Despite Tariff Shock, Foreign Holdings of U.S. Treasuries Remain at $9 Trillion

China Reduces, While Japan and the United Kingdom Increase Holdings

May and June Data Likely to Test Market Confidence

While the U.S. Treasury market has been shaken by President Donald Trump's announcement of high tariffs, the scale of net selling of U.S. Treasuries by foreign investors turned out to be smaller than expected. In particular, among major holders, both Japan and the United Kingdom actually increased their holdings of U.S. Treasuries. The market views the upcoming statistics for May and June as a barometer for gauging the level of concern among foreign investors regarding President Trump's tax cut plan and the expansion of the fiscal deficit.

According to data released by the U.S. Treasury Department on June 18 (local time), the amount of U.S. Treasuries held by foreigners stood at approximately $9 trillion as of April, down $36.1 billion from the previous month. This figure is close to the all-time high recorded in March, and with about one-third of all U.S. Treasuries still in foreign hands, it indicates that demand for U.S. Treasuries remains robust.

By country, China reduced its holdings, but Belgium (offshore Chinese entities), Japan, and the United Kingdom all increased theirs. Canada recorded the largest decrease, selling $57.8 billion worth of Treasuries. However, it should be noted that this data does not reflect changes in the market value of Treasuries during the month in question.

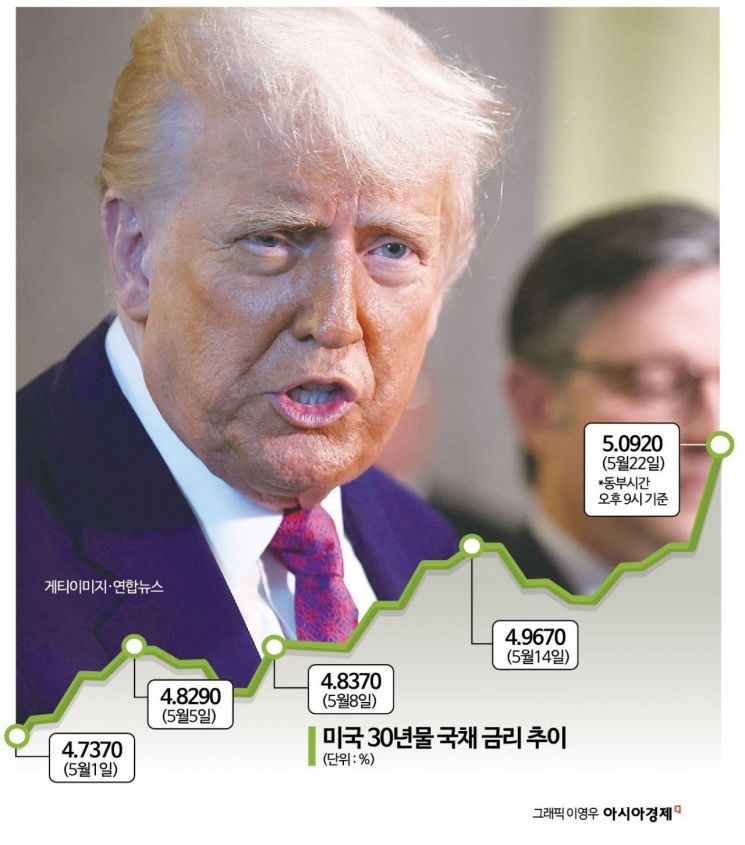

This outcome is particularly noteworthy given that, in early April, President Trump abruptly announced plans to impose high tariffs on major trading partners by declaring a "Day of Liberation," causing significant turmoil in the Treasury market. At that time, the yield on 10-year U.S. Treasuries soared to 4.59%, while the 30-year yield rose above 5%. As the tariff war escalated, the value of the dollar, stocks, and U.S. Treasuries all declined simultaneously, resulting in a "triple weakness" phenomenon. In response, President Trump shifted his stance by announcing a postponement of tariff enforcement.

However, experts warn that it is too early to be optimistic about future market trends. Megan Swiber, a rates strategist at Bank of America (BoA), cited the Federal Reserve's weekly data on foreign-held Treasuries to point out that there are clear signs of recent selling by foreign institutional investors. According to BoA, since the end of March, foreign investors have been net sellers of approximately $63 billion worth of Treasuries, and this trend has continued into May and June. Therefore, it is premature to conclude that foreign demand remains solid based solely on the April figures.

The market is closely watching the Treasury holding statistics to be released for May and June. These will serve as key indicators of how President Trump's budget proposal and the expansion of the federal fiscal deficit have influenced foreign investor sentiment.

The Financial Times reported, "Amid recent projections of a widening U.S. fiscal deficit, international credit rating agency Moody's downgraded the U.S. credit rating, which has led to a continued decline in U.S. Treasury prices and a rise in yields."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.