Debt Relief for Low-Income Self-Employed and Long-Term Delinquent Borrowers under Lee Jaemyung Administration

Over 1 Trillion Won to Be Invested for Large-Scale Debt Cancellation

Concerns Raised over Fairness and Moral Hazard for Diligent Payers

The Lee Jaemyung administration is set to launch a full-scale debt relief initiative for vulnerable groups, including low-income self-employed individuals and long-term delinquent borrowers. This move comes as the prolonged economic downturn has led to a significant increase in the number of people unable to repay their debts, resulting in the loss of opportunities for social recovery. However, there are concerns about fairness for those who have been diligently repaying their debts, as well as the potential for moral hazard, such as debtors ceasing repayment altogether.

Debt relief planned for low-income self-employed and long-term delinquent borrowers

According to the Financial Services Commission on June 20, the government plans to introduce a new long-term delinquent debt adjustment program to write off the debts of long-term delinquent borrowers who have lost the ability to repay. A total of 800 billion won, sourced from the supplementary budget and financial sector funds, will be invested to establish a debt adjustment organization (bad bank) under Korea Asset Management Corporation (KAMCO). The organization will bulk-purchase unsecured individual loans of up to 50 million won that have been delinquent for more than seven years. The total expected amount of debt to be purchased is 16.4 trillion won, and an estimated 1.13 million people are expected to benefit.

The government will also inject 700 billion won to strengthen the Saechulbal Fund, a debt adjustment program for small business owners and the self-employed. By expanding the scope of principal reduction, the aim is to help low-income self-employed individuals recover. Approximately 101,000 low-income small business owners are expected to benefit, which accounts for about 40% of all low-income delinquent small business owners.

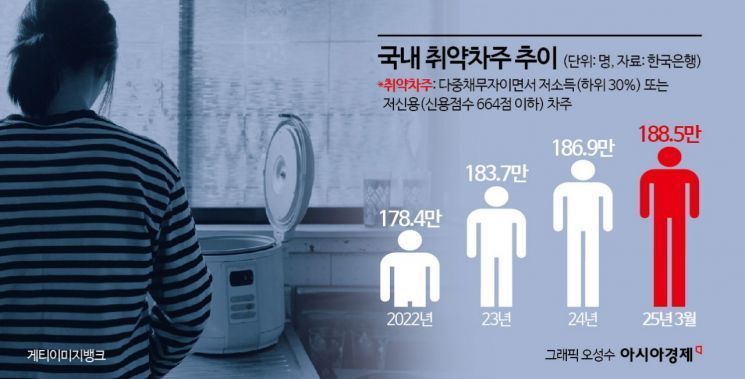

The government is mobilizing large-scale fiscal resources for debt relief among vulnerable groups because the prolonged economic downturn has led to a steady increase in the number of people unable to repay their debts. According to the Bank of Korea, the number of vulnerable borrowers in Korea rose from 1.78 million at the end of 2022 to 1.88 million at the end of the first quarter of this year, showing an annual increase rather than a decrease. Vulnerable borrowers are defined as those with multiple debts who are also low-income or have low credit.

The proportion of self-employed individuals among all vulnerable borrowers is increasing even faster. As of the end of last year, there were 427,000 vulnerable self-employed borrowers, an increase of 31,000 from 396,000 at the end of 2023. This represents a 7.8% increase in just one year, indicating a worsening situation. The delinquency rate on bank loans among vulnerable self-employed individuals surged by 2.26 percentage points in one year, reaching 11.16%.

Income polarization among self-employed individuals has intensified, with low-income self-employed people facing greater burdens due to declining income. In the first quarter of this year, the average monthly income for self-employed households in the lowest quintile fell by 5.4% compared to the same period last year, while the highest quintile saw a 2.7% increase.

Concerns over fairness and moral hazard for those who have diligently repaid debts

The government emphasized that this support measure is essential to provide opportunities for social recovery for the disadvantaged and to promote social cohesion.

An official from the Financial Services Commission stated, "As the recovery of domestic demand has been delayed even after COVID-19, the debt burden on self-employed individuals has increased, and it remains difficult for them to repay. There is also a need for fiscal responsibility to be shared for debts that inevitably increased as individuals fulfilled their responsibilities during the process of overcoming COVID-19." The official added, "For long-term delinquent borrowers, the government needs to provide active support, as they face severe difficulties not only financially but also in employment, housing, and other aspects of daily life."

Small business owners are also welcoming the government's new measures. The Korea Federation of Micro Enterprises stated, "With the government's new measures, up to 1.43 million small business owners will be able to significantly reduce their debt burden and have a fresh start."

However, if the government's new policy is implemented, controversy over discrimination against those who have faithfully repaid their debts is expected to be unavoidable, as there are more borrowers who have responsibly repaid their debts despite difficult circumstances. There are also concerns about moral hazard, such as an increase in borrowers intentionally delaying repayment as a result of these measures.

An official from the Financial Services Commission explained, "This program will strictly select only those delinquent borrowers who have lost repayment ability to a level equivalent to bankruptcy," and added, "Anyone can become a long-term delinquent borrower, so we ask for understanding in terms of promoting social cohesion and providing opportunities for recovery for the disadvantaged." The official further stated, "We plan to implement various safeguards to prevent moral hazard."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.