International Corporate Governance Network (ICGN) Forum

Frequent Overlap of Controlling Shareholders and Management

High Risk of Neglecting Interests of All Shareholders

Amid growing expectations for corporate governance reform through amendments to the Commercial Act following the inauguration of the Lee Jaemyung administration, there have been calls for transparent disclosure of management decision-making and compensation systems.

On the 24th, the Korea Exchange co-hosted a forum titled "Governance Reform as a Driving Force for Value Creation" with the International Corporate Governance Network (ICGN), providing a platform for public discussion on specific governance improvement measures. Experts attending the forum agreed that the new administration's policy direction to improve governance practices is encouraging. However, they unanimously emphasized that systems must be put in place to ensure transparent disclosure of management compensation structures, dividend policies, and decision-making processes.

Panelists are discussing at the International Corporate Governance Network (ICGN) forum titled "Governance Reform as a Driving Force for Value Creation," held on the 24th at the Korea Exchange Conference Hall. Photo by Jinyoung Kim

Panelists are discussing at the International Corporate Governance Network (ICGN) forum titled "Governance Reform as a Driving Force for Value Creation," held on the 24th at the Korea Exchange Conference Hall. Photo by Jinyoung Kim

Lee Dongseop, Head of Stewardship Responsibility at the National Pension Service, pointed out, "Korean companies do not transparently disclose their executive compensation systems, so it is impossible to know who is being rewarded, for what, and how. Compensation typically consists of base salary and incentives, but in Korea, the base salary is so high that even if management performance deteriorates, executives can still receive high pay."

Lee further explained, "In Korea, it is common for controlling shareholders to also serve as management, which leads to situations where, during decision-making processes such as mergers and acquisitions (M&A), losses are passed on to minority shareholders or decisions are made in favor of specific shareholders. To address this, we need to introduce 'Say on Pay,' so that the compensation systems for executives and the board are linked to the value of all shareholders." Say on Pay, first implemented in the UK, is a system where executive compensation is reviewed at the general shareholders' meeting.

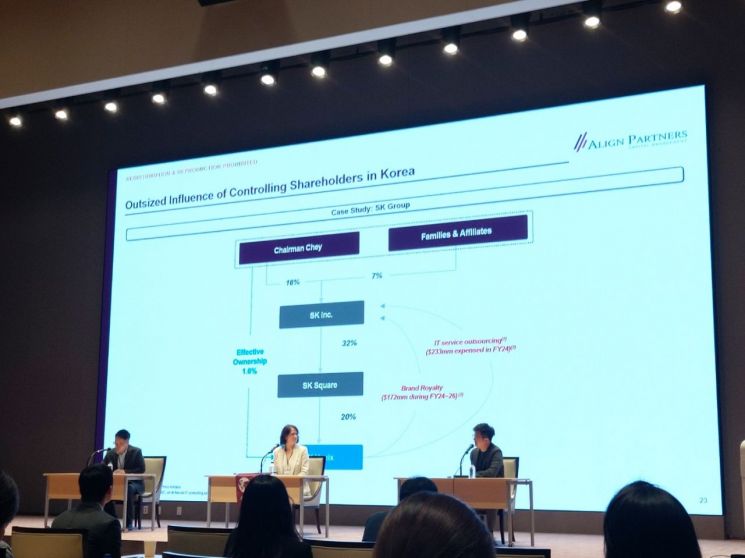

Experts believe that the Commercial Act amendment promoted by the Lee Jaemyung administration will be a turning point for the valuation of the Korean stock market. Lee Changhwan, CEO of Align Partners, said, "Various policies being pursued by the government, such as expanding the scope of directors' fiduciary duties, will mark a turning point in the development of the Korean stock market. Expanding cumulative voting, the separate election of audit committee members, and the application of the '3% rule' are also major tasks."

Strengthening board independence through active shareholder proposals was also identified as a key to improving corporate management practices. Lee explained, "For example, in the past, JB Financial Group was undervalued with a price-to-book ratio (PBR) of 0.3, despite having a return on equity (ROE) of 13%, due to poor capital allocation. Align Partners requested the appointment of two outside directors to JB Financial Group's board to readjust capital allocation, and the company subsequently established a plan to raise the shareholder return rate to 50%."

Lee Dongseop added, "In the past, SM Entertainment also faced major unfair transaction issues as the controlling shareholder was involved in management, but after Align Partners succeeded in appointing an auditor, the stock price rose by about 69%. This is a very important case of value creation through governance improvement in the Korean capital market." He continued, "Since 2016, the National Pension Service has been reviewing the dividend policies of all 250 or so companies in which it holds shares and demanding disclosure through shareholder engagement. Improvements have been observed in dividend payout ratios and dividend yields."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.