Q2 Business Index Up 11.2 Points from Previous Quarter

Positive Q3 Outlook Driven by Expectations for Domestic Demand Recovery

Performance Rebounding, but Financial Conditions Remain a Burden

The business sentiment among venture companies, which had been declining for four consecutive quarters, rebounded in the second quarter. Expectations for an improvement in domestic demand have grown, and the outlook index for the third quarter is also approaching the baseline, indicating that the recovery trend is likely to continue.

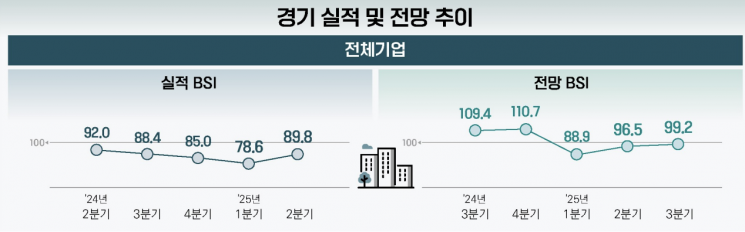

According to the "2025 Q2 Venture Business Survey Index" released by the Venture Business Association on the 26th, the business performance index for venture companies in the second quarter was 89.8, up 11.2 points from the previous quarter (78.6). Having hit its lowest point in the second quarter, the business performance index for venture companies has now broken out of a four-quarter decline, showing signs of recovery.

Among companies that responded that business performance had "improved" in the second quarter, the most frequently cited reason was "strong domestic sales" (79.7%). On the other hand, companies that reported "worsened" performance pointed to "sluggish domestic sales" (83.0%) as the primary factor, followed by "financial difficulties" (40.7%) and "rising raw material prices" (15.8%).

By industry, the manufacturing business performance index rose by 10.5 points to 88.9 compared to the previous quarter (78.4). Of the detailed sectors, only medical and pharmaceutical (102.0) exceeded the baseline of 100, while all other sectors fell short. Food and beverage, textiles, non-metallic, and other manufacturing (86.8), as well as machinery, automotive, and metals (83.7), increased by 16.3 points and 10.4 points respectively from the previous quarter, but still recorded the lowest figures among the sectors, as in the previous quarter.

The service industry business performance index was 89.6, up 10.3 points from the previous quarter (79.3), but still fell short of the baseline. All detailed sectors remained below 100, but wholesale and retail, R&D services, and other services (92.3), as well as information and communications and broadcasting services (91.3), saw significant improvements, rising by 16.1 points and 16.4 points respectively from the previous quarter.

By category, all indicators showed an upward trend compared to the previous quarter: business performance (92.6, up 11.2 points), financial status (87.6, up 7.4 points), cost expenditures (87.2, up 1.1 points), and workforce status (95.4, up 0.9 points). In particular, all subcategories of business performance increased from the previous quarter, with domestic sales showing a notable rise of 19.3 points to 92.5. Among the financial status subcategories, loans (84.5) decreased by 8.3 points from the previous quarter, and investment attraction (86.9) also saw a slight decrease of 0.7 points. In terms of cost expenditures, financial costs (88.9) rose by 0.4 points from the previous quarter, while operating costs (83.0) fell by 1.9 points, showing contrasting trends.

The business sentiment index (BSI) for venture companies for the third quarter stood at 99.2, up 2.7 points from the previous quarter (96.5), continuing the recovery trend. Among venture companies that expected business conditions to "improve," 81.8% cited "improved domestic sales" as the main reason. In contrast, the response rates for other factors such as "improved exports" (22.7%) and "smooth financial conditions" (19.9%) were relatively low, highlighting particularly strong expectations for a recovery in the domestic market. Among the factors cited for business deterioration, the response rate for "rising labor costs" (8.4%) declined sharply from the previous quarter (21.8%), suggesting that the employment burden on venture companies may ease somewhat. However, "sluggish domestic sales" (76.2%) and "financial difficulties" (44.9%) still recorded high response rates.

Song Byungjun, Chairman of the Venture Business Association, stated, "It is a significant sign of economic recovery that the venture business performance index, which had been declining since the second quarter of last year, has turned upward after a year. With the business sentiment index for the third quarter also rising close to the baseline, we expect the recovery trend to continue."

He added, "However, it is concerning that the response rate for 'smooth financial conditions' among the factors for improvement in both performance and outlook has dropped sharply from the previous quarter to around 20%. We hope that the new government will provide active support to address various difficulties faced by venture companies, including financial issues, so that the recovery trend will continue and venture companies can firmly establish themselves as a driving force for economic growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.