2025 Second Half Global Economic and International Financial Market Outlook Briefing

Global Stock Prices Expected to Rise Further on Solid Corporate Earnings and Major Countries' Economic Stimulus

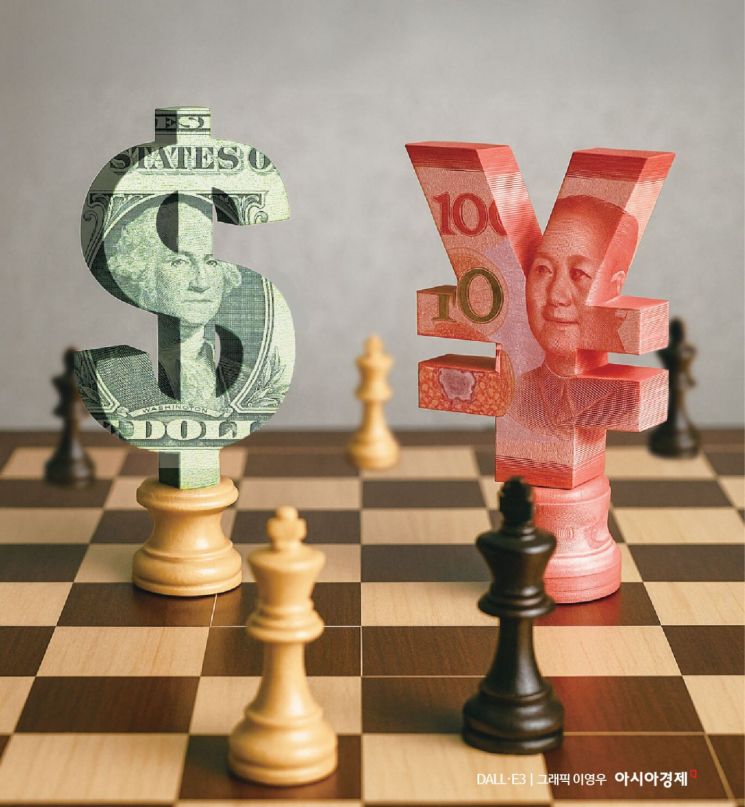

US Market Dominance Weakening... Diversification into Non-US Portfolios

Global Shift Away from the Dollar... Dollar Index Expected to Weaken Gradually

There is a forecast that global stock prices will continue to rise in the second half of this year. The US dollar is expected to remain weak as signs of a slowdown in US economic growth become more evident.

At a press briefing on the "2025 Second Half Global Economy and International Financial Market Outlook" held at the Bankers’ Club in Jung-gu, Seoul on June 26, Lee Yongjae, head of the International Finance Center, said, "Global stock prices in the second half will rise, supported by solid corporate earnings and economic stimulus measures in major countries."

In the United States, it is expected that policy support such as tax cuts and expanded fiscal spending, as well as continued investment in artificial intelligence (AI), will allow corporate profits to maintain an upward trend throughout the year. In particular, he noted that AI-related stocks have been rebounding more quickly than other sectors, suggesting that the upward trend could continue. AI-related stocks have risen 27% from their April low, which followed the recent announcement of US reciprocal tariffs, showing a much sharper recovery compared to the S&P 500’s 9% gain. The International Finance Center analyzed that, given the ongoing investment cycle in AI infrastructure such as semiconductors and the potential for further monetization driven by demand for AI cloud services, there is ample room for additional gains.

However, it is expected that the extent of stock price increases will be limited due to downward revisions to earnings estimates resulting from a slowdown in the real economy in the second half. Investors have also pointed out that the final tariff negotiations under the Trump administration and uncertainties in the inflation trajectory are additional risk factors. Lee Yongjae stated, "The dominance of the US is likely to weaken as portfolios diversify into markets outside the United States," and added, "As the status of the dollar weakens, with active economic stimulus in Europe and emerging markets and regional differences in stock valuations, the exceptional strength of the US stock market will likely moderate."

The US dollar is expected to weaken on the back of slowing growth. It is also expected to be affected by the weakening of US exceptionalism and the global movement away from the dollar. Lee Yongjae explained, "With signs of weakness in long-term leading indicators and prolonged uncertainty in the trade environment, it is inevitable that the vitality of the US economy will diminish compared to recent years," adding, "The dollar index (DXY) is expected to show a gradual weakening trend." Accordingly, he predicted that the won-dollar exchange rate will continue to face downward pressure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.