Additional Services to Be Added to Woori WON Banking

Insurance Products to Be Offered Upon Completion of Insurer Acquisitions

Real Estate and Foreign Exchange Services Also to Be Enhanced

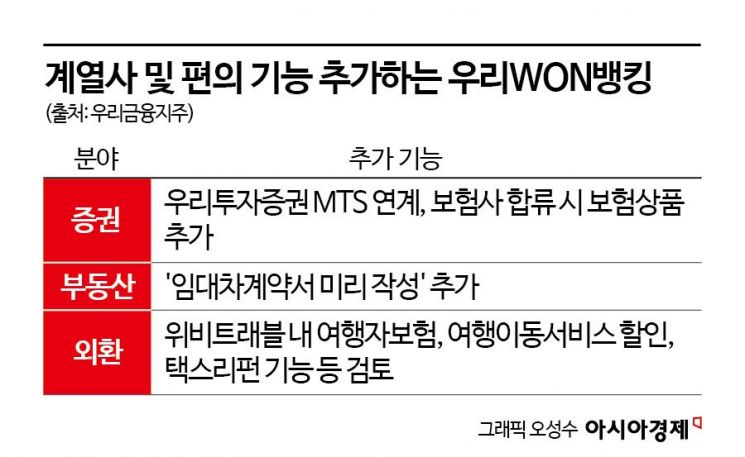

According to the financial industry on June 23, the "stock and bond trading service" and the "non-face-to-face securities account opening service (Hanwha Investment & Securities)" within Woori WON Banking were terminated as of 6:00 p.m. on June 20. This marks the end of the partnership between Woori WON Banking and Hanwha Investment & Securities, which had provided securities-related services through the app. Instead, starting next week, Woori Investment & Securities' MTS will be integrated into Woori WON Banking. Although the Woori Investment & Securities MTS was officially launched in March, its integration with Woori WON Banking was postponed due to technical issues.

By integrating the MTS, Woori Financial Group aims to both expand the product lineup within Woori WON Banking and strengthen the competitiveness of Woori Investment & Securities. Woori Investment & Securities was launched in July last year following the merger of Korea Post Securities and Woori Financial Capital. After receiving approval to change its business to investment trading in March, it has begun full-scale operations. The company is tasked with reshaping the group's concentrated portfolio by growing into a major investment bank (IB) within ten years. Since Woori Bank accounted for 96% of Woori Financial Group's net profit last year, the growth of non-banking affiliates is essential. For Woori Investment & Securities, selling securities products through the super app Woori WON Banking will increase its presence, while the holding company will be able to add non-banking products that were previously lacking in the app.

Woori Financial Group also plans to enhance real estate services within Woori WON Banking. In the second half of this year, a new "pre-fill lease contract" feature will be added to the app's dedicated real estate page, "WONhaneun Real Estate." The app currently offers features such as map-based complex information, news, and AI-powered price checks. The new content will allow young adults unfamiliar with lease contracts to experience the process in advance, helping them avoid issues such as jeonse fraud.

Various new features will also be added to the foreign exchange services. Woori Financial Group is currently considering expanding partnerships with travel-related services, centering on WiBee Travel. For example, the group plans to enhance benefits such as the "currency exchange pocket" within Woori WON Banking, WiBee Travel's travel insurance products, and discounts on travel mobility services. A new tax refund (tax refund) service will also be launched, allowing users to easily apply for VAT refunds incurred during overseas shopping in a more digital manner. In addition, the group is working to strengthen its digital foreign exchange business, including a QR code-based withdrawal service for foreigners.

Once the acquisition and merger procedures for Tongyang Life and ABL Life are completed, Woori Financial Group also plans to add insurance-related products. Furthermore, the group is experimenting with the "Woori Subscription WONhae" service, aiming to launch an AI subscription assistant within Woori WON Banking, and is preparing MBTI-related content linked to the group's character, WiBee Friends.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.