including AMPC, would be around 35.6 billion KRW, an 88.1% improvement from the previous quarter’s 299.3 billion KRW. Hana Securities also projected the second quarter operating loss at 117.8 billion KRW, expecting a significant reduction compared to the previous quarter.

SKBA has a total production capacity of 22GWh and is the exclusive battery supplier for Hyundai Motor’s electric vehicles produced in the United States. Analysts attribute the increase in battery cell production to the start of full-scale electric vehicle production and wholesale sales at Hyundai’s U.S. plant, which has driven up electric vehicle shipments.

Jeon Wooje, a researcher at KB Securities, analyzed, “SK On’s U.S. plant is estimated to have reached 100% full operation between March and April. From May, inventory buildup for high-performance electric vehicles such as the Ioniq 9 and EV9 began, and even considering only Hyundai’s April production, battery demand exceeded 1.5GWh.” Currently, SKBA’s supply to Hyundai accounts for as much as 75% of its output.

As expectations for a performance recovery grow, attention is also focusing on SK Innovation’s company-wide business restructuring. Recently, SK Innovation withdrew the planned IPO of its lubricant subsidiary SK Enmove, stating, “The decision was made after comprehensively considering market conditions and enhancing corporate value.” Industry insiders view this as part of a rebalancing strategy to focus capital and resources on SK On.

Jang Yongho, CEO of SK Innovation, has declared since the beginning of this year, “Portfolio rebalancing is an essential task for survival,” and added, “In the short term, we will concentrate on areas and markets where we can secure competitiveness, and by strengthening portfolio technology competitiveness, we will grow into a global top-tier battery company.”

An industry official stated, “Demand for SK On’s U.S. plant is expected to continue to grow,” and explained, “With the expansion of electric vehicle production in the U.S., the effect of IRA tax credits, and automakers’ local battery procurement strategies, SKBA’s utilization rate is expected to remain high.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.