BBQ, Kyochon, and Others Enter the Chinese Market One After Another

K-food Popularity and Government Consumption Policies Drive Growth

Number of Korean Franchise Brands Continues to Decline

Domestic chicken franchise companies are once again knocking on the doors of the Chinese market. After a period of stagnation due to the aftermath of THAAD (Terminal High Altitude Area Defense), business in China is being revitalized, buoyed by the recent popularity of K-food. However, some point out that the franchise model, which focuses on a single menu, has limitations given the highly diverse food culture across different regions in China.

BBQ, Kyochon, and Goobne Begin Full-Scale Expansion in China

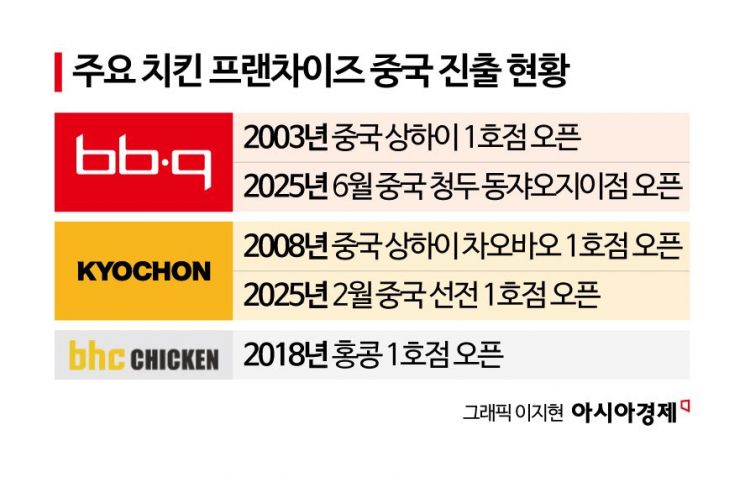

According to the food service industry on June 25, Genesis BBQ recently opened the 'BBQ Village Chengdu Dongjiaoji Branch' in Chengdu, Sichuan Province, China. 'Dongjiaoji' is an area in Chengdu known as the 'Seongsu-dong of Chengdu,' where consumer markets centered on young people, such as food streets and shopping malls, are growing rapidly. At this location, BBQ plans to offer chicken dishes such as Golden Olive Chicken, Yangnyeom Chicken, and Soy Garlic Chicken, as well as salads, pizza, and hamburgers, in addition to Korean dishes like Jjimdak and Tteokbokki. The company expects this store to serve as a hub where local MZ generation consumers can enjoy both K-food and Korean culture.

BBQ first entered China in 2003 and at one point operated over 400 stores. However, following the THAAD issue in 2017 and the resulting Hallyu ban, the number of stores declined sharply and the business naturally contracted. In May 2025, BBQ signed master franchise agreements with local business leaders in eight strategic regions of China, including Chengdu, Beijing, and Qingdao, and is now actively re-entering the Chinese market. The company aims to open directly managed stores in each region by the second half of this year and operate more than 1,000 stores across China.

Other major chicken franchises are also targeting the Chinese market. Kyochon F&B, which operates Kyochon Chicken, first entered China in 2008 with the opening of its first directly managed store in Chaobao, Shanghai, and has been expanding its presence since last year. In 2024, the number of Kyochon Chicken stores in China increased to 19, up 46% from 13 the previous year. In February 2025, the company opened a store in 'Qianhai Wanxiangcheng,' a premium shopping mall in Shenzhen, known as 'China's Silicon Valley.' As the Chinese market rapidly reflects the trends of young people, franchises consider this region a 'test bed' for targeting the Greater China market. Kyochon Chicken currently operates 18 franchise stores in major Chinese cities, including Shenzhen, Shanghai, and Hangzhou.

BHC, a chicken brand operated by Dining Brands Group, does not yet have any stores in mainland China but operates two stores in Hong Kong and is considering expanding into China. BHC opened its first Hong Kong store in December 2023 and, based on its popularity there, plans to open new stores in neighboring countries as well.

Goobne Chicken is also performing well in the Chinese market. Goobne Chicken entered the market in August 2015 by opening its first store in Guangzhou, China, and expanded its presence by opening its third store in Zhuhai, Guangdong Province, in November of the same year. The company notes that its 'Gochu Basasak' menu is particularly popular.

Saturated Domestic Market... Seeking Opportunities Overseas

The reason chicken franchises are turning their attention to the Chinese market is its significant growth potential. China, along with India, is considered one of the world's largest consumer markets. Last year, the size of China's food service market was estimated at about 5 trillion yuan (approximately 1,000 trillion Korean won). The market is rapidly expanding, recording an average annual growth rate of over 10%. With the recent easing of the Hallyu ban and growing interest in K-food among young Chinese consumers, industry insiders believe this is an ideal time for domestic brands to enter the market.

The limitations of growth in the domestic food service franchise market are also prompting companies to accelerate their entry into China. According to the Fair Trade Commission, the number of franchise brands in Korea was 12,377 last year, a 0.4% decrease from the previous year. This is the first decline since statistics began being compiled in 2019. The total number of food service brands decreased by 0.6%, with chicken franchises seeing the largest drop at 3.3%.

Yoon Honggeun, chairman of Genesis BBQ Group (center), and officials from the global business division are posing for a commemorative photo at the 'BBQ Village Chengdu Dongjiaoji Branch' opened in Chengdu, the capital of Sichuan Province, China. Genesis BBQ

Yoon Honggeun, chairman of Genesis BBQ Group (center), and officials from the global business division are posing for a commemorative photo at the 'BBQ Village Chengdu Dongjiaoji Branch' opened in Chengdu, the capital of Sichuan Province, China. Genesis BBQ

However, industry insiders unanimously agree that the Chinese market is as risky as it is attractive. The significant differences in food culture between regions in China make it difficult to meet consumer needs with a single recipe or operational model.

An industry official said, "With the era of mass production and mass consumption now over, Chinese consumers are increasingly favoring segmented values such as health or unique experiences. As the main consumer base shifts to younger generations, companies must focus on developing products, marketing strategies, and store interiors that meet their expectations." The official added, "The Chinese franchise market can be described as 'high risk, high return.' As it is a red ocean where domestic and international brands fiercely compete, it will be difficult to survive without a clear differentiation strategy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.