Kim Jinwook, Citi Economist, Forecasts Impact

Assuming Average Oil Prices of $75, $85, and $95 per Barrel Until Next Year

Negative Effects on Economic Growth, Current Account, and Consumer Prices

South Korea to Suffer the Largest Hit Among 23 Major Countries

"Greater Likelihood of Fiscal Policies Such as Fuel Tax Cuts"

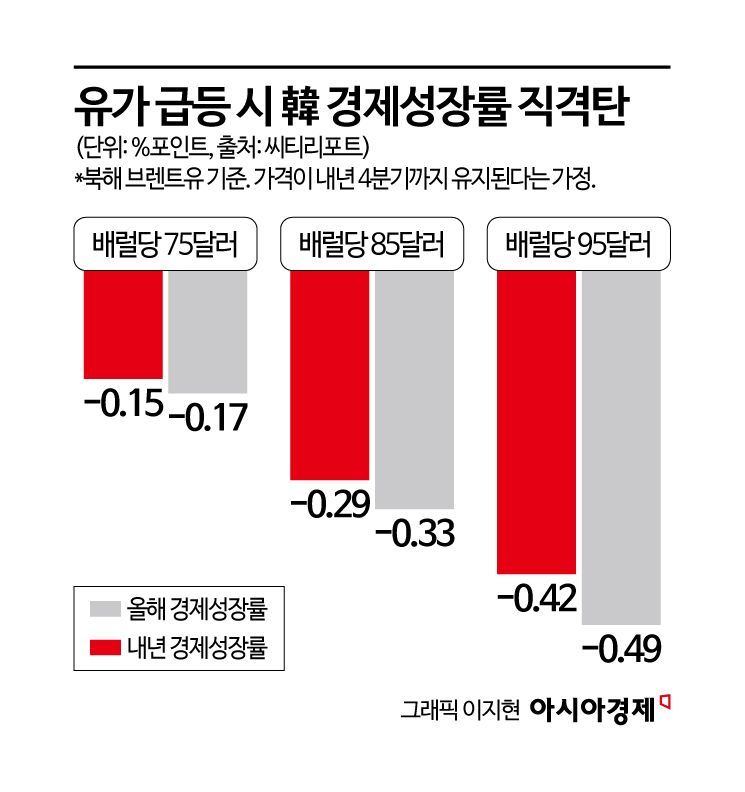

Amid concerns over a sharp rise in oil prices following the United States' attack on Iran's nuclear facilities, analysts warn that South Korea, which is highly dependent on energy and raw material imports, could see its economic growth rate negatively affected. If the average oil price reaches $95 per barrel (approximately 131,400 won) by the end of next year, it is projected that South Korea's combined economic growth rate for this year and next year will decrease by 0.91 percentage points. In order to minimize the negative economic impact, the use of fiscal policies such as a reduction in fuel taxes is being discussed.

Kim Jinwook, a Citi economist, recently quantified the economic impact of rising oil prices. Based on Oxford Economics' economic model, he outlined the effects of oil price increases on South Korea's economic growth rate, consumer price index, and current account balance under various scenarios. Assuming an average oil price of $65 per barrel from the second quarter of this year to the fourth quarter of next year, he analyzed the impact if oil prices were to rise by $10, $20, or $30 during this period. The results showed that rising oil prices have a negative impact on South Korea's economic growth rate, current account balance, and inflation.

On the 23rd, as the United States struck Iran's nuclear facilities, escalating tensions in the Middle East and raising concerns about rising oil prices, drivers are waiting to refuel at Mannam Square in Seocho-gu, Seoul. 2025.6.23. Photo by Kang Jinhyung

On the 23rd, as the United States struck Iran's nuclear facilities, escalating tensions in the Middle East and raising concerns about rising oil prices, drivers are waiting to refuel at Mannam Square in Seocho-gu, Seoul. 2025.6.23. Photo by Kang Jinhyung

If the average oil price rises by $10 to $75 per barrel by next year, South Korea's combined economic growth rate for this year and next year is expected to decline by 0.32 percentage points. The impact is 0.15 percentage points this year and 0.17 percentage points next year. If the price rises by $20, the combined decline is projected to be 0.62 percentage points (0.29 percentage points this year and 0.33 percentage points next year), and if it rises by $30, the decline is expected to reach 0.91 percentage points (0.42 percentage points this year and 0.49 percentage points next year). For consumer prices, a $10 increase would raise inflation by 0.22 percentage points this year and 0.13 percentage points next year. A $20 increase would result in a 0.42 percentage point and 0.26 percentage point rise, respectively, while a $30 increase would lead to a 0.62 percentage point and 0.38 percentage point rise. The current account surplus would decrease by 0.82 percentage points this year and 1.15 percentage points next year if oil prices rise by $10. A $20 increase would reduce the surplus by 1.66 percentage points and 2.32 percentage points, respectively, and a $30 increase would result in a 2.5 percentage point and 3.52 percentage point decrease.

Notably, South Korea is projected to suffer the largest impact on economic growth rate and current account balance among the 23 major countries if oil prices rise by $10. Taiwan would be the next most affected in terms of economic growth rate (-0.3 percentage points), while Vietnam would experience the next largest impact on its current account balance (-0.9 percentage points).

Kim explained that this is because South Korea relies heavily on energy and raw material imports from the Middle East. According to Citi Research and the Korea International Trade Association, as of last year, the four major energy sources (crude oil, natural gas, petroleum products, and coal) accounted for 25% of South Korea's total imports. Of the total imports, crude oil made up 14%, natural gas 5%, petroleum products 4%, and coal 3%. By region, South Korea imported 73% of its crude oil, 35% of its natural gas, and 62% of its petroleum products from the Middle East.

Kim stated that if rising oil prices deal a blow to the South Korean economy, the government is likely to turn to fiscal policy measures. He said, "The risk of rising oil prices and the recent rebound in the domestic housing market could lower the likelihood of the Bank of Korea cutting interest rates in the short term. Instead, the government is likely to use fiscal policies such as fuel tax cuts and energy vouchers if necessary." He added, "The 10.3 trillion won revenue adjustment included in the latest supplementary budget bill could provide room to further reduce fuel taxes if needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.