AMPC Directly Affects Korean Battery Industry

House Proposal to Move Up Expiration Date Reverted to Status Quo

Industry: "Relieved... But Final Legislation Still Needs to Be Watched"

After the U.S. Senate unveiled a proposed amendment to the Inflation Reduction Act (IRA) that maintains the expiration date for tax credits at 2032, the domestic battery industry is assessing that it has "avoided the worst-case scenario." However, since the amendment has not yet passed the Senate and further coordination with the House of Representatives is required, the legislative outcome remains uncertain.

According to industry sources on June 19, the bill released by the Senate Finance Committee revises the Advanced Manufacturing Production Credit (AMPC)?a benefit provided directly to battery manufacturers?in a way that is more favorable to domestic battery companies than the House version. Since the AMPC is a policy that offers direct benefits to domestic battery companies, the industry has responded by saying it has "avoided the worst-case scenario."

The AMPC is a provision that grants tax credits for manufacturing battery cells, modules, and materials within the United States. The amendment that passed the House last month shortened the expiration date by one year to 2031, raising concerns among domestic companies. However, the Senate amendment maintains the current expiration date of 2032.

In addition, the policy of restricting Chinese battery companies' entry into the U.S. market remains in place, and more detailed provisions?such as the definition of Prohibited Foreign Entities (PFE)?have been added. The previous House version prohibited companies from receiving the AMPC if they directly sourced critical minerals from a PFE. In contrast, the Senate version allows companies to receive the AMPC as long as the proportion of products sourced from PFEs does not exceed certain thresholds: 40% in 2026, 35% in 2027, 30% in 2028, 20% in 2029, and 15% from 2030 to 2032.

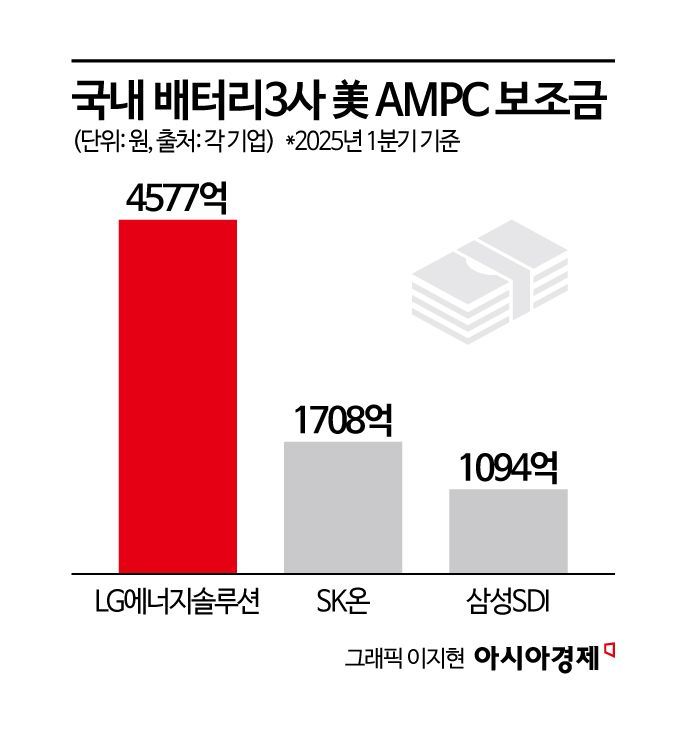

Until now, the three major domestic battery companies?LG Energy Solution, Samsung SDI, and SK On?have relied to some extent on the AMPC in the U.S. due to poor business performance. In the first quarter, LG Energy Solution received 457.7 billion won from the AMPC, recording an operating profit of 374.3 billion won. Excluding the AMPC, the company would have posted an operating loss of 83 billion won, essentially covering its deficit with the subsidy. Samsung SDI and SK On received 109.4 billion won and 170.8 billion won respectively, but still failed to avoid losses.

According to major foreign media outlets, the legislative outcome is expected to be determined as early as early July or as late as the end of August. However, it is reported that disagreements still exist within the Republican Party. An industry official stated, "We are not at the stage of revising our business strategies or readjusting our investment plans immediately, but since the Senate version still needs to be reconciled with the House, it is too early to be relieved. For now, the general sentiment is to closely monitor the legislative process." Another industry official remarked, "The Senate version has provided some breathing room, but ultimately, the final legislation is what matters. We will prepare response strategies for various scenarios during the remaining period."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.