Decrease in Occupancy Volume Due to Drop in Housing Starts...

Nationwide Supply Expected to Fall by 30.5% Next Year

Upward Trend Spreads to the Metropolitan Area...

Delays in the Third New Towns Hamper Supply Expansion

High Interest Rates, Inflation, Rising Debt, and Even Public Investment Contraction

It is expected that the supply-demand imbalance will continue in the second half of this year due to a decrease in housing starts, resulting in a reduction in the number of units available for occupancy. The number of new housing units available for occupancy in the Seoul metropolitan area next year is projected to decrease by as much as 27% compared to this year. While the upward trend continues in the metropolitan area, unsold housing inventory is accumulating in small and medium-sized cities in the provinces, highlighting the need for tailored responses.

The Korea Research Institute for Construction Industry held the '2025 Second Half Construction and Real Estate Market Diagnosis and Domestic Economy Revitalization Strategy Seminar' at 2:00 p.m. on June 24 at the Construction Hall in Gangnam-gu, Seoul. Sung Hwan Kim, a research fellow who presented the '2025 Second Half Real Estate Market Diagnosis and Economic Revitalization Strategy,' assessed, "In the second half of the year, the impact of reduced housing starts is highly likely to lead to a sharp decline in occupancy volume, so it is necessary to design flexible policies that proactively address supply-demand imbalances and demand polarization."

Ji Hye Lee, Research Fellow at the Korea Research Institute for Construction Industry, is presenting at the '2025 Second Half Construction and Real Estate Market Diagnosis and Domestic Economy Revitalization Strategy Seminar.' Provided by the Korea Research Institute for Construction Industry

Ji Hye Lee, Research Fellow at the Korea Research Institute for Construction Industry, is presenting at the '2025 Second Half Construction and Real Estate Market Diagnosis and Domestic Economy Revitalization Strategy Seminar.' Provided by the Korea Research Institute for Construction Industry

Occupancy Volume to Decrease Due to Reduced Housing Starts... Nationwide to Drop by 30.5% Next Year

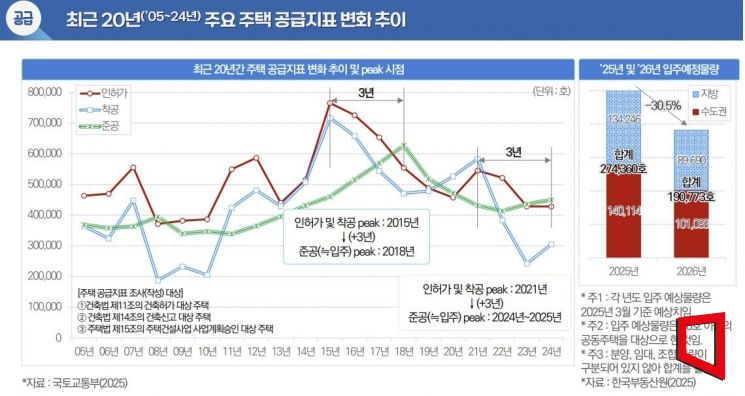

The number of housing units scheduled for occupancy nationwide next year is expected to be 190,773 units (according to the Korea Real Estate Board), a 30.5% decrease from this year's 274,360 units. By region, next year's occupancy is estimated at 101,083 units in the Seoul metropolitan area and 89,690 units in the provinces. The number of new units in the metropolitan area is expected to decrease by 27.83%, from 140,114 units this year to 101,083 units next year. The number of housing starts in 2021 is leading to completions in 2024 and 2025, and this is affecting the decrease in occupancy volume from the second half of this year onward.

The shortage in housing supply is expected to persist through the second half of this year and into next year. The leading indicator, private sector housing permits, has declined for two consecutive years. In the first half of this year, the nationwide number of permits was 76,778 units, a 16.8% decrease compared to the previous year. In the public sector, permits increased by 34.9% year-on-year, but in the private sector, they fell by 17.2%. Last year, the number of permitted units for pre-sale housing was 346,000, which is 29.6% less than the recent 10-year average of 491,377 units.

As of the first quarter of this year, the number of housing starts decreased by 25.0% compared to the previous year. Although housing starts increased by 26.1% last year, this was due to the base effect. From January to April this year, housing starts decreased by 33.7% compared to the same period last year. The ratio of housing starts to permits was 71.3% last year. While this is an increase from the previous year, it is still lower than the 20-year average of 81.6%. The number of permitted units that have not yet started construction is also accumulating. The gap between permits and starts from 2022 to 2024 totals 447,856 units. In particular, in areas outside the metropolitan region, the proportion of permitted but unstarted housing from 2022 to 2023 reached 49.9%.

Although the initial sales rate varies greatly by region, it is expected to remain at the current level for the time being. Looking at initial sales performance in the first quarter of this year: the metropolitan area recorded 81.5%, the five major metropolitan cities and Sejong City 79.2%, and the eight provinces 74.9%. Compared to the previous year, the metropolitan area decreased by 1.4 percentage points, and the eight provinces by 1.6 percentage points, while the five major metropolitan cities and Sejong City increased by 13.4 percentage points.

Upward Trend Expands to the Metropolitan Area... Delays in the Third New Towns Hamper Supply

Following the launch of the new administration, expectations of price increases and the effects of supply shortages led to the highest level of apartment transactions in Seoul in the first half of this year since 2020. Apartment sales in Seoul from January to June totaled 35,085 transactions. As the price increase trend spread to the metropolitan area, the weekly apartment sales price index for the metropolitan area (Korea Real Estate Board) turned positive, rising to 0.09% in the second week of June. The upward trend continues in core areas such as Songpa and Seocho districts, and the number of rising areas has expanded to the outskirts of Seoul and the eastern part of the metropolitan area.

Kim explained, "These indicators show that structural imbalances are underlying the short-term market recovery. While short-term policies are important, it is urgent to shift to policies that address medium- and long-term supply-demand balance and regional disparities."

Delays in the third new town projects are a major obstacle to resolving the supply shortage. With occupancy delayed compared to the original plans, most of the supply is now expected after 2027, except for Incheon Gyeyang (scheduled for the second half of 2026). The supply capacity from idle land within Seoul is also limited to about 12,000 units, which is less than half of the annual pre-sale volume.

In the rental market, the proportion of monthly rent transactions soared to 62.9% as of February, indicating that the transition from Jeonse to monthly rent is accelerating rapidly. Rental prices, once increased, rarely decrease, and the widening increase is adding to the monthly rent burden. As of April, the monthly rent index for Seoul apartments and officetels was 107.1 and 103.7, respectively.

Kim suggested that incentives should be introduced to encourage early construction starts in order to secure the pace of supply. He also recommended that the pre-sale price standards be adjusted to reflect reality, project financing (PF) support be strengthened, and improvements or abolition of the pre-sale price cap system be considered. He pointed out the need to revitalize redevelopment projects and pursue high-density urban development to improve housing supply conditions. This includes expanding floor area ratio incentives and rationalizing public contributions to enhance private sector profitability. In addition, he emphasized the need for early investment in transportation and other social overhead capital (SOC) for the third new towns to advance the timing of occupancy. To address unsold inventory in the provinces, he suggested reviving the long-term registered apartment rental business system to establish a stable rental supply base.

High Interest Rates, High Inflation, Rising Debt, and Even Public Investment Contraction

Construction orders in Korea for 2025 are expected to reach 222.1 trillion won, a 1.9% increase from the previous year. However, when accounting for inflation, this is effectively at the same level as the previous year. In the first half of this year, construction orders were sluggish due to political uncertainty, weakened investor sentiment, high construction costs, and real estate project financing (PF) insolvencies. Construction costs increased by 26% over the three years from 2020 to 2023, significantly worsening profitability in the private construction market.

Ji Hye Lee, a research fellow at the Korea Research Institute for Construction Industry, forecasted, "In the second half of the year, deferred orders will resume, and the effects of interest rate cuts and construction industry stimulus policies will combine to produce a recovery that can partially offset the sluggishness of the first half."

Construction investment is expected to decrease by 5.3% year-on-year, reaching 274.8 trillion won. Unlike construction orders, which are expected to improve somewhat in the second half, construction investment is projected to remain sluggish in both the first and second halves due to poor performance in leading indicators such as construction orders and housing starts.

Lee emphasized, "Multiple constraints such as weak domestic demand, high construction costs, lending regulations, and real estate PF insolvencies are hindering the recovery of the construction industry. In addition to short-term stimulus measures, a structural approach is needed to improve the fundamentals of the construction industry, and it is a critical time for joint efforts across the industry to lay the foundation for future growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.