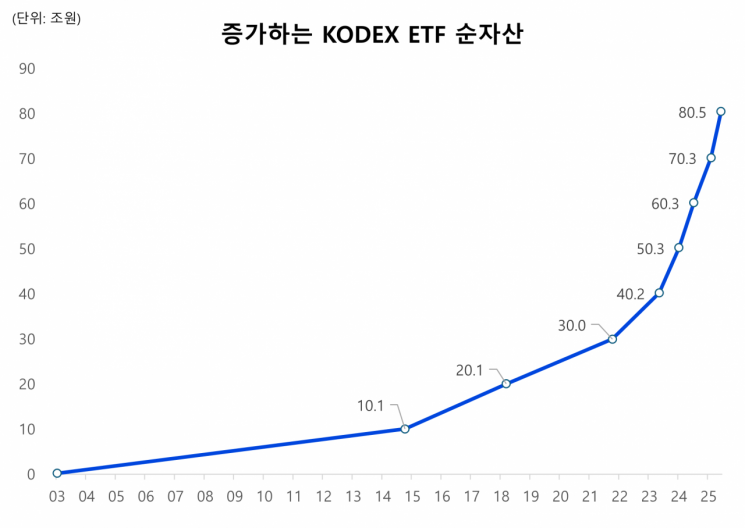

The net assets of KODEX ETFs, managed by Samsung Asset Management, the leading asset management company in South Korea, have surpassed 80 trillion won for the first time in the industry. This scale ranks 26th among global ETF managers. Analysts attribute this rapid growth to the expansion of individual investments in ETFs, in line with the new administration’s policy to revitalize the domestic stock market.

On June 25, Samsung Asset Management announced that KODEX ETFs' net assets reached 80.5 trillion won. This represents an increase of more than 10 trillion won in about four months since net assets surpassed 70 trillion won in February this year.

The rapid growth of KODEX is attributed to several factors: a favorable environment in both domestic and international stock markets; increased investor demand for parking-type products; and a general rise in monthly dividend and thematic products. Net assets of nearly 30 diverse ETFs?including domestic equity, overseas equity, parking-type, monthly dividend covered call, and new thematic types?each increased by more than 100 billion won. Purchases by individual investors also grew significantly.

KODEX200, the first ETF in Korea and the flagship product of Samsung Asset Management, was identified as the primary driver behind surpassing the 80 trillion won milestone. This was due to the sharp rise in the KOSPI, fueled by expectations for domestic stock market support following the launch of the new administration. Since KODEX ETFs surpassed 70 trillion won, the net assets of KODEX200 alone have increased by 1 trillion won.

Samsung Asset Management’s two major U.S. index ETFs have also attracted attention with their “additional distribution policy,” which returns accumulated dividends to customers. Since the point when Samsung Asset Management ETFs surpassed 70 trillion won, KODEX US S&P500 has grown by 608.6 billion won, and KODEX US Nasdaq100 by 678.9 billion won. This is interpreted as the result of a change in January this year from an automatic reinvestment (TR) type to a dividend payment (PR) type.

KODEX Money Market Active, which played a major role in surpassing 70 trillion won in net assets in February, has established itself as Korea’s leading ultra-short-term ETF, growing by approximately 1.3741 trillion won over the past four months. KODEX CD 1-Year Rate Plus also increased by 325.3 billion won, supported by continued demand for parking-type products. KODEX US Money Market Active, which was listed last month, has grown by 197.3 billion won in just about one month since its listing.

The growth of monthly dividend covered call ETFs is also notable. KODEX 200 Target Weekly Covered Call and KODEX Financial High Dividend TOP10 Target Weekly Covered Call, which utilize domestic assets, increased by 365.1 billion won and 287.7 billion won, respectively, thanks to the strength of the domestic stock market and high-dividend financial stocks. Since last year, KODEX has expanded its covered call product lineup to 10, reflecting growing interest from individual investors, and has recorded a combined net asset increase of 1.6688 trillion won since the beginning of the year. KODEX Financial High Dividend TOP10 Target Weekly Covered Call achieved a return of 31.64% since the beginning of the year, ranking first among all covered call ETFs and demonstrating outstanding performance.

Thematic products such as KODEX AI Power Core Equipment and KODEX Renewable Energy Active have recorded returns of 56% and 51%, respectively, since the beginning of the year, driven by expectations for the power equipment and nuclear industries. Their net assets increased by 111.5 billion won and 58 billion won, respectively. KODEX Korea Real Estate Infrastructure grew by 193.6 billion won, supported by a high distribution rate of 9.47% (over the past year) and the benefit of separate taxation. Products across various regions, types, and asset classes each recorded net asset increases of over 100 billion won, gaining popularity among investors.

The increase of about 3 trillion won in KODEX’s individual net assets, from 17.1 trillion won to 20 trillion won, is particularly noteworthy. Net assets of overseas equity ETFs, which are highly favored by individual investors, grew by 62.1%, from 7.3 trillion won to 11.8 trillion won. Considering that KODEX’s total net assets grew by 14.3%, from 70 trillion won to 80 trillion won, it appears that the development of new products and marketing activities tailored to individual investors’ preferences have yielded strong results.

The gap between Samsung Asset Management’s KODEX and the second-largest ETF provider has widened to 1.14 trillion won. KODEX currently manages 215 ETF products and has listed 13 new ETFs this year, the highest number ever. Based on single-country management, this scale ranks fourth after the U.S. asset managers iShares, SPDRs, and Invesco.

Park Myeongje, head of the ETF division at Samsung Asset Management, said, “I would like to thank our investors for their trust and support, which enabled KODEX ETFs to surpass 80 trillion won in net assets for the first time in the industry.” He added, “As the largest ETF manager in Korea, Samsung Asset Management will continue to prioritize customer returns and do its best to develop new products and services that meet customers’ expectations.” He further stated, “Samsung Asset Management will take the lead so that the Korean ETF market can continue to grow steadily beyond 200 trillion won and reach over 300 trillion won.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.