Eight of the Top 10 Groups Achieve Double-Digit Growth Rates

Hanwha Group Stands Out with Triple-Digit Increase

LG Group Alone Records a Decline

Strong Defense and Shipbuilding Stocks, Weak Secondary Battery Stocks Drive Trends

As the KOSPI surpassed the 3,000 mark for the first time in three and a half years, the stock market rally has led to a significant increase in the market capitalization of the top 10 business groups. Eight out of the top 10 groups recorded double-digit growth rates in market capitalization during the first half of this year.

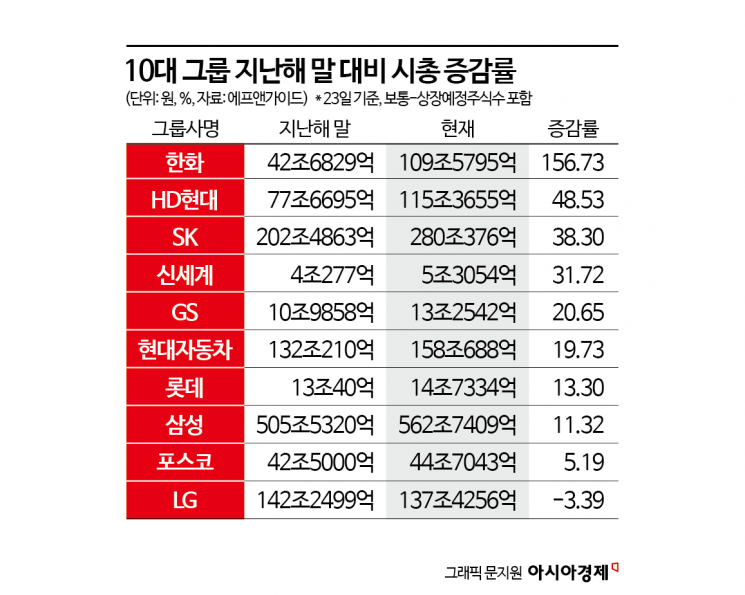

According to financial information provider FnGuide on June 25, the combined market capitalization of the top 10 groups as of June 23 stood at 1,441.2152 trillion won, up by 268 trillion won from the end of last year (1,173.159 trillion won).

Eight out of the top 10 groups posted double-digit growth rates in market capitalization. Among them, Hanwha Group saw the largest increase. Hanwha Group's market capitalization surged by 156.73%, from 42.6829 trillion won at the end of last year to 109.5795 trillion won. Of Hanwha's 12 listed affiliates, five stocks posted triple-digit growth rates this year. Among them, Hanwha (248.70%) and Hanwha Aerospace (218.41%) rose by more than 200%. Other groups that saw increases in market capitalization, in descending order, were HD Hyundai (48.53%), SK (38.30%), Shinsegae (31.72%), GS (20.65%), Hyundai Motor (19.73%), Lotte (13.30%), Samsung (11.32%), and POSCO (5.19%).

This year, defense and shipbuilding stocks emerged as leading sectors, which led to remarkable increases in the market capitalization of Hanwha and HD Hyundai, both of which have significant exposure to these industries. Hyundai Motor Group, despite sluggish performance in its flagship stocks Hyundai Motor and Kia due to tariff issues, benefited from a sharp rise in the stock price of its defense affiliate Hyundai Rotem, which drove the group's overall market capitalization higher. Hyundai Rotem’s stock price soared by 330.58% this year, marking the highest increase among affiliates of the top 10 groups.

Jung Dongik, a researcher at KB Securities, said of Hyundai Rotem, "The increase in export volume of the K2 tank, which is recording an operating margin in the 30% range, will accelerate the pace of performance improvement." He added, "Following a surprise earnings result in the first quarter, the company is expected to achieve record-high quarterly results in the second quarter, with sales of 1.4501 trillion won and operating profit of 253.4 billion won, surpassing market expectations."

Lee Dongheon, a researcher at Shinhan Investment & Securities, said, "In the first half of this year, the shipbuilding industry succeeded in decoupling from the sluggish shipping sector, as both earnings and stock prices showed strength." He explained, "Although freight rates and order volumes declined, the operating profit of major shipbuilders surged by 326% year-on-year, exceeding expectations, thanks to structural growth prospects." He added, "In the second half, the industry will enter a phase where both earnings growth and structural differentiation accelerate simultaneously. The stock price trend is likely to be newly formed around high value-added performance in LNG and special-purpose vessels, as well as differentiation in competitiveness among companies. Earnings, policy, and technological capabilities will be more important than the overall economy."

Among the top 10 groups, LG Group was the only one to see a decline in market capitalization this year. LG Group's market capitalization fell by 3.39%, from 142.2499 trillion won at the end of last year to 137.4256 trillion won. The continued sluggishness in the secondary battery sector this year affected major affiliates such as LG Chem and LG Energy Solution. LG Chem’s stock price dropped by 19% this year, while LG Energy Solution fell by 15.52%, LG Electronics by 10.54%, and LG Innotek by 9.88%.

Jang Junghoon, a researcher at Samsung Securities, said, "As of the end of May, the stock prices of the secondary battery value chain have declined by 15% compared to the beginning of the year, and by 72% from the peak in July 2023. The downturn has lasted for 22 months, making it a prolonged slump." He analyzed, "While demand for electric vehicles in Europe remained solid in the first half, the U.S. market was weaker than expected. In addition, policy risks such as tariff changes and amendments to the Inflation Reduction Act (IRA) following the start of Donald Trump's second term have weighed on stock prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.