Trump's Trade Regulations:

"Favorable for K-Batteries...

Demand Contraction Inevitable"

EU Regulations Also Tighten...

Urgent Need for Enhanced Battery 'Traceability'

As global trade regulations become increasingly sophisticated, the Korean battery industry is reorganizing its survival strategies. The United States' Inflation Reduction Act (IRA) and the European Union (EU) Battery Regulation are demanding not only technological advancements but also sustainability and transparency across the entire supply chain. In response, domestic battery companies are strengthening their capabilities in areas such as supply chain traceability, digital battery passports, and environmental, social, and governance (ESG) compliance, seeking solutions to turn this crisis into an opportunity.

Park Taesung, Executive Vice President of the Korea Battery Industry Association, delivers the opening remarks at a seminar held on the 25th at the Samil PwC headquarters in Yongsan-gu, Seoul. Provided by the Korea Battery Industry Association

Park Taesung, Executive Vice President of the Korea Battery Industry Association, delivers the opening remarks at a seminar held on the 25th at the Samil PwC headquarters in Yongsan-gu, Seoul. Provided by the Korea Battery Industry Association

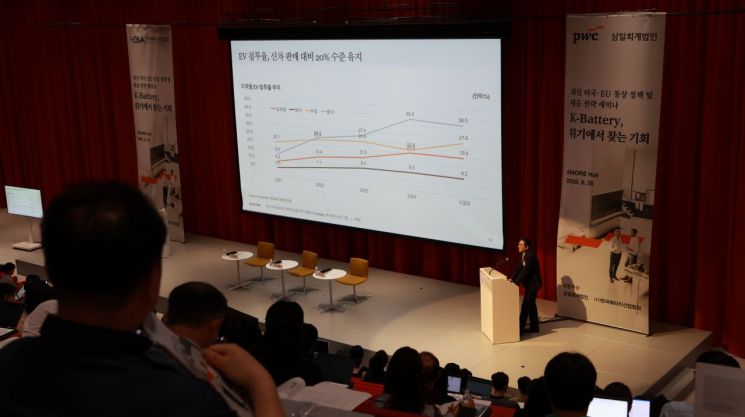

On the 25th, the Korea Battery Industry Association and Samil PwC jointly hosted the "Latest US and EU Trade Policy and Response Strategy Seminar - K-Battery: Finding Opportunities in Crisis" at the Amore Hall of Samil PwC's headquarters in Yongsan-gu, Seoul. The seminar covered a wide range of analytical information, including: ▲ Global electric vehicle (EV) and energy storage system (ESS) market outlook ▲ Current status of trade regulations under US President Donald Trump and response strategies ▲ Key issues in responding to EU regulations, the EU Battery Regulation, and case studies ▲ Establishing traceability management systems to respond to supply chain regulations.

Park Taesung, Executive Vice President of the Korea Battery Industry Association, said in his opening remarks, "Although the global battery market is growing rapidly, the K-battery industry has not been able to enjoy the benefits and is facing a complex crisis." He continued, "I hope that the new government's policy pledges?such as strengthening research and development (R&D) for securing super-gap technologies, introducing tax incentives to promote domestic production, and establishing a battery triangle belt?will be included in the top 100 national agenda items and implemented." He added, "The battery industry also promises to quickly restore the competitiveness of K-batteries and recharge the Korean economy."

Trump's Trade Regulations: "Favorable for K-Batteries... Demand Contraction Inevitable"

The seminar began with an analysis of the main content and outlook of the Advanced Manufacturing Production Credit (AMPC) provision for batteries in the draft of the Omnibus Budget Reconciliation Bill (OBBB) recently announced by the US Senate Finance Committee. According to the analysis, unlike the original House bill, the AMPC in the battery sector has been revised to reflect business realities, including the duration of tax credit eligibility, third-party transfers, and regulations on the Chinese supply chain, to facilitate the establishment of a domestic US battery supply chain.

Regarding the duration of tax credit eligibility, the House bill proposed ending it by the end of 2031, one year earlier than the IRA, but the Senate draft maintains the original IRA timeline, extending it to the end of 2032. The third-party transfer of tax credits, which the House bill proposed abolishing after the end of 2027, remains permitted in the Senate draft as originally planned.

For the regulation of the Chinese supply chain, the House bill introduced the Prohibited Foreign Entity (PFE) provision in the AMPC to regulate Chinese supply chains, similar to the Foreign Entity of Concern (FEOC) rule. However, rather than an outright ban on PFE support, the Senate draft adjusts the approach to gradually reduce support each year, thereby progressively decreasing dependence on the Chinese supply chain.

Notably, a new quantitative standard called the "Material Assistance Cost Ratio (MACR)" has been introduced to determine whether substantial support is provided to PFEs. The MACR represents the proportion of direct material costs, such as cathode and anode materials used in battery production, that are sourced from non-PFE entities. If this standard is adopted, local investment companies will be burdened with the need to reduce their dependence on the Chinese supply chain each year, but it will also make it more difficult for Chinese companies to export, invest, or enter technology transfer contracts with the US, which could present opportunities for domestic battery companies.

Soh Juhyun, Partner at Samil PwC, stated, "Although the law has not yet passed and we need to monitor the situation, the US has maintained its stance of excluding China, and the legal provisions have been clarified, reducing some uncertainty." She added, "For now, domestic battery companies may feel some relief, but as tax incentives for electric vehicles are reduced, a contraction in demand is inevitable."

EU Regulations Also Tighten... Urgent Need for Enhanced Battery 'Traceability'

The seminar also addressed trade regulations that link environmental and security concerns, such as the EU Battery Regulation (EUBR), the Corporate Sustainability Due Diligence Directive (CSDDD), and the Critical Raw Materials Act (CRMA), as well as corporate response strategies.

The EU is raising entry barriers to its internal market by strengthening supply chain transparency and sustainability standards throughout the entire supply chain lifecycle. This is expected to affect the entry of domestic battery companies into the European market. Accordingly, the seminar covered the various regulations of the EU, which has the world's second-largest market, and presented response strategies such as traceability management systems to help companies enhance their proactive response capabilities and minimize regulatory risks.

The EU relies on imports for nearly 60% to 100% of the core materials used in batteries that power key growth sectors such as semiconductors, electric vehicles, and renewable energy. To mitigate supply chain risks, the EU has long been expanding various regulations.

Lee Bohwa, Partner at Samil PwC, stated, "EU regulations incorporate reuse and recycling at the entire value chain level, so domestic companies must pay attention to enhancing sustainability throughout the product lifecycle." She added, "The EU is formulating regulations under a strategy to increase domestic production in key industries and reduce reliance on foreign raw materials." She continued, "In Europe, strong ESG management is not just a competitive advantage but a fundamental prerequisite that must be met," and emphasized, "Only by proactively responding to regulations can companies avoid problems in export business."

She further stated, "The most important requirement is the 'digital battery passport,'" explaining, "There is now a mandatory provision that requires disclosure of all necessary information related to the battery." The digital battery passport contains battery information such as the battery model, manufacturer, and unique identification code, as well as the origin history of raw materials and ESG performance based on 22 indicators.

Lee added, "The EU is negotiating an omnibus package that includes the CSDDD and EUBR," and "If this is approved, the supply chain due diligence requirement within the battery regulation is expected to be postponed for about two years." However, she emphasized, "Aside from supply chain due diligence, the timelines for other requirements such as carbon footprint and battery passport remain unchanged, so companies seeking to enter Europe must be aware of these regulations."

As a method to respond to US and EU regulations, "supply chain traceability" was proposed. Supply chain traceability is the ability to track and identify the movement of products or raw materials throughout the entire value chain, from raw material procurement, processing, parts manufacturing, and completion of finished goods, to consumption, disposal, and reuse or recycling.

Choi Jungul, Partner at PwC, stated, "As supply chain regulations expand, the need for traceability management is emerging." He explained that the EU's CRMA and EUBR, as well as the US IRA, each apply different regulations at every stage?raw material supply, material processing, parts manufacturing, and finished product production?so companies must identify and respond to the varying regulatory requirements and their impact on the entire value chain individually.

Choi advised, "If not managed in advance, exports may be blocked and corporate reputation may suffer, so it is necessary to manage the entire value chain in advance, including first-tier suppliers." He added, "When establishing a system, it should be designed flexibly so that new regulations can be incorporated as they arise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.