Seoul Apartment Prices See Largest Rise in Nearly 7 Years

"Demand for Upgrading to Prime Areas May Weaken"

"Inevitable Impact on Vulnerable Groups... Fine-Tuned Adjustments Needed"

According to the weekly apartment price trends released by the Korea Real Estate Board on June 20, Seoul apartment sales prices rose by 0.36% compared to the previous week. This is the highest weekly increase since the second week of September 2018, when the rate was 0.45%. Until April this year, Seoul’s apartment price growth rate remained at around 0.08% for three consecutive weeks. The rate then began to climb, reaching 0.13% in the third week of May and 0.16% in the fourth week (May 26). In June, the pace accelerated to 0.19% (June 2) and 0.26% (June 9). This week, the increase surpassed these figures, marking the largest jump since the Moon Jae-in administration.

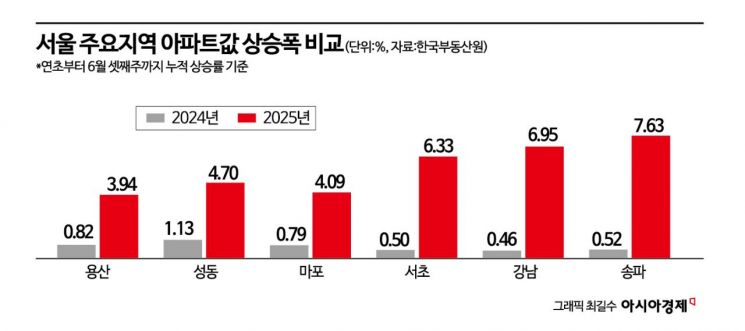

Seongdong-gu in Seoul recorded a 0.76% increase from the previous week, overtaking the three Gangnam districts to claim the top spot for weekly growth. This is the highest rate for Seongdong-gu in about 12 years and two months, since the fifth week of April 2013. Gangnam-gu (0.75%), Songpa-gu (0.70%), Gangdong-gu (0.69%), Mapo-gu (0.66%), and Seocho-gu (0.65%) also saw significant increases. For Gangnam-gu and Seocho-gu, this is the highest rate in 13 weeks since the third week of March, while Mapo-gu posted its highest rate since data tracking began. Yongsan-gu rose by 0.61%, its highest since February 2018, or seven years and four months. The Korea Real Estate Board stated, “As preferred complexes, including those undergoing reconstruction and large-scale developments, see sellers raising their asking prices and more buyer inquiries, upward transactions are being recorded, and the overall upward trend in Seoul continues.”

Amid these developments, the Financial Services Commission is reportedly considering applying the DSR to jeonse and policy loans as well, sparking debate over whether the plan will be implemented. The previous day, the commission reportedly presented this idea in a policy briefing to the National Planning Committee. Jeonse and policy loans are cited as major drivers of the recent surge in household debt. However, since these loans are aimed at ordinary citizens, there are concerns that tighter rules could worsen housing insecurity for low- and middle-income households. For this reason, financial authorities have been reluctant to directly regulate jeonse and policy loans.

Some in the market predict that if jeonse loans and similar products are tightened at a time when borrowers’ loan limits are already set to be reduced under the third phase of the DSR starting next month, it could help stabilize home prices. Ham Youngjin, head of Woori Bank’s Real Estate Research Lab, said, “If jeonse loans are included, there will effectively be no way to circumvent the lending cap, and borrowers’ capacity to take out loans will be greatly reduced. This year, demand for moving to more desirable areas has driven up home prices, but if this demand is dampened, the upward trend could lose momentum.”

However, there are also concerns that such measures could send the wrong signal to the market. While tighter management is necessary, if the measures are perceived as suppressing demand, they could further stoke buying sentiment. The three Gangnam districts and Yongsan-gu are already designated as land transaction permit zones, making gap investment impossible. Nevertheless, these areas continue to serve as the epicenter of Seoul’s rising home prices.

Park Won-gap, senior expert at KB Kookmin Bank, said, “Jeonse loans are primarily for real demand, and policy loans are intended to support housing for disadvantaged groups. If actual regulations are applied, the most vulnerable groups will inevitably be hit hardest. Rather than simply aiming to ‘control home prices’ or ‘impose regulations,’ policy objectives should be set to moderate volatility and curb sharp increases through more sophisticated and realistic adjustments.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.