Capital Soundness of Major Conglomerates Such as Kyobo, Samsung, and DB Declines

Falling Interest Rates Lead to Decreased Profits at Insurance Affiliates

Loss Absorption Capacity Remains Healthy

Last year, the capital soundness of domestic financial conglomerates declined sharply compared to the previous year. The decrease in profits at insurance companies due to falling interest rates was identified as the main cause, but the overall loss absorption capacity is still considered to be at a healthy level.

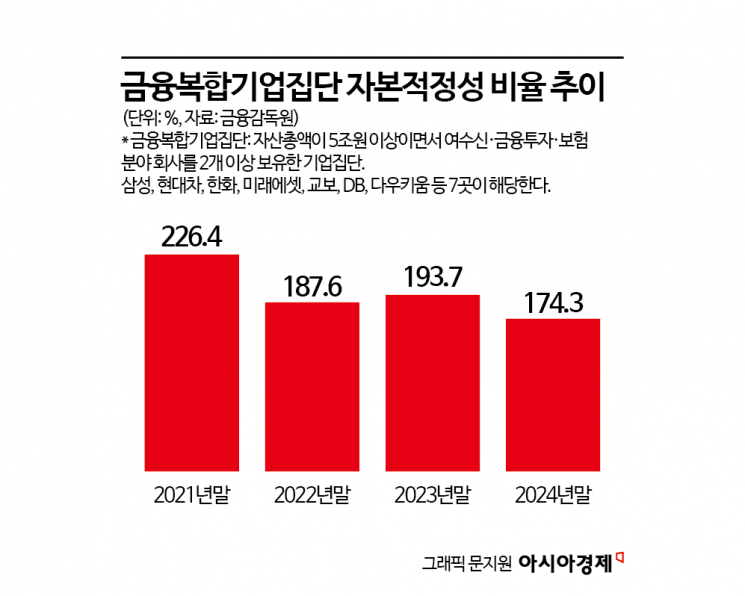

According to the "Capital Adequacy Ratio of Financial Conglomerates as of the End of 2024" released by the Financial Supervisory Service on June 25, the capital adequacy ratio of the seven domestic financial conglomerates at the end of last year was 174.3%. This represents a decrease of 19.4 percentage points from 193.7% recorded one year earlier. The capital adequacy ratio of financial conglomerates has been on a downward trend since it reached 226.4% at the end of 2021.

A financial conglomerate refers to a corporate group with total assets of at least 5 trillion won that owns two or more companies in the lending, investment, or insurance sectors. Examples include Samsung, Hyundai Motor, Hanwha, Mirae Asset, Kyobo, DB, and Daou Kiwoom. These groups are subject to supervision by financial authorities regarding capital soundness and related matters.

The sharp decline in their capital adequacy ratio last year was due to an increase in insurance liabilities as interest rates fell, which led to a decrease in profits at insurance affiliates. The combined equity capital of the seven conglomerates was 171.1 trillion won, down 4.7 trillion won (2.7%) from the end of the previous year.

Although the combined equity capital, which serves as the numerator in the calculation of capital adequacy, decreased, the combined required capital, which serves as the denominator, increased by 8.1% to 98.1 trillion won compared to the end of the previous year, resulting in an overall decline in capital adequacy. A Financial Supervisory Service official explained, "The main reason was a significant decrease in the accumulated other comprehensive income of insurance group affiliates due to the increase in insurance liabilities resulting from last year's interest rate decline."

As of the end of last year, the capital adequacy ratios by financial conglomerate were as follows: Kyobo (201.4%), DB (195.0%), Daou Kiwoom (193.8%), Samsung (185.1%), Mirae Asset (164.2%), Hanwha (154.9%), and Hyundai Motor (146.9%). In terms of the magnitude of the decrease in capital adequacy over the year, the order was Kyobo (-37.5 percentage points), Samsung (-25.4 percentage points), DB (-23.7 percentage points), Hanwha (-17.4 percentage points), Daou Kiwoom (-14.9 percentage points), and Hyundai Motor (-7.7 percentage points). Mirae Asset was the only group to see its capital adequacy ratio rise, with an increase of 8.7 percentage points.

A Financial Supervisory Service official stated, "Last year, the capital adequacy ratios of financial conglomerates declined due to the impact of interest rates and other factors." The official added, "However, as the ratios remain above the regulatory threshold of 100%, the loss absorption capacity is still at a sound level." The official went on to emphasize, "We will continue to monitor capital adequacy ratios in response to financial market fluctuations such as interest rates and stock prices, in preparation for both domestic and international uncertainties, including U.S. tariff policies. We also plan to strengthen management of potential risk factors related to internal transactions and joint investments to prevent risks from arising within financial conglomerates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.