Subscription Savings and Deposit-Secured Loans Not Subject to DSR

"Balloon Effect" as Demand Shifts to Cards and Insurance

# Recently, Mr. A, who set out to purchase a home, took out a loan using his savings account as collateral. This was because a mortgage loan alone was not enough to cover various additional costs such as real estate brokerage fees, acquisition tax, and interior renovation. He was hesitant to break his savings account since only a short period remained until maturity, but then learned about the option of taking out a loan secured by his savings account and decided to use it.

With the third phase of the Total Debt Service Ratio (DSR) regulation set to take effect in July, more borrowers are seeking "niche loans" that are not subject to the DSR rules. In the banking sector, loans secured by subscription savings accounts and regular savings or deposit accounts are cited as representative examples of loans not subject to DSR. In particular, recent homebuyers who have already maximized their mortgage loans?often referred to as "Yeongkkeuljok"?are now looking for loans that can bypass DSR restrictions when they still need more funds.

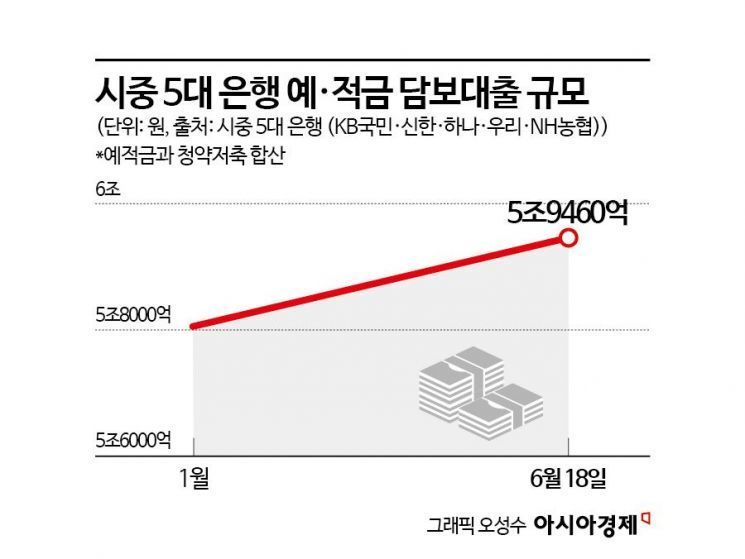

According to the financial sector on June 23, the total amount of loans secured by savings and deposit accounts (including subscription savings) at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 5.946 trillion won as of June 18. This represents an increase of about 100 billion won compared to the beginning of this year.

In the banking sector, the most representative loans not subject to DSR are those secured by subscription savings and regular deposit or savings accounts. Borrowers can take out loans for up to about 95% of their deposit balance. For banks, these are highly secure loans, while for borrowers, the interest rates are lower than unsecured credit loans, and they can obtain emergency funds without breaking their savings or deposit accounts, making this option highly preferred. The interest rate for deposit-secured loans is set at about 4%, which is the deposit rate plus approximately 1.25 percentage points (ranging from 1% to 1.5% depending on the bank). In particular, the average interest rate on deposit-secured loans, which was in the high 4% range last year, has now dropped to the low 4% range. This decline is also cited as a reason for the increasing demand for deposit-secured loans.

An official from the banking sector said, "In the case of unsecured credit loans, they affect the mortgage loan limit, so inquiries about niche loans that do not impact this limit have increased significantly," adding, "Many borrowers who are planning their finances ahead of real estate transactions are seeking subscription savings and deposit-secured loans."

With the third phase of DSR implementation approaching, a "balloon effect" is also occurring, with demand shifting to non-bank sectors such as credit cards and insurance. In the non-bank sector, representative loans not subject to DSR regulations include insurance policy loans and short-term card loans. Insurance policy loans allow borrowers to obtain immediate funds using their surrender value as collateral, without any screening process, making them a popular source of emergency cash. However, due to recent soundness issues at insurance companies, some restrictions such as loan limits have been introduced, causing the growth in these loans to slow somewhat. Short-term card loans are also not subject to DSR regulations. However, starting next month, card loans will be included under the third phase of DSR. As a result, there is a surge in demand from borrowers seeking to take out loans before the limits are reduced. Borrowers who have already taken out mortgage or unsecured credit loans may find that, after July, their card loan limits are reduced or that they are unable to obtain new loans due to the application of DSR regulations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.