New Government Launches, Easing Political Uncertainty

Expectations for Stock Market Stimulus Measures

Continued Inflow of Foreign and Individual Buying Expected

As the KOSPI recovered the 3,000-point level for the first time in about three and a half years, both foreign investors and individuals contributed to this milestone. Foreign investors continued their net purchases this month following last month, driving the index higher, while individual investors stepped in to buy whenever foreign demand weakened, thereby supporting the index.

According to the Korea Exchange on June 23, the KOSPI closed at 3,021.84 on June 20, up 1.48% from the previous session, thus reclaiming the 3,000-point mark. This is the first time the KOSPI has closed above 3,000 since December 28, 2021.

Foreign investors led the recovery of the KOSPI 3,000-point level by making net purchases exceeding 500 billion won. On this day, foreign investors made net purchases of 558.3 billion won in the main board market. In the futures market, they also bought more than 180 billion won.

A Korea Exchange official explained the background behind the KOSPI’s recovery of the 3,000-point level, stating, “With the launch of the new government, political uncertainty has been resolved, and investor sentiment has improved due to expectations for stock market stimulus measures.” The official added, “After nine consecutive months of net selling since August last year, foreign investors turned to net buying at the end of May and have expanded their purchases in June, indicating an improvement in foreign investor demand.”

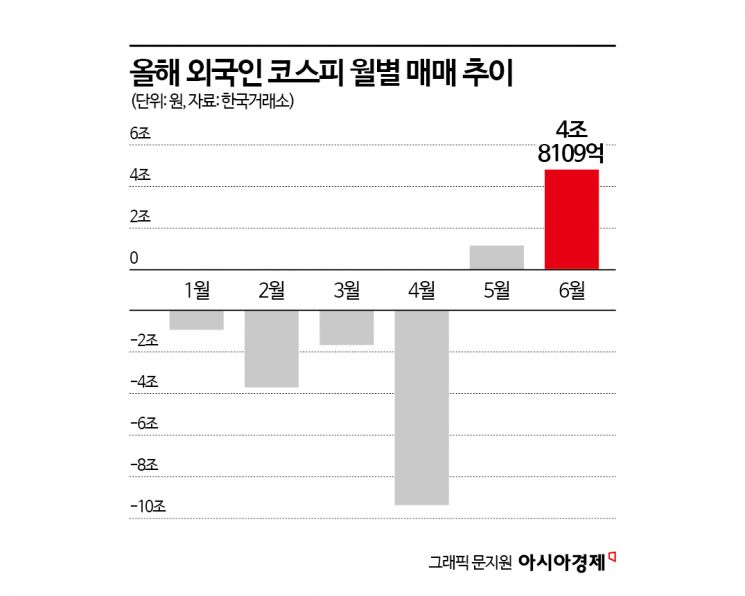

This month, foreign investors have made net purchases of 4.8 trillion won in the main board market.

The return of foreign investors has given further momentum to the KOSPI’s upward trend. During January to April of this year, when foreign investors continued to sell, the KOSPI rose 6.55%, but since foreign investors switched to buying in May, the index has surged by 17.8%.

The buying trend by foreign investors is expected to continue for the time being. Yeom Dongchan, a researcher at Korea Investment & Securities, said, “Considering the strength of the Korean won and the fact that the foreign ownership ratio has decreased to around the previous low of 30%, it is highly likely that net purchases by foreign investors will continue for some time.”

On the 20th, KOSPI surpassed 3,000 points intraday for the first time in 3 years and 5 months. Dealers are working in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. June 20, 2025. Photo by Kang Jinhyung

On the 20th, KOSPI surpassed 3,000 points intraday for the first time in 3 years and 5 months. Dealers are working in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. June 20, 2025. Photo by Kang Jinhyung

Shin Hyun-yong, a researcher at Yuanta Securities, also analyzed, “In the past, an increase in foreign ownership ratios has accompanied periods when the won-dollar exchange rate surged and then declined.” He added, “Moreover, based on the MSCI index, Korea ranks among the top global markets in terms of 12-month forward earnings per share (EPS) growth rate, but its price-to-book ratio (PBR) remains at the lowest level, making its valuation highly attractive. Due to the lower exchange rate and high valuation appeal, the inflow of foreign capital is expected to continue.”

Individual investors have supported the index by making net purchases whenever foreign demand weakened. The KOSPI has risen for five consecutive days recently, and on the days when foreign investors recorded net selling (June 16-17 and 19), individual investors consistently made net purchases, thereby defending the index. Kang Jinhyuk, a researcher at Shinhan Investment & Securities, said, “Recently, customer deposits have surpassed 65 trillion won, marking the highest level since the Donghak Ant Movement three years ago.”

With continued inflows of funds from both foreign and individual investors anticipated, the KOSPI’s upward trend is expected to persist. Lee Sujeong, a researcher at Meritz Securities, analyzed, “As supportive policies such as supplementary budgets and amendments to the Commercial Act are implemented, the likelihood of an overshooting in the Korean stock market is high,” adding, “This is because the inflow of foreign and individual funds has not yet fully materialized.” She further stated, “The current government is planning to provide nationwide livelihood recovery support payments, referencing the COVID-19 relief payments in 2020 and the national support payments in 2021. As the index breaks out of its ‘Boxpi’ range, the likelihood of individual funds entering the stock market in a lagged manner has also increased.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)